LG Energy Solution 10.7 Trillion

SK On 2.6 Trillion · Samsung SDI 7.7 Trillion

Used for Purchasing Materials and Components

SMEs and Mid-sized Companies in Materials, Parts, and Equipment

Opportunity to Strengthen Technological Competitiveness

Calls for Active Government Support

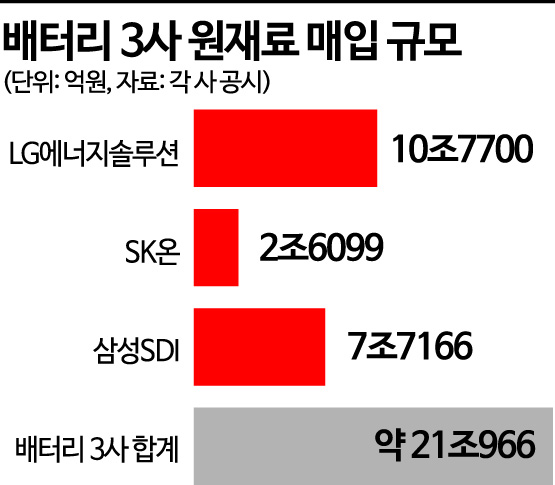

The battery big three have reportedly spent over 21 trillion won this year solely on purchasing raw materials such as materials and components. This is seen as an indication that the battery ecosystem encompassing domestic ‘SoBuJang (materials, components, and equipment)’ companies is expanding.

According to each company's quarterly reports on the 16th, the three battery manufacturers producing finished battery cells?LG Energy Solution, SK On, and Samsung SDI?purchased materials and components worth 21.0966 trillion won up to the third quarter of this year. By company, LG Energy Solution spent 10.770065 trillion won, SK On 2.60998 trillion won, and Samsung SDI 7.7166 trillion won. This amount far exceeds 50% of each company's cumulative sales.

Since the battery big three do not fully internalize the massive raw material market, small and medium-sized enterprises (SMEs) and mid-sized companies are developing technological competitiveness in the SoBuJang sector, leading to the formation of a ‘battery ecosystem.’ Although some materials and components still rely on overseas imports, internalization is underway for certain materials, and companies are focusing on enhancing technological competitiveness by sharing roles with partner firms. A battery industry insider stated, "While large manufacturers systematize manufacturing processes and have strengths in overseas expansion, SMEs and mid-sized companies are excelling in materials and components technology, which is why the Korean battery industry is gaining recognition in the global market."

Not only large corporations but also SMEs and mid-sized companies are actively developing technology and entering the market in the four core materials: cathode materials, anode materials, electrolytes, and separators, which are the largest markets. In the battery industry, companies such as Ecopro BM, L&F, Chunbo, and Nano New Materials are increasingly being called ‘hidden champions’ (excellent small and strong companies). The SoBuJang ecosystem is emerging as another strength of the Korean battery industry.

However, voices are calling for the government to take more proactive support measures to foster a healthy battery industry ecosystem. The battery industry argues that ▲tax benefits ▲securing an independent supply chain for raw materials ▲and fostering the used battery industry are necessary.

In particular, there is a call for a national response strategy to counter China's dominance of the battery supply chain. China controls the raw materials necessary for battery manufacturing. According to the Korea Institute for Industrial Economics and Trade, the import dependency on China for lithium, cobalt, and manganese by the three domestic battery companies is 81%, 87.3%, and 100%, respectively. Although supply chains are being diversified to Australia, South America, and other regions, the rapidly growing battery industry urgently needs to diversify its supply chain.

In 2016, the Chinese government urgently provided $6 million (7.81 billion won) in funding to the Democratic Republic of Congo, the world's largest cobalt reserve country, to secure stable battery raw materials. Additionally, China made massive investments totaling $144.7 billion (164.4 trillion won) in Australia and Chile, which account for 78% of the world's lithium production. Japan is focusing on overseas resource development to reduce its dependence on China for battery raw materials. The governments of the United States, Canada, and Australia have recently collaborated by creating a map sharing information on key mineral deposits.

Professor Park Cheol-wan of the Department of Automotive Studies at Seojeong University said, "It is necessary to properly establish the battery ecosystem and also nurture personnel in the basic and materials sectors, which have been cited as weaknesses. The government needs to implement policies that encompass the cultivation of innovative talent and industrial technology personnel."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.