Most Securities Firms' Controlled Liquidity Ratios Exceed 100%

However, Some Small and Medium Securities Firms Face Risks

Second Chaean Fund Launched That Day, Funds to Be Executed Around the 18th

[Asia Economy Reporter Junho Hwang] An analysis of the liquidity ratios of major securities firms in South Korea revealed that only a few securities firms fall short of the regulatory recommended standards. Additionally, the refinancing of real estate project financing (PF) asset-backed commercial paper (ABCP) has been proceeding normally despite rising interest rates. However, low-credit ABCP held by some small and medium-sized securities firms remains a concern. It is expected that the 'Second Chaean Fund,' a special purpose corporation (SPC) established on the 10th to provide liquidity support, will serve as a primary safety net once it becomes operational on the 18th.

Most Securities Firms Remain in a Safe Zone Even Excluding Debt Guarantee Balances

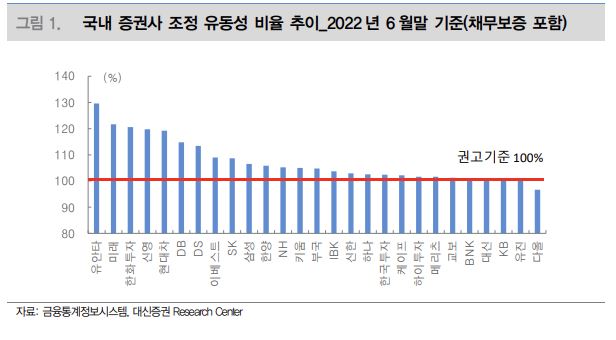

Daishin Securities reported on the 10th in its 'Securities Firms Liquidity Risk Check' report that the liquidity ratio of domestic securities firms as of the end of June this year stood at 125%. The liquidity ratio refers to the ratio of liquid assets maturing within three months to liquid liabilities maturing within the same period. Regulatory authorities recommend that this ratio exceed 100%.

Furthermore, the adjusted liquidity ratio, which takes into account the increased risk of real estate PF, was found to be 107.6%. The adjusted liquidity ratio reflects the debt guarantee balances in addition to the general liquidity ratio. Among 27 securities firms, only Daol Investment & Securities showed a ratio below 100%.

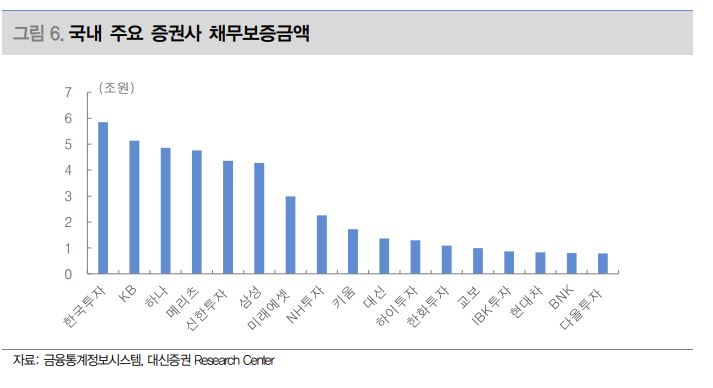

Daishin Securities analyzed that large firms with equity capital exceeding 4 trillion KRW hold liquidity assets worth over 20 trillion KRW, with debt guarantee balances ranging from approximately 2 trillion to 5.8 trillion KRW. Accordingly, even under the extreme assumption that the entire amount of debt guarantees, including real estate PF, becomes non-performing, the liquidity ratio is not expected to decline significantly.

ABCP Refinancing Issuance Sees Higher Interest Rates

However, Daishin Securities noted that in extreme scenarios, there is a risk of bankruptcy due to credit tightening stemming from such situations, and there exists fear centered on real estate PF, which is the most vulnerable starting point.

According to Korea Credit Rating, refinancing issuance of securities firms' securitized bonds is currently being absorbed. However, interest rates have risen. The average issuance rate across the entire industry increased from 2.9% in November last year to 5.1% in November this year. The average CP rate for three-month maturities among five major securities firms is 5.13%, and including some small and medium-sized firms, it is about 5.29%.

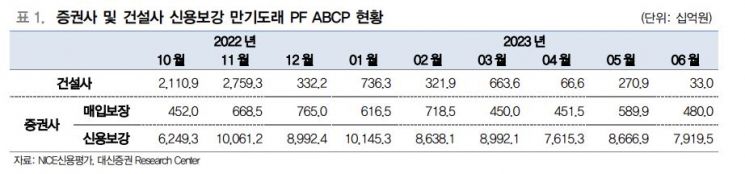

Regarding short-term PF securitized bonds backed by securities firms' credit enhancement, according to NICE Credit Rating's analysis, 10 trillion KRW must be refinanced this month. In the case of securities firms' purchase guarantee agreements, only the refinancing risk is borne by the securities firms. When these types are combined, a total of 10.7 trillion KRW in November and 9.8 trillion KRW in December, amounting to 20.5 trillion KRW in short-term securitized bonds, are scheduled for refinancing by year-end. However, large securities firms are understood to be capable of responding through their own funding measures.

Nonetheless, low-credit ABCP held by some small and medium-sized securities firms is expected to pose problems. Researcher Hyejin Park of Daishin Securities stated, "Securitized bonds guaranteed by securities firms are being refinanced in the market despite high interest rates." She added, "However, this only means that on average it is so; liquidity risks exist for some small and medium-sized firms and securities firms with massive debt guarantees, including affiliates."

She further observed, "If the 'Second Chaean Fund,' established by nine major firms, is launched as planned with a scale of 450 billion KRW on the 10th and half of that amount is disbursed by the 18th, it will act as a primary safety net for low-credit ABCP held by some small and medium-sized securities firms."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)