LNG Ship Orders Near 64.6% Share... Container Ships 30.9%

Chinese Shipbuilders Expanding Presence in LNG Ship Market

"Successfully Defended Against Chinese Offensive, Strategic Response Crucial"

[Asia Economy Reporter Oh Hyung-gil] China is likely to maintain its position as the world's top shipbuilder for the fourth consecutive year. Since 2018, the Korean shipbuilding industry, which has been striving to reclaim the throne, has achieved success in confirming its strengths in LNG carriers, the key driver of its rebound. However, China is fiercely pursuing this market, making strategic responses essential to maintain competitiveness.

According to Clarkson Research, a UK-based maritime market research firm, in October, out of the global ship orders totaling 3.41 million CGT (75 vessels), Korea secured 1.43 million CGT (22 vessels), accounting for a 42% share. During the same period, China received orders for 1.8 million CGT (32 vessels), capturing 53% and ranking first.

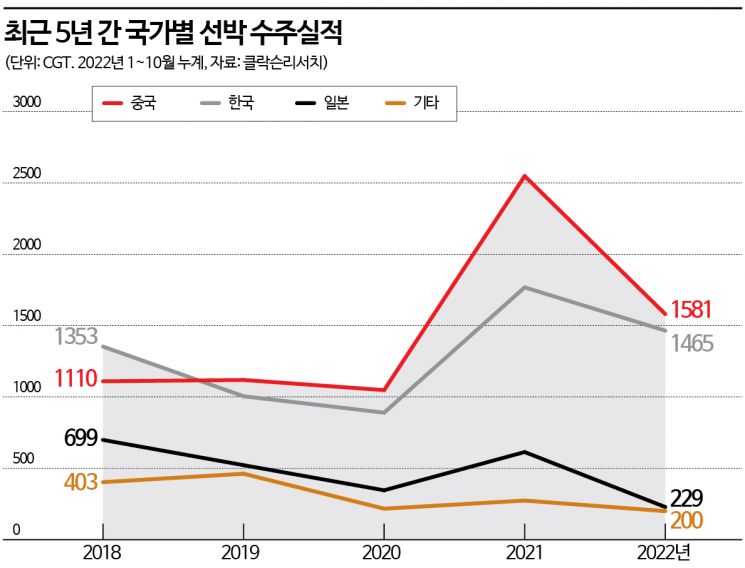

As a result, the narrow gap in annual order volume between China and Korea, which had been closing until September, has widened again. The cumulative global orders from January to October totaled 34.75 million CGT. Korea accounted for 14.65 million CGT (261 vessels), or 42%, while China recorded 15.81 million CGT (570 vessels), or 46%.

The order backlog at the end of October increased by 860,000 CGT from the previous month to 104.7 million CGT. Of this, Korea held 36.75 million CGT (35%), and China 44.89 million CGT (43%). Compared to the previous month, Korea's backlog increased by 780,000 CGT (2%), and China's by 590,000 CGT (1%).

Compared to last year, when the gap with China exceeded 15 percentage points, Korean orders are rapidly recovering. The recent expansion of the eco-friendly ship market driven by carbon emission reduction has been effective, with orders focused on high value-added vessels centered on LNG carriers.

Up to the third quarter, LNG carriers accounted for nearly 64.6% of the cumulative orders in the Korean shipbuilding industry by vessel type. Container ships followed at 30.9%, with these two types making up 95.5% of total orders, exerting an absolute influence on order volume.

LNG carriers transport cargo that is gaseous at ambient temperature by liquefying it through ultra-low temperature cooling or high pressure, requiring higher technology in ship design and construction compared to general-purpose vessels to maintain the liquefied state.

In particular, Korea holds an absolute advantage in the large LPG carrier market, based on the competitiveness of its major shipbuilders. However, China is seeking to expand its market share, and Japan also holds a significant portion based on domestic demand.

Chinese shipbuilders are expanding their presence in the LNG carrier market, supported by the domestic market and national backing. Recently, large Chinese shipyards have been making large-scale investments to increase LNG carrier production, launching a volume offensive.

China State Shipbuilding Corporation (CSSC) plans to invest 20 billion yuan (approximately 3.9 trillion KRW) this month to start building a shipyard in Dalian, China, while CSSC's subsidiary Hudong-Zhonghua Shipbuilding is investing 18 billion yuan (approximately 3.5 trillion KRW) to secure a shipyard in Shanghai. Both investments are aimed at entering the LNG carrier market.

Concerns have arisen that China's aggressive investments could shake the entire shipbuilding industry. The Japanese Nikkei newspaper predicted that the volume offensive led by Chinese shipbuilders in LNG carrier investments could soon lead to oversupply, worsening the shipbuilding market conditions.

An industry insider said, "Although China's possibility of overtaking in the LNG carrier market is still low due to technological factors, China has previously dominated the bulk carrier and container ship markets through state-backed financial support and price offensives, so the future situation cannot be guaranteed."

Yang Jong-seo, senior researcher at the Korea Eximbank Overseas Economic Research Institute, said, "Except for some signs in the large container ship market, major shipbuilders have successfully defended the market against the rising competition from China in most markets," adding, "How the industry responds to market changes is expected to determine the future market share structure, so strategic responses through internal industry and inter-industry cooperation are important."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)