[Asia Economy Reporter Lee Myunghwan] Among visitors to the homepage of FTX, the world's second-largest cryptocurrency exchange that has filed for bankruptcy, Korean users are estimated to be the most numerous. As FTX has filed for bankruptcy and customers' funds are frozen, damage to domestic users is expected.

According to website data analysis firm 'SimilarWeb' on the 14th, during the recent 28 days (October 16 to November 12), Korean users accounted for 7.21% of the total visitors (traffic) to FTX's PC homepage. This proportion of domestic users' traffic is the highest among all countries during this period. Following Korean users were Japan (6.82%), Singapore (4.96%), Germany (4.72%), and the United Kingdom (4.62%). During this period, FTX experienced a liquidity crisis due to the fragile financial structure issues of its affiliate 'Alameda Research' and ultimately filed for bankruptcy.

Looking at a broader period from August to October, Korean users ranked second with a 6.69% share of visitors by country. The top country during this period was Japan (6.72%), showing a small gap of only 0.03 percentage points. However, considering that FTX's cryptocurrency trading services are provided not only through the PC web page but also via mobile applications (apps) and mobile web pages, it can be interpreted that the proportion of Korean users utilizing the PC web exchange is the highest.

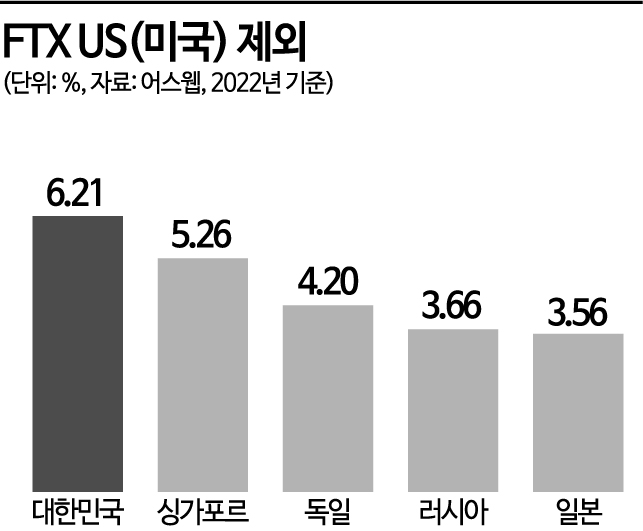

Statistics also show that this year, among FTX's overseas users, the proportion of Korean users is the highest. According to the online research media EarthWeb, as of August, the proportion of Korean users among FTX's overseas users ranked first. The media reported that Korean users accounted for 6.21% of FTX users.

As FTX, an overseas exchange, offers various cryptocurrency investment methods, it appears that some domestic investors targeting these options have flocked to it. FTX has supported cryptocurrency leverage and futures trading, which are not available on the top five domestic exchanges.

Currently, both FTX and FTX US have blocked cryptocurrency withdrawals. In the United States, if a bank fails, the Federal Deposit Insurance Corporation (FDIC) protects deposits, but cryptocurrency exchanges do not have such safeguards. If FTX's bankruptcy is finalized, the exchange's funds could be completely seized. According to Mobile Index and others, the number of domestic individual investors directly using the FTX exchange exceeds 10,000. The Japanese cryptocurrency exchange Mt. Gox ceased operations and filed for bankruptcy in 2014, and users whose assets were frozen at that time have yet to recover their funds.

Therefore, damage to domestic investors who used FTX seems inevitable. Bloomberg News pointed out, "Ordinary people who entrusted money to cryptocurrency exchanges or even kept money for savings purposes may suffer the deepest wounds."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)