Current Reverse Jeonse Crisis Due to Interest Rate Hikes

Worsened by Additional Housing Supply

As the real estate market experiences severe stagnation, cases of jeonse prices falling below those from two years ago are emerging nationwide as lease contracts approach expiration. This has led to a phenomenon known as 'reverse jeonse crisis,' where landlords must return deposit money to tenants upon lease renewal.

The problem is that the supply of new housing in the metropolitan area is expected to increase further. Until now, the decline in jeonse prices was largely influenced by interest rate hikes. With the addition of a housing supply surge, concerns are growing that the reverse jeonse crisis could worsen significantly.

◆ Implementation of Jeonse Loan System in 2014... Low Interest Rates Led to 'Jeonse Price Increase → Housing Price Increase'

According to a recent report titled 'Implications of the Reverse Jeonse Crisis and Housing Price Changes' published by the Korea Local Tax Research Institute on the 20th, the fundamental cause of the recent reverse jeonse crisis is 'interest rate hikes.'

The jeonse loan system, implemented since 2014, has provided tenants with a means to secure better housing at lower interest rates. Additionally, by increasing liquidity in the jeonse market, it pushed up jeonse prices. During the low-interest period of rising real estate prices, jeonse loans maximized leverage effects, also driving up housing prices.

However, the institute stated, "During high-interest periods, jeonse loans rather accelerate the decline in real estate prices, acting as a reverse leverage effect that speeds up housing price drops." It further analyzed, "The occurrence of the reverse jeonse crisis in the housing market in the second half of this year is more due to the rise in jeonse loan interest rates than an increase in housing supply."

◆ Now Facing a Housing Supply Surge... 'Reverse Jeonse Crisis Deepens → Accelerated Housing Price Decline' Reversal

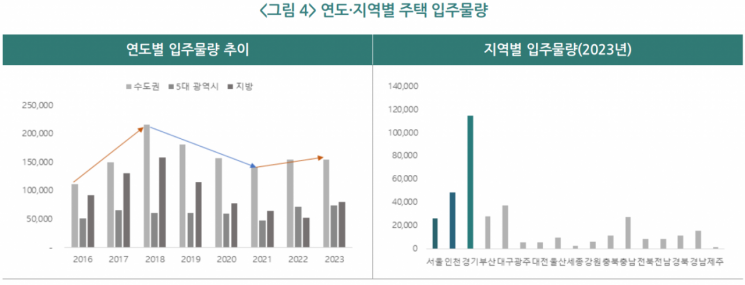

The problem is that following interest rate hikes, a 'housing supply surge' is also hitting the market. The institute noted, "New housing supply usually concentrates at year-end, and from the end of 2022, housing supply is expected to increase significantly." It added, "In particular, in Seoul, apartment move-ins are scheduled in areas such as Seodaemun-gu and Yeongdeungpo-gu, which could promote housing price declines in nearby areas due to the reverse jeonse crisis."

By region, the highest expected move-in volumes are in Gyeonggi, Incheon, Daegu, Chungnam, Busan, and Seoul, in that order. The institute also added that in Incheon, the decline in jeonse and housing prices could be more pronounced.

In some areas of Seoul, Incheon, Suwon, Sejong, and Daegu where sales and jeonse prices have dropped significantly, a phenomenon called 'reverse monthly rent' is also occurring. This happens when landlords, unable to return the jeonse deposit, pay the difference in deposit as monthly rent to tenants. The reverse monthly rent phenomenon was also observed during the 2019 move-in period of Helio City in Songpa-gu, Seoul.

Prospective tenants should check jeonse market prices and subscribe to Jeonse Deposit Return Guarantee Insurance

Experts advise tenants to make careful decisions as there is a risk of losing deposits or being unable to move out on time.

Ye Kyung-hee, Senior Researcher at Real Estate R114, said, "Due to the recent increase in jeonse loan interest burdens and concerns over 'empty jeonse' (where the deposit exceeds the market value), tenant demand for monthly rent is rising. This increases the likelihood of jeonse listings with prices lower than two years ago, not only in small and old complexes but also in areas with apartment move-ins or where gap investments were common in the past." She added, "Tenants should avoid moving into apartments where jeonse prices have sharply dropped recently and take measures to protect their deposits, such as subscribing to Jeonse Deposit Return Guarantee Insurance."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)