Highest Proportion of Equity Funds Relative to Market Cap This Year

Proportion Expands with ETF Growth

Impact of Increased Low-Price Buying Pressure

[Asia Economy Reporter Hwang Junho] Investment in equity funds in South Korea has increased significantly. This is analyzed as a result of steady inflows into exchange-traded funds (ETFs) despite interest rate hikes and concerns about an economic recession. The securities industry forecasts that the growth trend of ETFs will continue in the future.

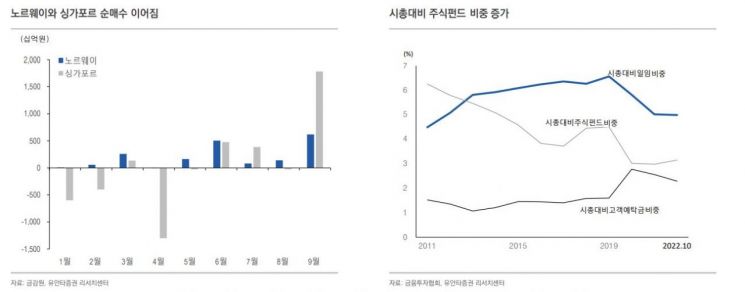

According to the Korea Financial Investment Association on the 8th, as of the end of last month, the proportion of equity funds relative to the market capitalization of the KOSPI and KOSDAQ was 3.58%. This is the highest level of the year. This proportion gradually declined after reaching 5.09% at the end of 2019 but has been on an upward curve since hitting a low of 3.48% at the end of August.

Considering that the KOSPI market capitalization fell from 2,203 trillion won at the end of December last year to 1,810 trillion won at the end of last month, it is analyzed that investors tired of direct investment are flocking to the fund market. In particular, the growth of ETFs rather than public funds has increased the proportion of funds. The market capitalization of ETFs increased from 74 trillion won at the end of last year to 78 trillion won. Individuals invested 195 billion won in ETFs in just last month.

Foreigners’ net buying is also notable. As tensions between the U.S. and China have increased, investors allocating global assets are increasingly concerned about reducing their exposure to China. This so-called ‘China run’ raised worries about a decline in domestic stock market demand, but funds have been flowing in instead. For example, the Texas Retirement System (TRS) in the U.S. decided to reduce its China investment ratio from 35% to 17% and redistribute the reduced portion to other emerging markets. Additionally, the prolonged Russia-Ukraine war has increased the possibility of expanding domestic investment proportions.

On the 17th of last month, ahead of President Xi Jinping’s third term, foreigners net sold 235 billion won only in ETFs, but since then, they have steadily continued net buying, purchasing 103 billion won on the 7th.

Researcher Kim Hoojung of Yuanta Securities stated, "The ETF market will grow in size next year as demand increases." He added, "Even as investment funds in general active equity funds decrease, active ETFs have continued to grow."

Kim Junghyun, head of the ETF Center at Shinhan Asset Management, said, "The pillars of ETF growth next year can be divided into income (dividends or interest), benefits from various countries’ policies, and the pension market," adding, "Concerns about the global economy and responses to high interest rate levels will also play a major role in the ETF market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)