Interest Rate Hike and Legoland Incident Cause REITs Stock Decline

Recovery Expected Based on Government Policies and Next Year's Capital Circulation

[Asia Economy Reporter Junho Hwang] The financial market tightening caused by the Legoland Project Financing (PF) Asset-Backed Commercial Paper (ABCP) crisis has also frozen the Real Estate Investment Trust (REITs) market. With rising interest rates compounded by the liquidity crunch, the flow of funds into the real estate market has been blocked. Although this situation is expected to gradually improve from next year, the benefits will likely vary across different sectors.

Legoland PF Crisis Freezes REITs Market

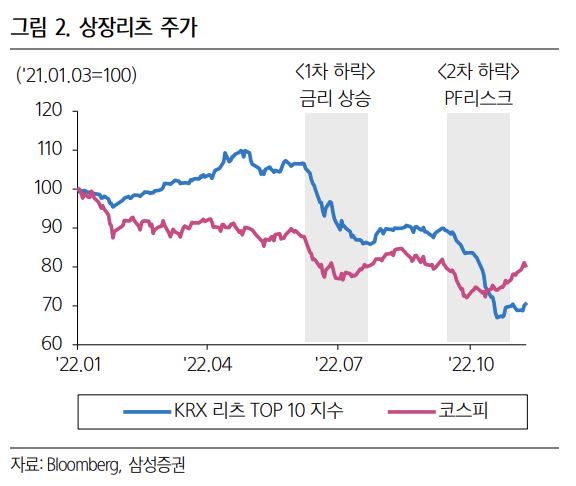

According to the Korea Exchange on the 22nd, as of the 21st, the KRX REITs TOP 10 index recorded 825.06. This index had fallen to 763.83 on the 25th of last month but has been showing a gradual recovery.

Jihwan Hong, a researcher at NH Investment & Securities, analyzed, "REITs’ performance improves in an environment where the economy is good and interest rates are low. This year, although interest rates rose sharply, economic outlooks continuously declined, causing both economic and interest rate factors to negatively impact the REITs market."

In particular, as doubts about refinancing various real estate projects grew due to the Legoland PF fallout, the impact spread to the REITs market. This index has dropped about 13% compared to 950.78 at the end of September when the Legoland PF crisis occurred.

REITs Market to Rebound Next Year

Experts predict that the REITs winter will ease around the first quarter of next year. Currently, PF ABCP maturities are being extended by one month due to the liquidity crunch, but this situation is likely to be resolved as financial institutions complete their fiscal year-end settlements and funds begin to flow from early next year.

Kyungja Lee, a researcher at Samsung Securities, analyzed, "Considering the active market stabilization measures implemented from this month and the possibility of market interest rate stabilization around the first quarter of next year, credit spreads are likely to gradually stabilize starting at the end of this year. This implies a recovery in the lending function of the real estate market."

