Jung In-young, Associate Research Fellow at the National Pension Research Institute, Analyzes Issues of Pension Income Replacement Rate

"Should Be Raised for Retirement Security" vs "Maintain or Reduce Considering Basic Pension" in Opposition

[Asia Economy Reporter Jo In-kyung] As discussions on the '5th National Pension Financial Calculation' gain momentum, the appropriate income replacement rate and how to adjust it have emerged as key issues in the National Pension reform debate. An analysis revealed that if the current National Pension income replacement rate and the Basic Pension system are maintained, more than 3 out of 10 elderly people will suffer from economic poverty even after 2045.

National Pension Fails to Prevent Elderly Poverty

Jung In-young, Associate Research Fellow at the National Pension Research Institute, estimated at the National Pension Expert Forum held on the 10th that "if the National Pension income replacement rate is maintained at 40% and the Basic Pension system continues to provide 300,000 KRW to 70% of the elderly, the elderly poverty rate for those aged 65 and over will reach 31.49% in 2045."

The income replacement rate indicates the percentage of a National Pension subscriber's pension amount relative to their lifetime average income. For example, an income replacement rate of 50% means that if the average monthly income during the subscription period (based on 40 years) is 1 million KRW, the monthly pension received would be 500,000 KRW. Currently, South Korea's National Pension income replacement rate is 43%, which has been gradually lowered from 70% at the time of the pension's introduction in 1988 through two reforms, with a plan to reduce it stepwise to 40% by 2028.

However, experts point out that this 40% refers only to the 'nominal income replacement rate,' which means the income replacement rate for those with an average income over a 40-year subscription period, and the actual 'real income replacement rate'?the ratio of the pension amount in the first year of receipt to the lifetime average income of current beneficiaries?is lower.

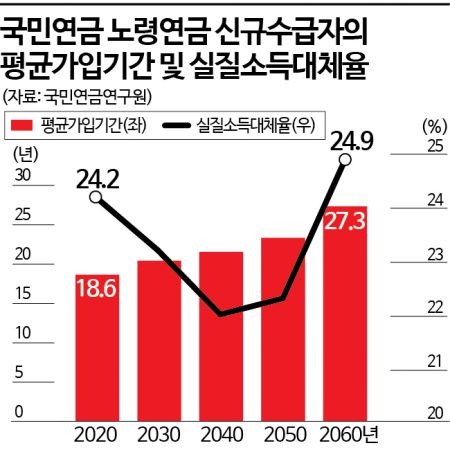

According to Associate Research Fellow Jung, as of 2020, the average subscription period for new old-age pension beneficiaries was 18.6 years, and the real income replacement rate was 24.2%. Due to the low real income replacement rate, the average old-age pension payment in 2019 was 520,000 KRW, and even when combined with the Basic Pension of 236,000 KRW, it amounted to only about 19.7% of the average worker's income.

This is not unrelated to South Korea's elderly poverty rate, which is among the highest in the Organisation for Economic Co-operation and Development (OECD). Although South Korea's elderly poverty rate has been decreasing since 2011, it still stands at 39% (as of 2020), significantly higher than the OECD average of 13.1%. The poverty gap between the working-age population and the elderly is also large, placing South Korea alongside countries like Latvia and Estonia as nations with very high elderly poverty rates compared to overall population poverty rates among OECD countries.

To reduce elderly poverty, the income replacement rate must be raised to strengthen the role of public pensions, but considering insurance premium burdens and financial stabilization, this is not a simple decision. Associate Research Fellow Jung pointed out, "Raising the income replacement rate requires a considerable increase in insurance premiums, and the acceptance of not only workers but also employers and self-employed individuals must be taken into account."

Diverging Opinions on Income Replacement Rate Adjustment

Among experts, there are conflicting views: some argue that the National Pension income replacement rate needs to be increased to guarantee a stable retirement life, while others believe it should be maintained at the current level or even reduced, considering its relationship with the Basic Pension.

Regarding income replacement rate adjustment plans, some advocate for an increase based on the perception that benefits are low compared to public pensions in other countries, while others propose maintaining the 40% income replacement rate but reducing the Basic Pension recipients from the current bottom 70% income bracket and increasing the benefit level, transforming it from a universal Basic Pension to a form of public assistance targeting low-income elderly.

There is also a proposal to lower the income replacement rate to ensure the National Pension's financial soundness while converting the Basic Pension into a universal allowance that can be received by meeting only age and residency requirements. Currently, the Basic Pension is provided to the bottom 70% of elderly income earners, and this proposal suggests raising it to 100%. However, this would inevitably require restructuring between the current National Pension and Basic Pension systems.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.