US Democratic Election Victory Boosts IRA

Impact on Electric Vehicle Battery Supply Chain

Domestic Battery Companies Achieve Record-Breaking Q3 Performance Reflecting Mineral Price Adjustments

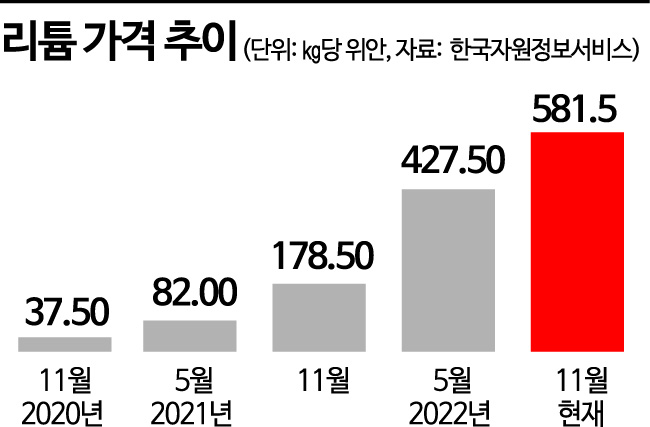

The results of the U.S. midterm elections have bolstered the Inflation Reduction Act (IRA) promoted by the Joe Biden administration, directly impacting the battery supply chain. Lithium prices, which have surged over 400% in one year, have once again reached an all-time high.

According to the Korea Resource Information Service on the 14th, the price of lithium (based on 99% lithium carbonate) per kilogram reached 581.5 yuan (approximately 107,827 KRW). This is more than three times the price of 178.0 yuan (about 32,979 KRW) a year ago and 15 times the price of 37.5 yuan (about 6,948 KRW) two years ago. This sharp price increase highlights the critical value of lithium, a key mineral in the battery supply chain restructuring centered around the U.S. Other battery minerals such as nickel and cobalt have seen prices drop about 40% from their peak in the first half of the year due to recession concerns.

Lithium generates electricity through a chemical reaction in which lithium ions move between the cathode and anode within the battery. It is used in cathode materials and electrolytes, which account for about 40-50% of the battery cost. Lithium is one of the most widely used minerals in batteries and has even earned the nickname "white petroleum." It is known that about 700 tons of lithium are required to produce 1 GWh of electric vehicle batteries (enough for 15,000 electric vehicles).

The Inflation Reduction Act is expected to drive a structural price increase in battery minerals such as lithium. The law excludes any electric vehicle battery minerals or components from "concerned countries" like China and Russia from tax credit benefits. It specifies that battery minerals must be mined and processed in the U.S. or countries with which the U.S. has a Free Trade Agreement (FTA), or recycled in North America, to receive up to half of the maximum subsidy ($3,750, approximately 4.93 million KRW). The required percentage of qualifying materials starts at 40% next year and must increase to 80% by 2027.

As a result, significant changes are expected in the battery supply chain previously dominated by China. China has led most of the battery supply chain, from mineral mining to refining, processing, and finished battery cell production. However, as North American and European markets seek to exclude Chinese supply chains, domestic companies have recently diversified their mineral supply sources to Australia, South America, Southeast Asia, and Africa. With the battery supply chain splitting into Chinese and non-Chinese segments and new investments needed for the new supply chain, lithium supply is expected to decrease in the short term, while long-term investments in mineral mining and refining will increase.

Domestic battery companies are smiling despite rising raw material mineral prices. They recorded record-breaking performance by reflecting this year's mineral price increases in third-quarter battery sales prices. This proves the logic that increased production costs due to rising mineral prices can lead to higher profits rather than harming earnings. Efforts to secure lithium supply chains are also accelerating. LG Energy Solution has agreed to receive large quantities of lithium from mineral companies in Canada and the U.S. starting in 2025, and SK On has signed a long-term contract to supply 230,000 tons of high-purity lithium from an Australian mining company.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)