FTX Liquidity Crisis Drives Trading Volume Up

Massive Sell-Off by Investors

Some Low-Price Buying Inflows

Price Briefly Rises

[Asia Economy Reporter Lee Jung-yoon] The world's largest cryptocurrency exchange Binance has withdrawn its acquisition of FTX, an exchange facing a liquidity crisis, causing severe turmoil in the domestic virtual asset market. While some virtual asset exchanges saw a rebound as bargain buying surged for cryptocurrencies including Bitcoin, which plummeted on the 9th, other exchanges experienced accumulating sell orders, showing signs of a 'panic sell,' raising concerns about a possible 'coin run' where virtual assets are withdrawn as cash.

As of 9:56 AM on the 10th, Bitcoin was trading at 23.42 million KRW on Upbit, the top domestic exchange by market share, up 2.18% from the previous day. At the same time, Coinone also showed a similar upward trend in Bitcoin prices, recording 23.47 million KRW, up 2.30% from the previous day. Conversely, Bithumb saw Bitcoin prices decline, dropping 7.10% to 23.46 million KRW compared to the previous day.

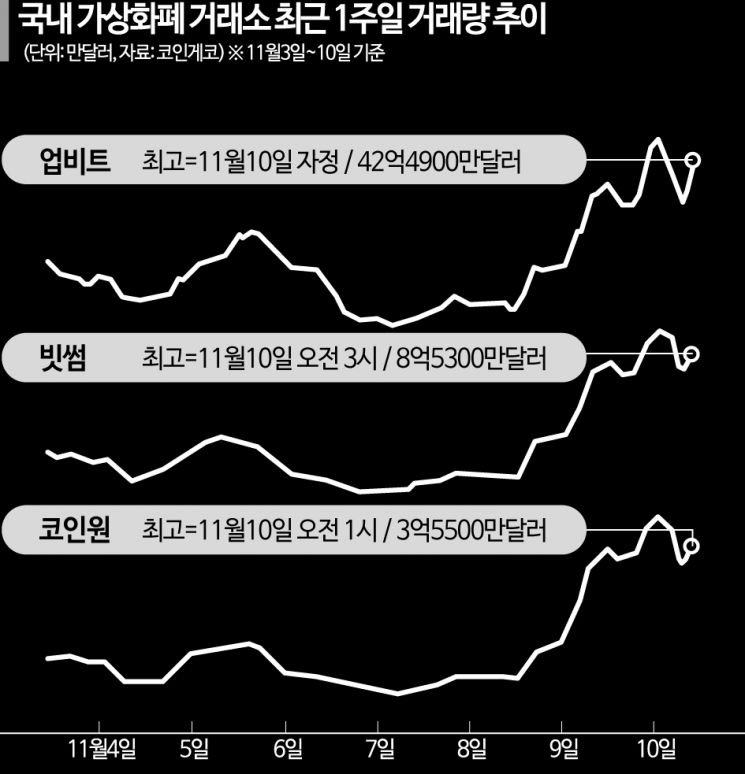

Since the FTX incident, trading volumes at domestic exchanges have surged significantly. According to cryptocurrency market tracking site CoinGecko, Upbit's trading volume rose from $1.48474 billion (approximately 2.0252 trillion KRW) at noon on the 8th to $4.1822 billion (approximately 5.6995 trillion KRW) by 1 AM on the same day. Bithumb showed a similar pattern, with trading volume increasing from $268.77 million (approximately 366.1 billion KRW) to $873.68 million (approximately 1.1907 trillion KRW) during the same period. This increase in trading volume is interpreted as a result of massive sell-offs by investors following the sharp drop in coin prices due to the FTX crisis.

Binance CEO Changpeng Zhao announced the day before that they would pursue the acquisition of FTX, which was experiencing a liquidity crisis. Although he also stated that due diligence would be conducted for the acquisition, the decision was reversed within a day. As a result, Bitcoin prices, which had fallen from the $20,000 range to the $18,000 range and then stabilized, plunged to the $15,000 range, the lowest since November 2020. In domestic exchanges, prices dropped to the 22 million KRW range.

As the coin market took a direct hit, investors sold off coins, but some exchanges saw bargain buying, showing contrasting behavior. On Upbit and Coinone, Bitcoin prices rose in the morning, attributed to the influx of bargain buying. Meanwhile, Bithumb and Korbit still showed declining prices, suggesting that distrust in the cryptocurrency market is leading to coin sell-offs.

With FTX, the world's largest exchange, facing a liquidity crisis and overall trust in the cryptocurrency market declining, domestic exchanges are expected to suffer inevitable damage. There are concerns that the market contraction due to coin price drops could lead to a long-term decrease in trading volume.

However, concerns about a bank run (a situation where customers withdraw funds all at once), like in the FTX case, remain low at present. The current Act on Reporting and Using Specified Financial Transaction Information (Special Act on Financial Transactions) requires that investors' deposits be managed separately from the virtual asset operators' own assets. Additionally, major KRW market exchanges disclose customer deposits as liabilities in their business reports and quarterly/half-year reports, and also reveal the status of the virtual assets they hold. A Bithumb official explained, "In Korea, exchanges cannot operate customers' assets and keep them all in custody, so the possibility of a bank run is low."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.