Gold Prices Rise as Strong Dollar Pauses

Shows Strength During Every Recession

Experts Say "Approach with Long-Term Perspective"

Gold-related products are displayed at the Korea Gold Exchange in Jongno-gu, Seoul. Photo by Kang Jin-hyung aymsdream@

Gold-related products are displayed at the Korea Gold Exchange in Jongno-gu, Seoul. Photo by Kang Jin-hyung aymsdream@

[Asia Economy Reporter Minji Lee] After struggling under the strong king dollar, gold prices have started to stretch out this month. This is thanks to the expectation of a slowdown in the pace of interest rate hikes, which has eased the dollar's strength. Experts advise that it is worth paying attention to gold in the long term, as historically gold has shown strong performance during economic recessions.

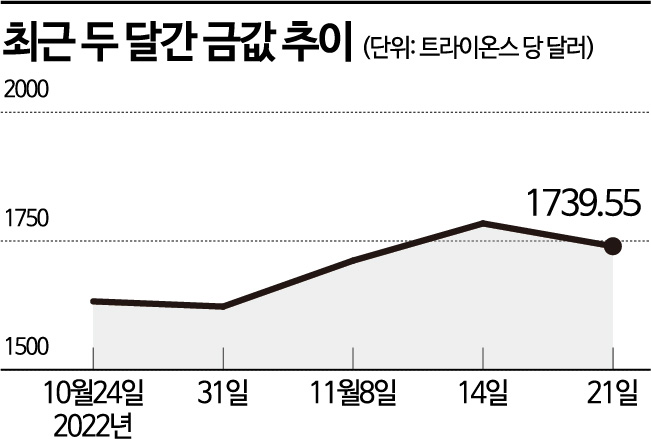

According to the financial investment industry on the 22nd, as of the 21st (local time), the December gold futures price recorded $1,739.60 per troy ounce. Since the announcement of the US October CPI (Consumer Price Index) earlier this month, the dollar index, which had been hovering around 115, fell to just above 100, causing gold prices to rise. Since gold is traded in dollars on the international market, its price tends to increase as the dollar's value decreases. Recently, cracks in the virtual asset market also contributed to the rise in gold prices. Following the bankruptcy of FTX, the world's second-largest virtual asset exchange, Bitcoin prices plummeted more than 20% in about a month, which is estimated to have increased interest in safe-haven assets.

As attention shifts from interest rate hikes to economic recession issues, interest in gold investment is expected to expand further. Gold's investment appeal has increased when concerns about economic recession or slowdown intensify. Historically, during recession periods, investing in gold yielded higher returns than investing in stocks. For example, during the global financial crisis triggered by the 2008 subprime mortgage crisis, from January 2, 2008, to December 31, 2009, the S&P 500 index fell 24% over two years, but gold prices surged 30%. The same was true in 2020. Due to the COVID-19 pandemic, the global economy was paralyzed, and during this period, while the S&P 500 rose 16%, gold jumped more than 24%.

The growing demand for gold purchases also supports the outlook for rising gold prices. According to the World Gold Council, gold demand in the third quarter of 2022 increased by 28% year-on-year to 1,181 tons, with central banks showing strong purchasing demand. They bought 400 tons of gold, which is 300% more than the previous year, with emerging countries such as Turkey, Uzbekistan, and India being major buyers. This appears to be for exchange rate defense against US interest rate hikes and hedging tail risks (extremely low probability but potentially devastating risks once they occur).

However, experts advise that if you want to start investing in gold now, you should have a long-term perspective. While it is true that expectations for a slowdown in the pace of interest rate hikes have entered the market, the fact remains that interest rate hikes will continue until the first half of next year. Jaeyoung Oh, a researcher at KB Securities, emphasized, "If real interest rates fall further, the short-term rebound in gold may continue, but since additional interest rate hikes are scheduled, it is difficult to expect a decline in interest rates." He added, "Even if interest rate hikes stop, high interest rates can burden gold prices. For gold prices to rise significantly, it will likely be in 2024, when an interest rate cut cycle may begin, rather than in 2023."

For gold investment, you can stockpile gold bars at home, but considering value-added tax and management costs, approaching through financial products (ETF, ETN, etc.) is more effective for increasing returns. Investors can invest in gold futures price changes through gold futures ETFs such as 'KODEX Gold Futures ETF' or 'ACE Gold Futures Leverage ETF,' or related ETN products. If you had invested in the ACE Gold Futures Leverage ETF earlier this month, the return would be around 13%. Futures investments can yield large profits in a short period due to high volatility. However, when investing long-term, rollover (contract extension) costs are reflected, and capital gains tax applies, which can reduce returns.

For long-term investment, it is better to approach gold in physical form. You can invest in physical gold by opening a physical gold account, and capital gains are tax-exempt. The commission fee is around 0.2%. If you want to invest in physical gold through a pension savings account, you can also access it via 'ACE KRX Physical Gold ETF' or 'Samsung KRX Physical Gold ETN.' If you invest through a general account, a 15.4% dividend income tax applies to capital gains, but if you invest through these accounts, only a pension income tax rate of around 3% applies. On the 8th of this month, a leveraged investment product aiming to double the movement of the physical gold index calculated by the exchange was also launched. If you had invested in the newly listed 'Daishin Leverage KRX Physical Gold ETN,' the return would be around 3%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)