Discussion on K-Chips Act Progresses in Subcommittees of Industry and Finance Committees

Opposition Party's Semiconductor Support Bill Also Scheduled for Introduction This Week

Will Corporate Tax Credit Rates Be Adjusted in Bill Consolidation Review?

"To Secure Competitiveness, It Must Be Raised by More Than 20%"

[Asia Economy Reporter Kim Pyeonghwa] The National Assembly is making progress in the long-stalled discussions on the K-Chips Act (National Advanced Strategic Industry Amendment and Restriction of Special Taxation Act Amendment), moving one step closer to passing the bill. With the opposition party likely to propose a similar K-Chips Act bill this week, active discussions and combined reviews are expected going forward. However, there are concerns that the key issue demanded by the semiconductor industry?the increase in the tax credit rate?may be lowered from the originally proposed rate during negotiations.

According to the National Assembly and the semiconductor industry on the 22nd, the Industry, Trade, and Small and Medium Enterprises Committee’s Subcommittee on Industry, Trade, and Patents held a meeting to discuss the National Advanced Strategic Industry Amendment. This amendment is part of the K-Chips Act bill, which was proposed together with the Restriction of Special Taxation Act Amendment. Yang Hyang-ja, Chairperson of the National Assembly’s Semiconductor Special Committee, proposed it in August to enhance the competitiveness of the national semiconductor industry. The National Advanced Strategic Industry Amendment is characterized by support for the creation of industry-specialized complexes and expedited processing of permits and approvals.

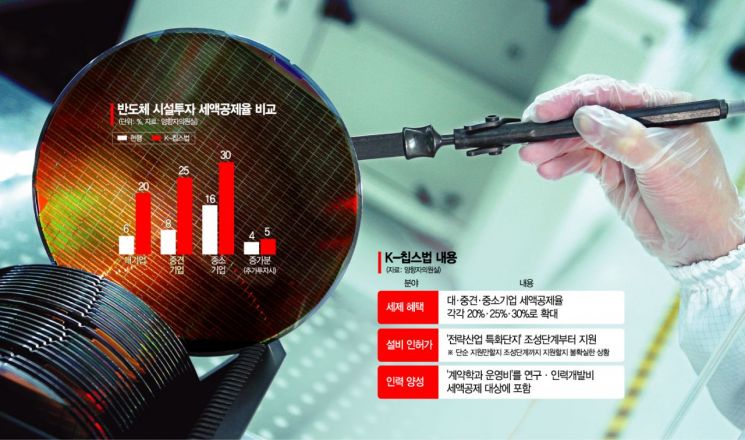

The Restriction of Special Taxation Act Amendment, which includes an increase in the tax credit rate for semiconductor facility investments, is being handled by the National Assembly’s Planning and Finance Committee. The Tax Subcommittee of the Planning and Finance Committee plans to review various proposed amendments to the Restriction of Special Taxation Act, including the K-Chips Act, by the 29th. Although some related discussions have progressed in the Industry Committee, little discussion has taken place in the Planning and Finance Committee regarding the K-Chips Act, drawing attention to the bill’s processing. In particular, the increase in the tax credit rate has been a part that the semiconductor industry has consistently emphasized as necessary.

Another point of interest is the announcement of a semiconductor support bill similar to the K-Chips Act by the opposition party in the Industry Committee. Kim Han-jung, the opposition party’s ranking member of the Industry Committee from the Democratic Party of Korea, plans to propose the National Advanced Strategic Industry Amendment and the Restriction of Special Taxation Act Amendment together on the 22nd. Given the high similarity between the two bills, it is widely expected inside and outside the National Assembly that they will be reviewed jointly in both the Industry Committee and the Planning and Finance Committee.

However, concerns have been raised that the tax credit rate might be lowered during this process. This is due to the opposition party’s criticism of the K-Chips Act for providing preferential treatment to large corporations. The tax credit rate for large corporations included in the opposition party’s bill is 10%, lower than the 20% rate in the K-Chips Act. There is speculation that during the combined review, as the ruling and opposition parties seek a compromise, the tax credit rate could be reduced from the original proposal.

The semiconductor industry and academia argue that since competing countries like the United States and Taiwan are aggressively increasing tax credit rates and offering support measures to secure technological supremacy, a reduction in the tax credit rate could undermine the effectiveness of the bill. In August, the United States passed the Chips and Science Act (CSA), which raised the tax credit rate for semiconductor facility investments to 25%. The Taiwanese government recently increased the tax credit rate for semiconductor companies’ research and development (R&D) expenses from 15% to 25%, and is pushing for an additional 5% tax credit rate for advanced equipment investments.

Park Jae-geun, President of the Korea Semiconductor Display Technology Society, emphasized, "Taiwan, the United States, and Europe are all striving to support the semiconductor industry, so if the domestic tax credit rate becomes too low, competitiveness could decline. It is appropriate to raise the tax credit rate to over 20% during the current bill discussions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)