[Asia Economy Reporter Lee Seon-ae] Experts have differing opinions on whether foreign capital, which has withdrawn from the Chinese market, will continue to flow into the domestic stock market. Since October, the increase in foreigners' net purchases of KOSPI stocks, driven by the 'China Run' (the phenomenon of global investment funds exiting China), has been propelling the index upward, but uncertainty about its sustainability is growing. If the pattern of 'selling China - buying Korea' does not continue long-term, voices warn that the negative impacts must be carefully guarded against. Should the foreign investors' supply-demand environment change again, the upward momentum of KOSPI will weaken, inevitably increasing volatility.

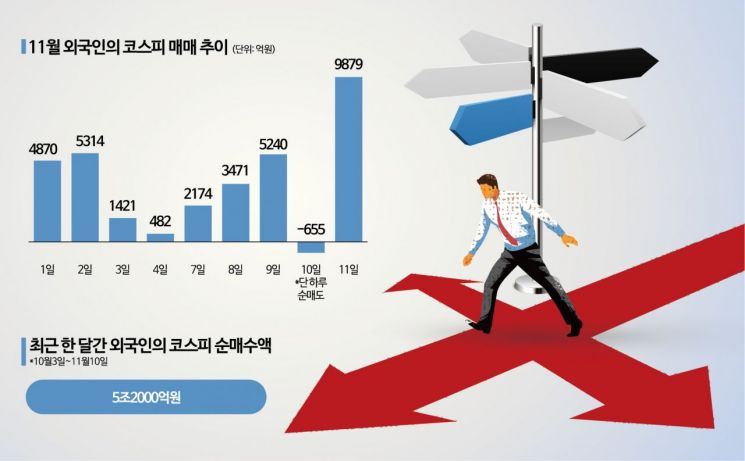

On the 14th, the securities industry predicted that KOSPI could reclaim the 2500 level this week. The expected range is from a minimum of 2350 to a maximum of 2520. Along with expectations of a Federal Reserve (Fed) pivot (policy direction shift), a favorable supply-demand environment driven by foreign buying is expected to lead the index higher. Over the past month, foreigners have net purchased stocks worth 5.2 trillion KRW in the KOSPI market (from October 3 to November 10). Except for one day (the 10th) in November, all other days showed a buying advantage. This was the driving force behind last week's recovery of KOSPI to the 2480 level. Accordingly, if the foreign investors' supply-demand environment continues to be supportive, reclaiming 2500 is also considered possible.

Yang Ji-yoon, a researcher at NH Investment & Securities, said, "From November 1 to 9, foreigners bought about 2 trillion KRW worth of KOSPI stocks," adding, "After the 20th National Congress of the Chinese Communist Party last month and President Xi Jinping's third term, China policy risks intensified, causing a China Run in global stock markets, leading to capital transfers to other countries within Asian emerging markets. Recently strengthened zero-COVID policies are also a factor driving capital outflows from the Chinese stock market."

The won-dollar exchange rate has also stabilized, creating a favorable environment for foreign investors' supply-demand. Seo Jeong-hoon, a researcher at Samsung Securities, said, "The sharply falling won exchange rate has been evidence of foreign investors' supply-demand and is expected to be a driving force going forward. The 'spiral effect of exchange rate and supply-demand' is worth anticipating," adding, "The recently rising expectations of easing China's quarantine policies will also be a positive factor domestically."

Accordingly, Kim Young-hwan, a researcher at NH Investment & Securities, forecasted that the stock market rebound might test levels close to the August peak. KOSPI rose to around 2530 on a closing basis in mid-August.

However, there are also skeptical views about whether the foreign buying momentum will continue. The rapid increase in foreign buying is attributed to the China Run's reflexive benefits. After President Xi Jinping's third term was confirmed, large-scale funds from global institutions sought alternative investment destinations to China, and this capital flowed into the domestic stock market. According to Yuanta Securities, the Texas Teachers' Retirement System, which manages assets worth $98.7 billion, reduced its China investment proportion and increased its Korea allocation.

Researcher Kim Young-hwan said, "There is little sign that benchmark changes by U.S. state-run pension funds like the Texas Teachers' Retirement System are spreading," adding, "If this is a tactical portfolio adjustment due to concerns about China's geopolitical risks, the pattern of selling Chinese stocks and buying Korean stocks is unlikely to continue long-term."

Furthermore, the securities industry expresses concern about the recent stock price rebound. Since the surge was temporary and driven by foreign supply-demand without positive fundamental changes, if supply-demand slows, the upward momentum will inevitably weaken. Kim Soo-yeon, a researcher at Hanwha Investment & Securities, said, "A rebound without accompanying fundamental improvements is difficult to sustain," adding, "Especially, the stock prices of the secondary battery sector, which led this rebound, began to slow down last week, which I consider a signal of the index's slowing rise."

Park Sang-hyun, a researcher at Hi Investment & Securities, noted, "Typically, when China risks spread, foreigners tend to net sell domestic stocks, but this is a somewhat different phenomenon," adding, "While foreign net selling is strengthening in the Taiwan stock market, which shares the common factor of semiconductor and IT industry downturns, strong foreign buying is appearing in the Korean stock market, which is an unexpected situation." He emphasized, "The negative effects that the China Run could bring must be clearly guarded against."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)