Decline in Oil Prices and Refining Margins

11.12% Decrease Compared to Q2

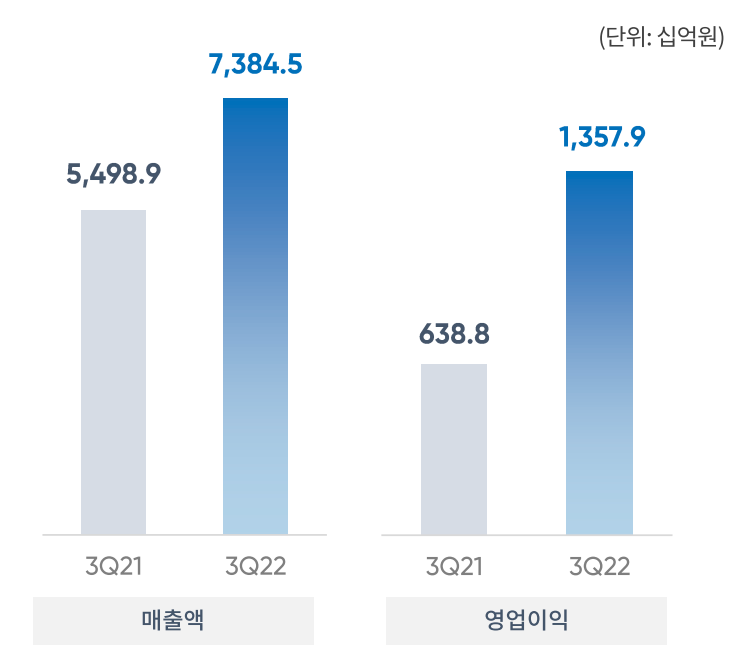

[Asia Economy Reporter Choi Seoyoon] GS posted an operating profit of 1.3579 trillion KRW in the third quarter of this year, an increase of 112.56% compared to the previous year, driven by strong performance from its subsidiaries.

According to GS on the 9th, consolidated sales for the third quarter of this year reached 7.3845 trillion KRW, up 34.29% from a year earlier. Net profit for the period recorded 560.6 billion KRW, a 7.04% increase over the same period. Compared to the second quarter, sales increased by 1.68%, but operating profit decreased by 11.12%.

GS explained, "Operating profit declined slightly compared to the previous quarter due to a drop in crude oil prices and refining margins, which had surged in the second quarter. However, overall strong performance from subsidiaries led to favorable results compared to the same period last year."

Among the six subsidiaries included in GS’s consolidated results, four recorded operating profits that increased by 100% to 300% year-on-year, except for GS Retail (-16%) and GS Global (-34%).

First, GS Caltex posted an operating profit of 817.7 billion KRW, up 106% year-on-year despite the global economic downturn. The petrochemical and lubricants divisions performed well. Operating profits in petrochemicals and lubricants increased by 327% and 61%, respectively.

In the petrochemical sector, strong demand for semi-finished products due to robust gasoline prices in the second quarter lowered paraxylene (PX) inventory levels in China, and the PX spread remained strong in the third quarter. The lubricants division saw strong results due to steady demand and a tight supply situation caused by increased diesel production compared to base oils. GS stated, "Although prices for base oil products declined in the third quarter, the drop in raw material prices due to falling crude oil prices was relatively larger, resulting in favorable margins."

On the other hand, the refining division posted an operating profit of 558.8 billion KRW, down 72% year-on-year, marking a decline. GS analyzed, "The impact of falling crude oil prices was significant due to concerns over a global economic downturn and the strength of the US dollar."

Other GS subsidiaries, GS Energy and GS EPS, recorded operating profits of 95.75 billion KRW and 19.43 billion KRW in the third quarter, growing 137% and 308% year-on-year, respectively. GS E&R also posted an operating profit of 5.8 billion KRW, up 159% during the same period.

Regarding the outlook for the fourth quarter, GS stated, "Since the second half of the year, international crude oil prices have shifted to a downward trend and concerns over a global economic recession are rising, causing rapid changes in the business environment. We are closely monitoring the impact accordingly."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)