Impact and Implications of Choeunjeo on South Korea's Exports

Yen-Dollar Exchange Rate Rises 17.9% Through Q3 This Year

[Asia Economy Reporter Park Sun-mi] An analysis has been raised that South Korea's exports decreased by $16.8 billion cumulatively from January to September this year due to the rapid depreciation of the Japanese yen.

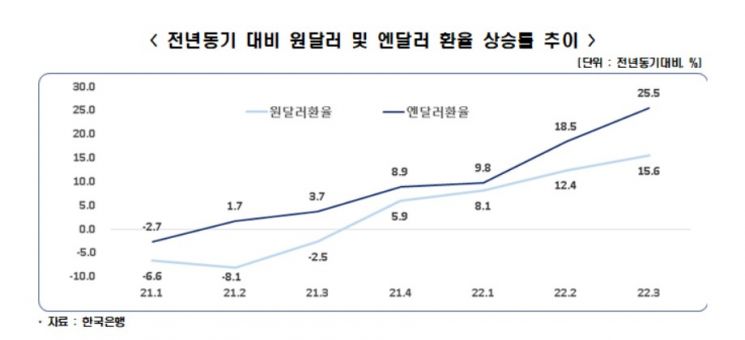

On the 17th, the Korea Economic Research Institute (KERI) announced through the analysis titled "The Impact and Implications of Ultra-Yen Weakness on South Korea's Exports" that the yen-dollar exchange rate increase rate showed a sharp rise compared to the same period last year, with 9.8% in Q1, 18.5% in Q2, and 25.5% in Q3, indicating that the ultra-yen weakness phenomenon is intensifying. The average increase rate for the first three quarters of this year was 17.9% compared to the same period last year.

KERI estimated that if the yen-dollar exchange rate increase rate rises by 1 percentage point (meaning the yen depreciates by 1 percentage point), South Korea's export prices fall by 0.41 percentage points, and export volume decreases by 0.20 percentage points. Accordingly, the export amount growth rate is analyzed to decrease by 0.61 percentage points.

During the first three quarters of this year, the yen-dollar exchange rate increase rate was 17.91%, which is 5.86 percentage points higher than the won-dollar exchange rate increase rate of 12.05%. Using the excess yen-dollar exchange rate increase rate of 5.86 percentage points for the first three quarters and the export amount growth rate impact coefficient of -0.61 percentage points per 1 percentage point increase in the yen-dollar exchange rate, the estimated decrease in South Korea's exports due to the sharp rise in the yen-dollar exchange rate up to September this year was $16.8 billion. This corresponds to 58.2% of South Korea's cumulative trade deficit of $28.89 billion up to September.

Additionally, it was found that if the yen-dollar exchange rate increase rate is 1 percentage point higher compared to the same period last year, the won-dollar exchange rate increase rate rises by 0.14 to 0.28 percentage points.

KERI stated that ultra-yen weakness is a major factor worsening the trade balance not only for South Korea but also for Japan, arguing that ultra-yen weakness increases import costs such as raw materials, deepening the trade deficit, which in turn causes further yen depreciation, leading to a cumulative surge in the trade deficit. In fact, Japan's trade deficit ratio relative to trade volume from January to September this year is 9.1%, more than three times South Korea's 2.7%.

Choo Kwang-ho, Director of Economic Policy at KERI, said, "If the ultra-yen weakness intensifies, major exporting countries including South Korea will be negatively affected, and it will not benefit Japan either," adding, "Efforts for international cooperation to mitigate the negative effects of ultra-yen weakness, along with strengthened export support such as research and development (R&D) for items with high export competition with Japan, are required."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)