Purchase of 1.8 Trillion KRW PF ABCP Executed

Small and Medium Securities Firms "Sweet Relief in a Drought"

Securities Industry "Time Needed Until Market Recovers"

The 1.8 trillion won-scale PF (Project Financing) ABCP (Asset-Backed Commercial Paper) purchase program was launched on the 21st, leading to an assessment that concerns have eased until the end of the year. However, the prevailing opinion is that more time is needed to thaw the frozen credit market tightening.

On this day, the Financial Services Commission began operating the 'Second Chaean Fund.' Nine major securities firms each contributed 50 billion won, totaling 450 billion won (subordinated tranche 25%), and the Korea Development Bank and Korea Securities Finance Corporation each added 450 billion won (senior tranche 25%). The securities firms applying to purchase PF ABCP prepared another 450 billion won (junior tranche 25%), creating a total of 1.8 trillion won to be injected into the market.

The response from applicant firms is encouraging. A small-to-medium securities firm that applied for support of 30 billion won stated, "We expect the Second Chaean Fund to have a positive impact on the bond market." The securities firms eligible to apply for the Chaean Fund include SK Securities, Daol Investment & Securities, Ebest Investment & Securities, Eugene Investment & Securities, Hanyang Securities, Bookook Securities, and Cape Investment & Securities, each able to apply for support up to 200 billion won.

However, some firms, while concerned about the 'stigma effect' associated with applying for financial support, judged that the fear of repercussions from the tightening was greater. A representative from a small-to-medium securities firm said, "Even if there is no immediate liquidity problem, due to the unstable market situation, we applied for the sake of future liquidity stabilization."

It appears that more time will be needed for overall market stabilization. A representative from a major securities firm said, "It is expected to help stabilize the atmosphere to some extent, but since it is the year-end settlement period and both credit and liquidity in the bond market are problematic, we need to observe a bit longer to see if the market itself can thaw."

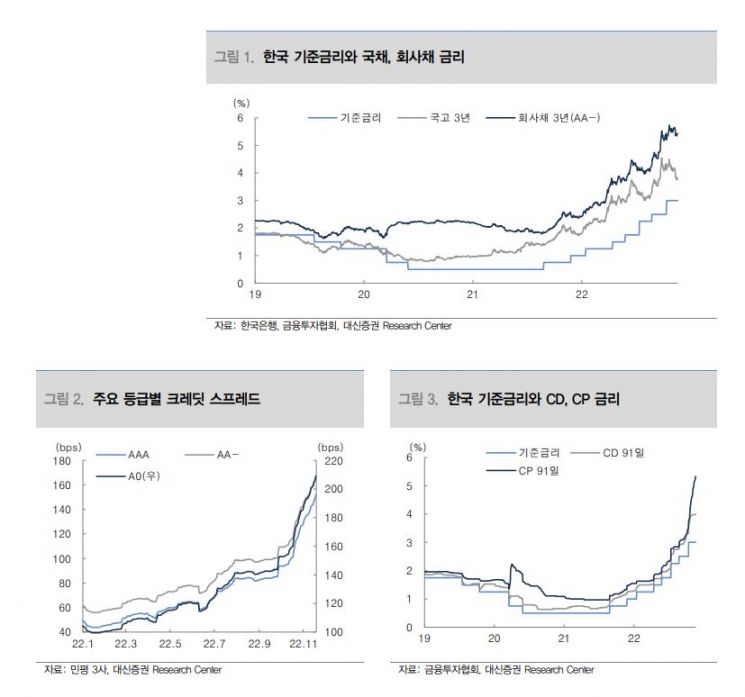

Gong Dong-rak, a researcher at Daishin Securities, said, "Since the market had entered a 'tightening' phase, short-term normalization does not seem smooth," adding, "If aggressive tightening, called overkill, continues and highlights factors of economic contraction, credit market stability will only be possible after safe assets within the bond market, such as government bonds, first enter a stable trajectory, which will take considerable time."

The Financial Monetary Policy Committee meeting scheduled for the 24th is also a variable. If the tightening intensity increases, market funds may dry up further. An Ye-ha, a researcher at Kiwoom Securities, predicted, "From the Bank of Korea's perspective, since government support has been provided and market sentiment has partially stabilized, even if a big step (0.50%p base rate hike) is burdensome, it will be necessary to maintain the additional rate hike stance."

Some point out that fundamental resolution is difficult with ABCP purchases through policy funds alone. According to Hi Investment & Securities, the scale of PF-ABCP and PF-ABSTB maturing within the year is about 34 trillion won.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)