Polarization Expected by Asset Type

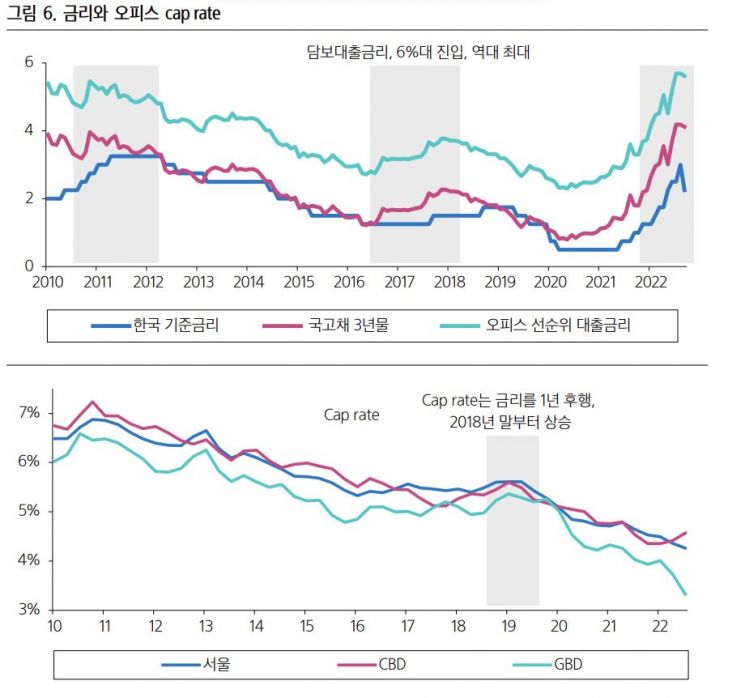

The favorable wind in the REITs market next year is expected to affect assets differently. The 16 domestically listed REITs mainly hold assets divided into offices and logistics centers. Among these, Seoul offices are expected to see rent increases due to historically low vacancy rates and supply shortages, leading to a rise in capital return rates (cap rate, net yield relative to real estate purchase price). Accordingly, the average annual real rent growth rate for this year and next is expected to be around 14%. On the other hand, logistics assets are estimated to have a cap rate in the 6% range, rising about 100 basis points compared to last year due to oversupply and transaction contraction.

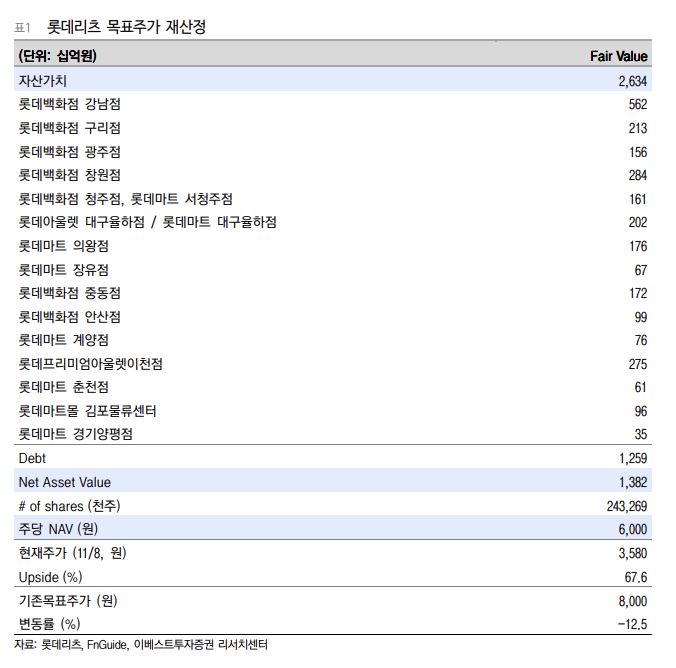

The outlook also varies by product. Lotte REITs is considered a representative stock weighed down by concerns over borrowings maturing next year amid the liquidity crunch, with significant worries about dividend reductions due to rising interest rates during refinancing.

Researcher Seryeon Kim of Ebest Securities stated, "Although the target price has been lowered from 8,000 won per share to 6,000 won, if refinancing is successful and the dividend policy based on cash is maintained, there is room for the target price to be revised upward."

Samsung Securities also forecast that, besides Lotte REITs, NH All One REITs will see a decrease in dividends this year compared to next year due to increased refinancing costs. The researcher predicted, "With variable interest rates, the fluctuation range of dividends may decrease, and there is a possibility of supplementing dividends with reserved cash, so the dividend decline compared to the previous year is expected to be within about 10%."

New Investment Opportunities

REITs newly launched next year may become the protagonists of the favorable trend. Samsung FN REITs and Hanwha REITs, prepared by insurance companies within Samsung Financial Group and Hanwha Financial Group respectively, are known to be either conducting Pre-IPO or have completed preparations aiming for listing in the first half of next year. Including these, along with Daishin Global REITs, Inmark Global Prime, Lotte Hotel REITs, and Balhae Infrastructure Fund, a total of about 2 trillion won worth of new REITs market is expected to open.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.