Naver's Q3 Operating Profit Down 5.6% YoY... Kakao Also Down 11%

Advertising Revenue Hit Hard by Economic Downturn... Operating Costs Including Labor Expenses Continue to Rise

[Asia Economy Reporter Yuri Choi] Following Kakao, Naver also recorded its highest-ever sales in the third quarter of this year, but operating profit declined. This was the result of a decrease or slowdown in growth of advertising revenue, a major source of income, due to the economic downturn. Additionally, increased operating expenses caused by last year's IT industry wage hike competition added to the performance burden.

Naver's Sales Growth Slows in Advertising and Others... Operating Cost Burden

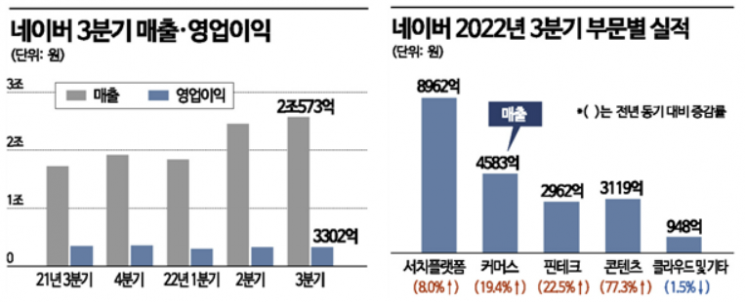

On the 7th, Naver announced that its consolidated sales for the third quarter of this year reached 2.0573 trillion KRW, with an operating profit of 330.2 billion KRW. Sales increased by 19.1% compared to the same period last year, setting a new record for the third quarter. However, operating profit decreased by 5.6%, marking a decline for the first time in six quarters. Sales by business segment were ▲ Search Platform 896.2 billion KRW ▲ Commerce 458.3 billion KRW ▲ Fintech 296.2 billion KRW ▲ Content 311.9 billion KRW ▲ Cloud and Others 94.8 billion KRW.

The Search Platform segment recorded 896.2 billion KRW, an 8.0% increase from the same period last year. The growth slowed due to the contraction of the advertising market caused by the economic downturn combined with seasonal off-peak effects. Display advertising revenue increased by only 2.3% to 228.5 billion KRW, while search advertising, less affected by the recession, grew by 10%.

Commerce recorded 458.3 billion KRW, up 19.4% year-on-year, supported by commerce advertising, brand stores, and an increase in membership subscribers. Fintech grew by 22.5% to 296.2 billion KRW. Although growth continued, it slowed compared to the 30% range recorded last year.

Content sales rose 77.3% year-on-year to 311.9 billion KRW. The global webtoon integrated transaction amount in the third quarter grew by 18.1% to 457 billion KRW. The Cloud and Others segment recorded 94.8 billion KRW, down 1.5% year-on-year, attributed to a decrease in orders due to the economic downturn.

Despite the slowdown in sales growth, costs continued to rise. Total operating expenses in the third quarter increased by 25.4% to 1.7271 trillion KRW. This was due to increased hiring following the incorporation of newly acquired subsidiaries and business expansion. Labor costs rose 17.8% to 433.5 billion KRW, and partner costs increased 31.6% to 722.2 billion KRW, reflecting the effect of acquiring subsidiaries such as eBook Japan.

Naver CEO Suyeon Choi said, "We will discover more diverse new growth engines including the recently announced acquisition of Poshmark, new advertising products, Naver Arrival Guarantee Solution, Open Talk, and Issue Talk. We will continue to grow by expanding synergy across business areas through more efficient organizational operations such as integrating B2B business units and constantly pioneering new markets."

Kakao Faces Advertising and Gaming Revenue Slump... Labor Costs Up 41%

Kakao, which announced its earnings earlier, also could not smile despite posting record-high results. Operating profit declined due to a slowdown in the advertising market causing a decrease in TalkBiz advertising revenue and a drop in game revenue amid user communication controversies.

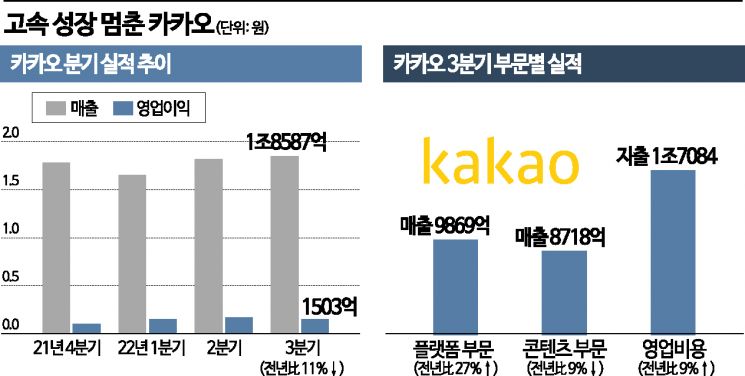

Kakao recorded consolidated sales of 1.8587 trillion KRW and operating profit of 150.3 billion KRW in the third quarter of this year. Sales increased 7% compared to the same period last year, setting a record high, but operating profit decreased by 11%.

The sluggish performance of the content segment, a key driver of results, had a significant impact. Content segment sales in the third quarter fell 9% year-on-year to 871.8 billion KRW. In particular, Kakao Games, which accounts for one-third of content segment sales, saw a 36% drop. This was due to decreased domestic and overseas sales of the mobile game "Odin: Valhalla Rising" and user attrition caused by poor management of the new title "Uma Musume Pretty Derby."

Platform segment sales, another pillar of performance, rose 27% year-on-year to 986.9 billion KRW, but TalkBiz advertising revenue fell 4% from the previous quarter due to the advertising market slowdown and seasonal off-peak. Bizboard and KakaoTalk Channel were hit hard by the advertising market slowdown and seasonal off-peak.

Like Naver, operating expenses increased. Third-quarter operating expenses rose 9% year-on-year to 1.7084 trillion KRW. Labor costs during this period increased 41% to 43.3 billion KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.