Global DRAM Sales Decline Largest Since Financial Crisis

Samsung Electronics Drops 33.5%, Largest Decrease Among Top 3

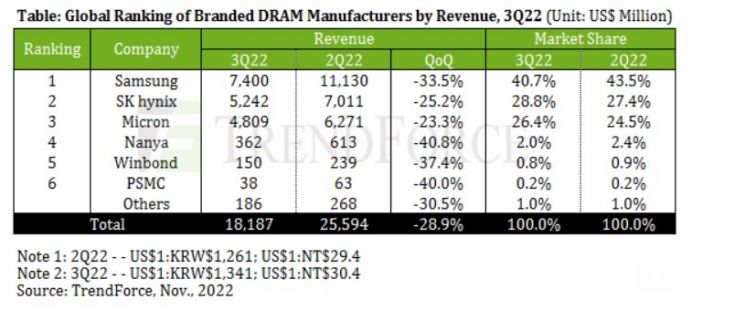

[Asia Economy Reporter Park Sun-mi] Due to the impact of price declines caused by decreased demand, the total sales of the global DRAM industry in the third quarter of this year dropped by as much as 28.9%. This is the largest decline since the global financial crisis in 2008.

On the 17th, Taiwanese market research firm TrendForce announced that the DRAM industry's sales in the third quarter of this year reached $18.19 billion, a 28.9% decrease compared to the previous quarter. This is the first time since the 2008 global financial crisis that such a large sales decline has occurred within a single quarter. The decrease in sales is largely due to the sharp contraction in demand for consumer IT devices amid economic uncertainty, which caused DRAM contract prices to fall by 10-15%. Even server DRAM, which had stronger price resistance than consumer products, saw a noticeable drop in shipments, resulting in an overall downturn in the DRAM market affecting both consumer and enterprise sectors.

The top three DRAM companies experienced significant sales declines. Industry leader Samsung Electronics recorded $7.4 billion in sales for the third quarter, marking the largest decrease among the top three at 33.5% compared to the previous quarter. Its market share in the third quarter also fell by 2.8 percentage points from 43.5% in the second quarter to 40.7%. SK Hynix, ranked second, posted sales of $5.242 billion, a 25.2% decrease from the previous quarter. Its market share in the third quarter rose by 1.4 percentage points to 28.8% from 27.4% in the second quarter.

Micron, ranked third, experienced the smallest sales decline. Its third-quarter sales were $4.809 billion, down 23.3% from the second quarter. Its market share increased by 1.9 percentage points to 26.4% in the third quarter from 24.5% in the second quarter.

TrendForce assessed that although the top three companies are maintaining profitability despite steep sales declines, the DRAM inventory adjustment that began this year is expected to continue at least until the first half of next year, which could increasingly pressure profitability. In fact, the average fixed transaction price of PC DRAM general-purpose products (DDR4 8Gb) in October dropped to an average of $2.21, 22.46% lower than $2.85 in September, indicating that the price decline trend is accelerating in the fourth quarter as well.

Companies are enduring the harsh period by controlling shipment volumes. SK Hynix, anticipating that supply will continue to exceed demand for the time being, plans to reduce next year's investment scale by more than 50% compared to this year's investment amount, which is expected to be in the high 10 trillion won range, and to cut production volumes focusing on low-profit products.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)