[Asia Economy Sejong=Reporter Kim Hyewon] The national budget deficit increased to 91.8 trillion won from January to September this year. National debt was recorded at 1,029.1 trillion won, down 1.6 trillion won from the previous month.

According to the 'Fiscal Trend November Issue' announced by the Ministry of Economy and Finance on the 17th, the cumulative management fiscal balance as of September this year showed a deficit of 91.8 trillion won, an expansion of 17.1 trillion won compared to the same period last year. Compared to the end of August, a month ago, the deficit increased by 6.5 trillion won.

The management fiscal balance is an indicator showing the government's actual fiscal condition by subtracting the four major social security funds, including the National Pension, from the integrated fiscal balance (total revenue - total expenditure).

The government aims to manage within the planned management fiscal balance deficit of 110.8 trillion won, which was forecasted during the formulation of the second supplementary budget.

The integrated fiscal balance recorded a cumulative deficit of 52.7 trillion won from January to September, an increase of 23.1 trillion won compared to one year ago.

Total revenue from January to September was 483.2 trillion won, an increase of 40.9 trillion won compared to the same period last year.

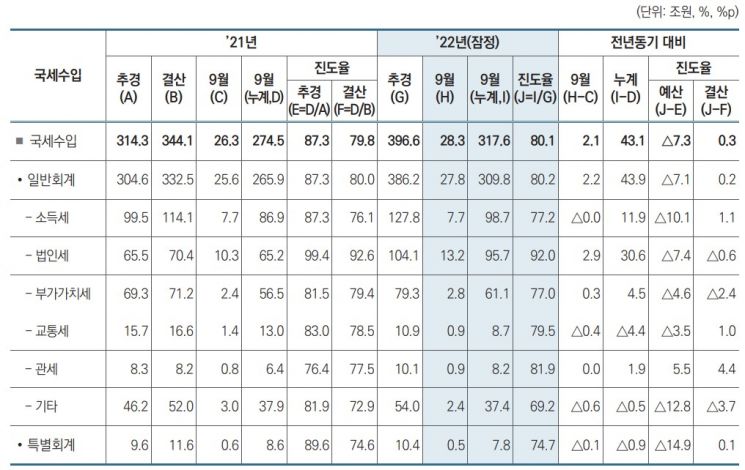

Among this, national tax revenue was 317.6 trillion won, up 43.1 trillion won from a year earlier. The progress rate was 80.1%. This increase was due to improved corporate performance and increased consumption, which led to rises in corporate tax (30.6 trillion won), income tax (11.9 trillion won), and value-added tax (4.5 trillion won). On the other hand, transportation tax decreased by 4.4 trillion won due to the temporary reduction of fuel tax.

Non-tax revenue was recorded at 23.6 trillion won, an increase of 1.4 trillion won compared to the same period last year. Recently, asset management income declined, causing fund income (141.9 trillion won) to decrease by 3.7 trillion won.

Total expenditure was 536 trillion won, an increase of 64 trillion won compared to a year ago. Budget spending increased by 20.6 trillion won due to local allocation tax and grants, as well as ongoing COVID-19 crisis response projects, and fund expenditure also rose by 34.5 trillion won due to payments of loss compensation to small business owners.

As of the end of September, the central government debt balance was recorded at 1,029.1 trillion won, down 1.6 trillion won from the previous month. Compared to the end of last year, the balance of treasury bonds increased by 87.7 trillion won, housing bonds by 0.4 trillion won, and foreign exchange stabilization bonds by 1.9 trillion won, respectively. The government's year-end national debt forecast based on the second supplementary budget is 1,037.7 trillion won.

The issuance scale of treasury bonds in October was 11.2 trillion won. The Ministry of Economy and Finance stated, "Recently, interest rates showed a downward stabilization trend due to the easing of inflation concerns following the U.S. consumer price index (CPI) in October falling short of expectations, expectations for a slowdown in monetary tightening, and concerns about domestic and international economic slowdown." However, it added, "Market volatility is likely to continue depending on future monetary policy decisions such as the Financial Monetary Committee (November 24) and the U.S. Federal Open Market Committee (December 13-14), as well as major economic indicators."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)