Inverted Yield Curve Phenomenon Continues Since July This Year

Past 6 Instances of Yield Curve Inversion... Average 14 Months Later Economic Recession Begins

Fed Pivot in First Half of Next Year, Investment Stocks When Yield Curve Rebounds

[Asia Economy Reporter Ji Yeon-jin] The inversion of the 'yield curve'?a signal often interpreted as an indicator of economic recession?continues this year. The yield curve refers to the difference between the 10-year and 2-year U.S. Treasury yields, where typically long-term yields are higher. However, when short-term yields, closely linked to the benchmark interest rate, rise rapidly and surpass long-term yields, this inversion has often preceded economic recessions. Recently, with U.S. inflation easing, the Federal Reserve's (Fed) pace of interest rate hikes may slow, suggesting the need for investment strategies that anticipate a rebound in the yield curve inversion.

According to Hana Securities on the 21st, there have been six instances of yield curve inversion since 1978, with recessions entering on average 14 months later. Since the inversion began in July, applying the average period suggests a recession could start around September next year. However, considering the fastest recession onset during the COVID-19 crisis, which was six months after inversion, a recession could occur as early as January next year.

The yield curve inversion is expected to continue into next year. However, with last month's U.S. Consumer Price Index (CPI) falling below expectations, calls for moderating the pace of rate hikes have emerged. If the Fed concludes its rate hike policy in the first quarter of next year, there is a possibility of a rebound with a narrowing of the yield curve inversion.

Looking at the average returns of major indices during past periods of U.S. inflation decline and yield curve steepening, the Dow Jones Industrial Average had the highest returns, followed by the Standard & Poor's (S&P) 500, Russell 2000, and Nasdaq. The KOSPI's average monthly return was 1.5%, with large-cap, mid-cap, and small-cap stocks in descending order of returns.

During this period, there was no difference in average monthly returns between growth and value stocks. The best-performing category was the high-margin High Quality Index (0.6%), while high-dividend and momentum stocks posted negative returns, performing the worst. Researcher Lee Jae-man of Hana Securities explained, "While the current CPI decline should be seen as easing inflationary pressures, falling prices can generally be perceived as weakening demand," adding, "In a phase where growth momentum weakens and the yield curve steepens due to falling short-term rates, large-cap stocks and the High Quality Index, which maintain market dominance and high profitability, tend to perform relatively well."

By sector, during this period, among the 24 sectors of the S&P 500, retail, semiconductors, and equipment had the highest average monthly returns. However, the probability of gains for these two sectors was only 56% and 52%, respectively, making it difficult to deem their performance consistently strong. Sectors with both stable high returns and gain probabilities included pharmaceuticals & biotechnology, healthcare equipment, materials, and capital goods.

Among the 26 KOSPI sectors, IT home appliances, software, and semiconductors recorded the highest average monthly returns. However, similar to the U.S., these sectors had relatively low gain probabilities around 50%. Instead, banking, construction, and chemicals showed relatively stable returns and gain probabilities. Researcher Lee noted, "At the early stage (3 months) of yield curve steepening reversal, both U.S. and domestic stock markets commonly see strength in financial sector stocks," adding, "This is due to rising net interest margins, which should be considered when selecting companies."

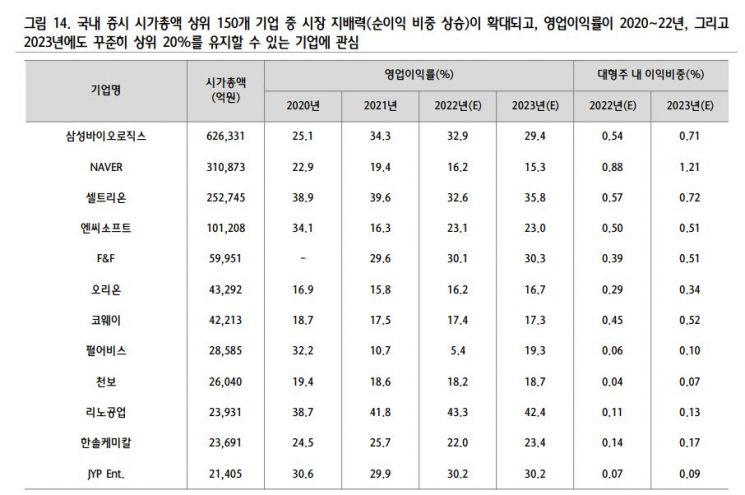

Researcher Lee recommended stocks including Samsung Biologics, NAVER, Celltrion, NCSoft, F&F, Orion, Coway, Pearl Abyss, Chunbo, Lino Industrial, Hansol Chemical, and JYP Entertainment.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)