KCCI Holds '2023 Distribution Outlook Seminar'

'What Will Next Year's Consumer Market Be Like?' Attracts Over 500 Participants

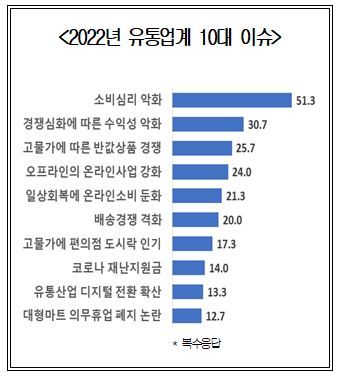

[Asia Economy Reporter Donghoon Jung] 'Worsening consumer sentiment post-COVID-19,' 'Competitive pressure among retail formats,' 'High inflation,' and 'Delivery wars' were cited as the top 10 news items in this year's consumer market.

The Korea Chamber of Commerce and Industry (KCCI) held the '2023 Retail Industry Outlook Seminar' on the 22nd at the Chamber of Commerce building to review this year's retail industry and preview changes and trends in next year's retail market. About 500 people from manufacturing, retail, logistics, and finance sectors attended, making it the largest in-person event held in the international conference hall.

According to the 'Top 10 Consumer Market Issues of 2022' survey conducted by KCCI targeting 300 retail companies, the biggest hot issue in the retail industry this year was 'deterioration of consumer sentiment (51.3%).' This was followed by profitability deterioration due to intensified competition among formats (30.7%), pressure from high inflation (25.7%), offline formats entering online business (24.0%), slowdown in online consumption due to the return to normal life (21.3%), delivery wars (20.0%), popularity of convenience store lunchboxes with cost-effective macros (carbs, protein, fat) (17.3%), COVID-19 disaster relief funds (14.0%), expansion of digital transformation in retail companies (13.3%), and controversy over the abolition of mandatory closure days for large supermarkets (12.7%).

KCCI stated, "Even after the post-COVID-19 period, consumer sentiment has not revived easily, and combined with high inflation, the profitability of retail companies has worsened and competition has intensified." In fact, as offline formats entered online markets, barriers between retail sectors became meaningless. They added, "Despite the worsening consumer market, 'value-packed lunchboxes gained popularity, and delivery wars targeting home sales also intensified.'" Keywords in retail such as 'digital transformation' and 'retail regulations like mandatory closure days for large supermarkets' remain challenges for our companies and society.

Retail Experts: "Stores, Value Chains, and Service Models Must All Be Customer-Centric... DX Implementation Must Be Accelerated"

Regarding this, Kim Myung-gu, Partner at Monitor Deloitte, who gave the keynote speech, emphasized, "In the era of the three highs (high inflation, high interest rates, high exchange rates), companies that fail to manage service efficiency and quality are falling behind. In an era where failure to understand consumer behavior characteristics can instantly lead to loss of competitiveness in the market, stores, value chains, and service models must be completely reorganized to be customer-centric."

Professor Baek In-su of Osaka University, Japan, introduced digital transformation (DX) cases of retail companies in Korea, the U.S., and Japan. Professor Baek said, "DX is evolving from emphasizing the necessity of introduction to establishing DX as a revenue model. To establish DX, building an ecosystem is important, and active investment in talent and technology as well as a shift in mindset to internalize DX company-wide are required."

Lee Kyung-hee, Executive Director of Emart Retail Industry Research Institute, forecasted, "Large supermarkets will see steady grocery sales due to increased demand for home meals, but the slowdown in durable goods consumption such as home appliances and furniture will limit performance recovery." She added, "(Department stores) are expected to experience slowed growth due to recent asset price declines, interest rate hikes, and a rapid increase in overseas travelers."

Shin Ja-hyun, Head of the Korea Duty Free Shop Association, diagnosed, "Despite various policy supports this year such as removal of purchase limits, increase of duty-free limits (from $600 to $800), and extension of license periods (from 5 to 10 years), the uncertainty in the duty-free industry has not been completely resolved due to high exchange rates and continued lockdown measures in China."

Kim Jong-geun, Executive Director at Market Link, emphasized, "SSMs (Super Supermarkets) see 43% of customers aged 20-40 visiting at least once a month. They need to seek new opportunities through omni-channel strategies utilizing stores as online delivery hubs, product differentiation, digital-based operational cost efficiency, and store personalization strategies tailored to commercial district characteristics."

Following this, Yang Jae-seok, Executive Director at BGF Retail, predicted, "Next year will be a year when consumers' convenience store selection criteria shift from 'proximity and convenience' to 'product and marketing differentiation.'" Yang analyzed that in response to this change, "the industry will expand products reflecting MZ generation consumption trends, extend convenience store-based content areas (dramas, entertainment, etc.), and strengthen value consumption product policies such as health and eco-friendliness."

Seo Jung-yeon, Research Fellow at Shin Young Securities, said, "Until the first half of next year, inflation and consumption contraction are expected, so transaction volumes for food delivery services, home appliances, furniture, and daily necessities will decrease, but grocery and travel/cultural service categories will continue to grow." He predicted, "E-commerce companies will shift from 'spending strategies' to 'profit-making strategies' and focus on building 'membership ecosystems.'"

Jang Geun-moo, Director of KCCI Retail Logistics Promotion Institute, said, "Political and financial uncertainties at home and abroad will continue to affect the domestic retail market next year. It will be important to enhance the ability to analyze customer needs and provide customized products and services through company-wide digitalization, while strengthening cost efficiency capabilities to target price-sensitive consumers."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.