Domestic Fashion Companies' Sales Reach 20.5778 Trillion KRW in First Half of Year, Up 7.0% YoY

Casual and Sportswear Lead Growth Amid Trend Toward Comfortable Clothing

Consumer Shift from Women's Suits Intensifies as Casual and Sportswear Expand

[Asia Economy Reporter Eunmo Koo] As the preference for comfortable and active clothing over formal suits becomes more distinct, casual wear that can be worn comfortably and lightly is driving growth in the domestic fashion market.

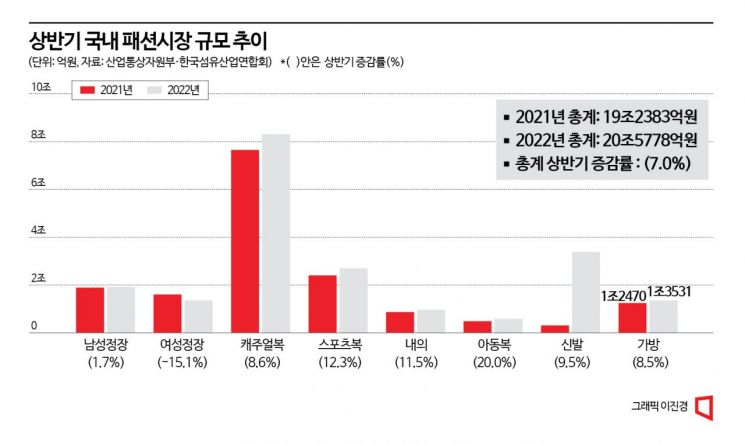

According to the Korea Federation of Textile Industries on the 22nd, the sales of domestic fashion companies in the first half of this year amounted to 20.5778 trillion KRW, showing a 7.0% growth compared to the same period last year (19.2383 trillion KRW).

The performance of listed companies showed an even clearer recovery trend. The sales of 37 fashion companies disclosed in the Financial Supervisory Service’s electronic disclosure system for the first half of this year reached 6.9248 trillion KRW, an 18.7% increase compared to the same period last year. This is a significant improvement compared to 14.1% growth last year and -10.0% in 2020 for the same period. Seven companies exceeded 500 billion KRW in sales in the first half, including Samsung C&T, F&F, Handsome, Shinsegae International, LF, Kolon Industries, and Shinsung Tongsang. Among them, F&F (65.9%), Kolon Industries (28.2%), and Shinsung Tongsang (27.6%) recorded high sales growth rates.

The growth of fashion companies in the first half was led by casual wear. Sales of casual wear in the first half reached 8.3112 trillion KRW, an 8.6% increase compared to 7.6551 trillion KRW in the same period last year. This accounts for more than 40% of the total market and shows a sales increase exceeding the overall market growth rate. As lifestyles shift toward seeking activity and comfort, the casual wear market, which allows for informal and light dressing, continues to grow steadily. Following double-digit growth (11.5%) last year, high growth rates have continued this year.

The leading items in the casual wear market are T-shirts, jumpers, and pants. As of last year, the market size of these three items was 8.9248 trillion KRW, accounting for 51.3% of the entire casual wear market. In terms of brand preference, Samsung C&T’s Beanpole (15.3%) ranked first, followed by LF’s Hazzys (12.1%), Polo (7.2%), and Lacoste (4.1%). Due to the boycott of Japanese products, Uniqlo (3.5%) fell out of the top five for the third consecutive year.

Sportswear followed casual wear with sales of 2.6969 trillion KRW in the first half, a 12.3% increase from a year earlier. Interest in golf, yoga, tennis, and other sports is rising, especially with an increasing female sports population, leading to steady growth in the related market. The sportswear market is heavily influenced by brand power, with Nike maintaining an overwhelming first place in brand awareness, preference, and purchase indicators. Nike’s preference in the first half of this year was 40.2%, showing a large gap compared to Adidas (21.9%) and Fila (6.8%), which ranked second and third. Nike Korea recorded sales of 1.4522 trillion KRW last year, a 12.3% increase from the previous year, ranking sixth among all fashion companies.

On the other hand, the women’s formal suit market showed a decline, being the only sector to shrink. Sales of women’s formal suits in the first half were 1.3597 trillion KRW, down 15.1% from 1.6007 trillion KRW in the same period last year. As the trend favoring casual and sportswear strengthens, consumer departure from the women’s formal suit market appears to be intensifying relatively. The market size is also widely regarded as a mature market.

The domestic fashion market is expected to continue its growth trend in the second half of this year, following the lifting of social distancing measures and improvement in consumer sentiment, marking two consecutive years of growth since last year. However, volatility is expected depending on factors that may hinder growth, such as the degree of COVID-19 resurgence, inflation rate, and employment indicators.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.