[Asia Economy Reporter Lee Seon-ae] The upcoming monetary policies of South Korea and the United States this week are expected to heighten caution in the KOSPI market. The minutes of the U.S. Federal Open Market Committee (FOMC) are anticipated to reflect a hawkish (preference for monetary tightening) stance. It is widely expected that the Bank of Korea will raise its benchmark interest rate at the last Monetary Policy Committee meeting of the year. After a rebound following slowing inflation indicators, the KOSPI index is forecasted to struggle to surpass the '2500 barrier' due to growing concerns over tightening.

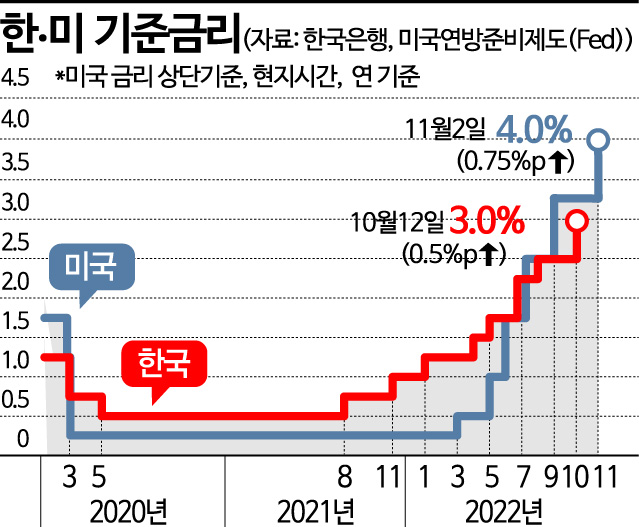

On the 20th, the securities industry recommended a conservative approach, anticipating a tug-of-war between upward and downward forces amid uncertainties in the Korea-U.S. monetary policies. First, the Monetary Policy Committee meeting is scheduled for the 24th. The Bank of Korea is expected to raise the benchmark interest rate by 25 basis points (bp) (1bp = 0.01 percentage point), implementing a 'baby step' (0.25 percentage point increase). Previously, the Bank of Korea raised the benchmark rate five consecutive times from April to October this year, marking the first time in history for such a streak. With the interest rate gap between the U.S. and Korea widening to 1 percentage point, another rate hike is expected, setting a record of six consecutive increases. If the baby step is implemented, the domestic benchmark interest rate will close the year at 3.25%.

Researcher Ahn Ye-ha from Kiwoom Securities explained, "Since the October Monetary Policy Committee meeting, expectations for the U.S. Federal Reserve's (Fed) policy rate pace adjustment have strengthened, and considering the won-dollar exchange rate falling to the 1300 won level, the Bank of Korea is more likely to respond with a 25bp increase rather than a big step (0.5 percentage point increase) that could heighten financial instability." However, he advised not to lower vigilance as further tightening is expected, with the final rate level reaching 3.75%. Although Bank of Korea Governor Lee Chang-yong mentioned at the last Monetary Policy Committee meeting that a final appropriate rate level would be around 3.50%, if the Fed's final rate exceeds 5%, uncertainty remains. This is because the Bank of Korea may focus on narrowing the Korea-U.S. interest rate gap and stabilizing inflation. Ultimately, the possibility of a big step remains open.

Uncertainty over U.S. monetary policy is also increasing. Recent remarks from Fed officials reveal mixed opinions between doves (favoring monetary easing) and hawks (favoring tightening). Last month’s Consumer Price Index (CPI) fell short of expectations, spreading hopes that inflation has peaked, but cautious views remain strong. James Bullard, President of the Federal Reserve Bank of St. Louis and a prominent hawk, stated on the 17th (local time) that the benchmark interest rate should be raised to as high as 7%. In a speech held in Kentucky, Louisiana, he said, "Despite generous assumptions, the benchmark rate has not yet reached a level that can be justified as sufficiently restrictive," adding, "According to monetary policy rules, the rate should rise to at least 5% annually, and applying the rules more strictly could push it beyond 7%." The current U.S. benchmark interest rate stands at 3.75?4.00% annually.

Investors’ attention is focused on the Fed’s November FOMC minutes, scheduled for midweek. They are expected to seek hints about the rate hike magnitude at the December meeting and the final rate in this tightening cycle. While a 50bp hike is anticipated at the December FOMC, the stock market’s direction will likely depend on how high the final rate reaches.

Researcher Choi Yoo-jun from Shinhan Investment Corp. said, "After the minutes are released, uncertainty about the final rate level could again weigh on the market," adding, "The minutes may point out that inflation is slowing but still broadly high, and many may argue that rate hikes should continue in response."

The KOSPI is expected to enter a consolidation phase for the time being. Researcher Kim Young-hwan from NH Investment & Securities stated, "The cheers from favorable inflation have subsided, and there are conflicting interpretations regarding the future economic and monetary policy directions," adding, "With no clear catalyst to define direction in the short term, the tug-of-war between upward and downward forces is expected to continue for a while."

Calls for a conservative approach are strong. Researcher Ahn emphasized, "Given the still high uncertainty about the Korea-U.S. final rate levels, a conservative approach remains valid even after the November Monetary Policy Committee meeting."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.