'Lotte Je-gwa' Expected to be Included in KOSPI, 'Seongil Hightech' in KOSDAQ

[Asia Economy Reporter Kwon Jae-hee] Interest is growing in the stocks to be newly included as the results of the regular changes to the KOSPI 200 and KOSDAQ 150 indices next month are expected to be announced at the end of this month. This time, only two stocks are expected to be added or removed in the KOSPI 200 regular changes, making it the smallest scale of KOSPI 200 regular changes in history.

According to the securities industry on the 6th, the regular changes to the KOSPI 200 and KOSDAQ 150 will be announced at the end of November after the review reference date (October 31). The index changes are scheduled to take place on the 9th of next month.

In the securities market, it is forecasted that Lotte Confectionery will be newly included in the KOSPI 200 through this regular change. Samyang Holdings is expected to be removed due to Lotte Confectionery's inclusion.

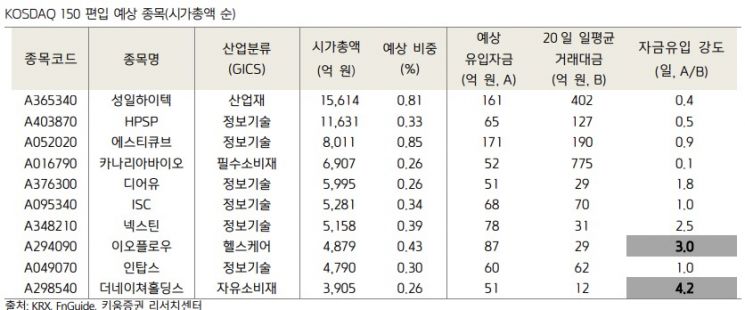

In the KOSDAQ 150 regular changes, Seongil Hightech and HPSP are expected to be included as they meet the large-cap special conditions, which will likely increase the weight of the industrials and information technology sectors. In addition, a total of 10 stocks including ST Cube, Canaria Bio, and DearU are expected to be included. Accordingly, 10 existing stocks such as FST, Ebest Investment & Securities, and AP System are expected to be removed.

These regular changes will cause changes in supply and demand due to the inclusion and exclusion of stocks in the index baskets during the rebalancing of index funds and exchange-traded funds (ETFs) that track these indices.

Considering the expected inflow and outflow funds relative to the recent average daily trading volume, the securities industry expects that among the KOSDAQ 150 included stocks, Eoflow and The Nature Holdings will experience significant supply and demand effects. On the other hand, among the excluded stocks, Eugene Enterprise and RSUPPORT are expected to face relatively strong capital outflows.

Choi Jae-won, a researcher at Kiwoom Securities, analyzed, "Due to the regular inclusion and exclusion, the weight of the consumer staples sector in the KOSPI 200 is expected to slightly increase, and in the KOSDAQ 150, the industrials sector weight will rise due to Seongil Hightech, while the information technology sector weight will increase due to the new inclusions such as ST Cube and HPSP."

Meanwhile, he advised that attention should also be paid to changes in the free float ratio in this regular change besides the newly included stocks. In particular, LG Energy Solution's free float ratio is expected to be adjusted upward from 10% to 15% as the six-month mandatory holding commitment was lifted as of July 27. Accordingly, LG Energy Solution's expected weight within the KOSPI 200 is projected to increase by about 0.62 percentage points. Researcher Choi added, "Besides LG Energy Solution, due to changes in major shareholder stakes, Doosan Enerbility, KT, and KG Steel are expected to see an increase in their free float ratios, while Lotte Fine Chemical is expected to see a decrease. It is necessary to also examine the rebalancing effects caused by changes in free float ratios."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)