Rapid Increase in Deposit Fraud Cases Including Kkangtong Jeonse

Establishment of Rights to Verify Delinquency Information and Senior Tenant Information

The government's move on the 21st to strengthen the lease system is interpreted as a response to the growing concerns over a sharp downturn in the housing market, which has led to serious housing insecurity for tenants. In fact, as nationwide house prices have been falling sharply, incidents of ‘empty-can jeonse’?where tenants cannot get their deposit back?are rapidly increasing.

According to the Korea Real Estate Board's ‘Lease Market Siren,’ the amount of jeonse deposit accident cases nationwide last month was 152.62455 billion won, a 39% increase compared to September (109.8727 billion won). Deposit accidents are counted based on cases where tenants fail to receive their jeonse deposit within one month after terminating or ending the jeonse contract, or when the property is auctioned or sold during the lease period and tenants do not receive their deposit after distribution. The number of incidents increased by 34%, from 523 to 704 during the same period, and the accident rate rose by 2.0 percentage points (p), from 2.9% to 4.9%.

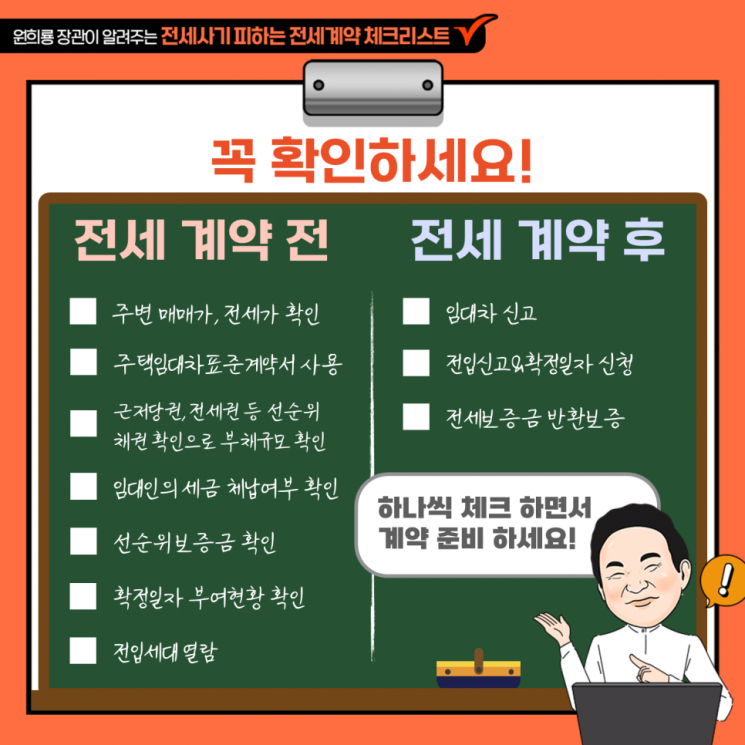

From the tenant’s perspective, it is difficult to completely prevent jeonse accidents. However, it is expected that the lease system improvement plan announced by the government this time will reduce the likelihood or minimize the damage to some extent once implemented.

Verification of delinquency information is a representative measure. Currently, landlords can hide delinquent facts such as comprehensive real estate tax arrears and proceed with lease contracts, and if the property goes to public auction, tenants may lose part or all of their deposits. Even if tenants have registered their residence and obtained a fixed date, if there are prior tax delinquencies, their priority ranking is pushed down. Although the current standard contract requires landlords to inform tenants of delinquency, it is a recommendation, not an obligation, so most landlords generally do not disclose such information to tenants.

The establishment of the right to confirm information on senior tenants is also expected to serve as a tool for tenants to detect the risk of deposit accidents. Under current law, prospective tenants can request lease information such as senior deposits from the fixed date granting agency with the landlord’s consent, but if the landlord refuses, this is ineffective.

Recently, ‘management fee tricks’ have also been rampant in the lease market. Since the introduction of the monthly rent reporting system in June last year, landlords must report contract details if the deposit is over 60 million won or monthly rent exceeds 300,000 won. However, some landlords lowered monthly rent and raised management fees to avoid reporting. Phenomena such as monthly rent being 70,000 won while management fees reach 380,000 won have appeared in various places.

There have also been numerous fraud cases exploiting tenants’ unfamiliarity with the lease contract law. After signing a monthly rent or jeonse contract, the ownership is transferred to a third party on the day of tenant registration to embezzle the deposit. In other words, before the tenant’s opposability arises on the day of registration, the property is sold to someone without the ability to return the deposit, so even if the new tenant claims the deposit, they cannot recover the money because the owner changed before opposability arose. This exploits the fact that under the Housing Lease Protection Act, the tenant’s opposability and priority repayment rights arise not on the ‘day of registration’ but on the ‘day after registration.’

The government’s announced measures, including ▲the addition of a management fee item in the standard lease contract and ▲a special clause prohibiting the landlord from setting collateral rights after contract signing but before move-in, are expected to resolve such issues.

Additionally, to prevent tenant damage, it is recommended to check the jeonse price ratio and auction statistics. The jeonse price ratio is the ratio of the jeonse price to the sale price; when this ratio is high and the jeonse price approaches or exceeds the sale price, tenants face a greater risk of losing their deposits to landlords. In some local areas, the jeonse price ratio for multi-family and row houses has exceeded 100%, with some places where jeonse prices surpass sale prices. The Ministry of Land, Infrastructure and Transport explained, "The higher the jeonse price ratio, the greater the risk of not recovering the jeonse deposit when sale prices fall, so it is necessary to refer to the jeonse price ratio in the area before signing a jeonse contract."

It is also advisable to check auction and bidding statistics in advance on the Korea Real Estate Board’s ‘Lease Market Siren’ website. Auction and bidding statistics are used as indicators of the real estate market situation. When a property is auctioned due to landlord default or bankruptcy, tenants can estimate the amount of deposit they might recover. A Ministry of Land official stated, "In areas with many deposit accidents and high accident rates, it is necessary to carefully examine the rights related to the property, surrounding sale and jeonse prices, and whether the landlord has tax delinquencies to avoid risky contracts. After signing, it is important to secure priority repayment rights through lease reporting (automatic fixed date assignment) and residence registration, and to be especially cautious by subscribing to jeonse deposit guarantee products."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)