Exports of $216.2 million through Q3

Likely to surpass last year's performance

Recovery in global skincare market

Expansion into European and South American markets effective

Internal legal disputes amid MFDS administrative actions

Overcoming unexpected obstacles is key

[Asia Economy Reporter Lee Gwan-joo] Botulinum toxin formulations, a flagship export item in the pharmaceutical and bio industry, are expected to record the highest export performance ever this year. This is interpreted as a result of each company accelerating its overseas expansion and enhancing the status of ‘K-Botulinum.’ However, the current atmosphere within the industry is unsettled. Legal battles continue due to administrative sanctions by regulatory authorities, and conflicts among the so-called ‘Big 3’ companies are ongoing. Depending on how these conflicts unfold, next year’s performance may also be affected.

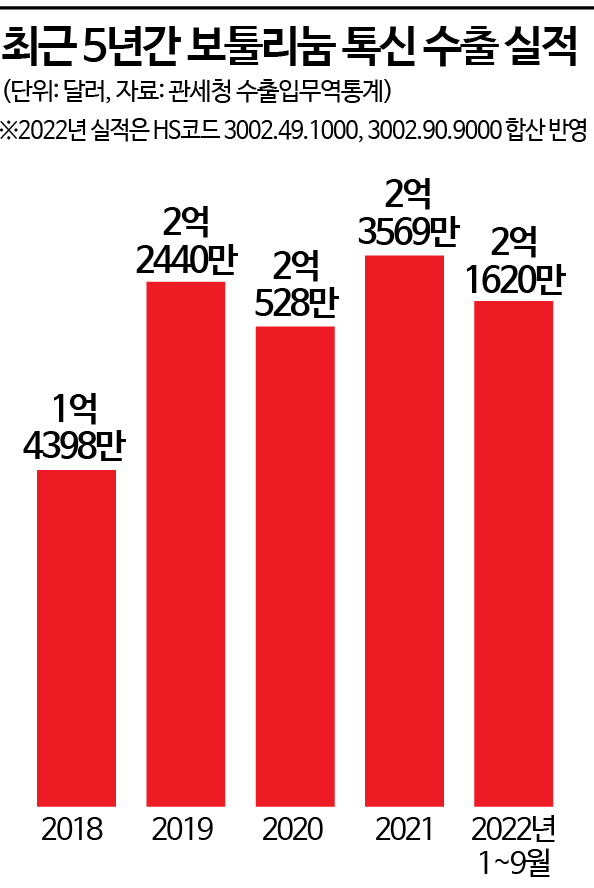

Surpassing $200 million by Q3... Likely the Largest Export Ever

According to the Korea Customs Service’s export-import trade statistics on the 9th, the export amount of botulinum toxin formulations (based on the combined HS codes 3002.49.1000 and 3002.90.9000) reached $216.2 million (approximately 290 billion KRW) through the third quarter (January to September) of this year. This has already surpassed the 2020 export performance ($205.28 million) and is expected to exceed last year’s record-high export of $235.69 million.

The favorable export trend is primarily due to increased global demand. As the skin beauty market, which had been depressed by the COVID-19 pandemic, has entered a clear recovery phase, demand for botulinum toxin formulations, mainly indicated for glabellar lines, has grown. Market research firm Global Information projected that the global botulinum toxin market size will more than double from $3.45 billion last year to $7.51 billion by 2027.

Efforts by the domestic botulinum industry to expand overseas have also driven export growth. Hugel obtained product approvals for ‘Botulax’ (export name Retivo) in 11 major European countries including the UK, France, Germany, Italy, and Spain this year, launching full-scale exports to Europe. Daewoong Pharmaceutical’s ‘Nabota’ also recorded export sales of 32.6 billion KRW in the third quarter alone, a 130% increase compared to the same period last year, supported by smooth progress in the US market and new launches in the UK. A Daewoong Pharmaceutical official explained, “Sales have increased in the US, Europe, Southeast Asia, and Latin America as well,” adding, “We are expanding market share through active marketing.”

Legal Disputes Cast Shadows Amid Strong Performance

Despite ‘record-breaking’ exports, the mood within the domestic botulinum industry is not entirely bright. Recently, the Ministry of Food and Drug Safety (MFDS) has issued consecutive administrative sanctions to manufacturers and distributors, triggering backlash. When MFDS revoked product approvals and imposed six-month manufacturing suspensions on Jetema, Korea BNC, and Korea BMI for violating national batch release approvals, some companies immediately filed lawsuits. Jetema recently submitted lawsuits for nullification and cancellation of the sanctions, as well as requests for suspension of execution and provisional suspension of effect to the court. Jetema stated, “We exported all products overseas and actively explained our efforts for national export achievements, but we deeply regret MFDS’s excessive sanctions.” Medytox, PharmaResearch Bio, and Hugel are also engaged in similar legal disputes with MFDS.

Statement from Jetema regarding administrative measures by the Ministry of Food and Drug Safety.

Statement from Jetema regarding administrative measures by the Ministry of Food and Drug Safety. [Photo by Jetema]

The disputes among Medytox, Daewoong Pharmaceutical, and Hugel are still ongoing. In 2017, Medytox filed a civil lawsuit alleging that Daewoong Pharmaceutical had stolen its bacterial strain. The first trial verdict is scheduled for next month. Depending on the outcome, an appeal by either party is likely, but as this is the first conclusion in five years, the industry is paying close attention. In addition, in April this year, Medytox filed a complaint with the US International Trade Commission (ITC) against Hugel for the same reasons as against Daewoong Pharmaceutical, and the ITC investigation is currently underway. All three major domestic botulinum companies bear management risks.

It is fortunate that efforts to secure future growth engines continue despite these disputes. Hugel and Daewoong Pharmaceutical are accelerating their attacks on new markets such as Europe and South America, while Medytox is ramping up mass production of its new product ‘Coretox’ and intensifying development of new toxin formulations. An industry insider said, “As the COVID-19 pandemic subsides to some extent, the growth potential of the botulinum toxin market has increased significantly,” adding, “It is necessary to pay attention to how some legal dispute risks are overcome and to growth through expanded indications and new market development.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)