Korea Electric Power Corporation's (KEPCO) financial burden is intensifying as the 'System Marginal Price (SMP),' the benchmark price at which KEPCO purchases electricity from power producers, continues to hit record highs day after day. This is because electricity purchase costs are soaring sky-high in a situation where raising electricity rates is difficult. In response, the government is considering introducing an 'SMP cap system' that temporarily limits the electricity purchase settlement price starting next month, but strong opposition from private power producers has created a dilemma, making even this difficult.

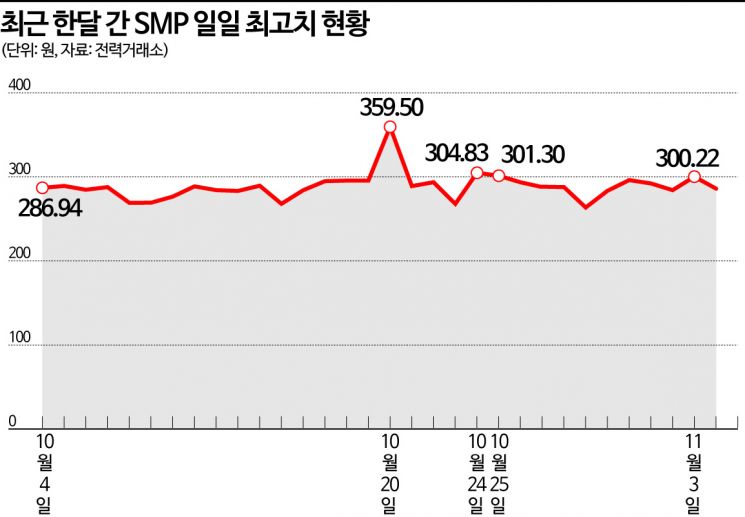

According to the Korea Power Exchange on the 5th, the SMP (based on the mainland) temporarily reached 300.22 KRW per kWh (kilowatt-hour) on the 3rd. This was the first time this month that the SMP surpassed 300 KRW per kWh. Already on the 20th of last month, the SMP surged to 359.5 KRW, setting an all-time high since the establishment of the Korea Power Exchange in 2001. The previous highest was 335.17 KRW recorded on January 14, 2010. The higher the SMP rises, the more KEPCO has to pay power producers for electricity.

As the structure where selling electricity at soaring SMP results in losses became entrenched, the government decided to introduce the 'Emergency Settlement Price Cap for the Electricity Market (SMP cap system)' within next month and is accelerating related procedures. Earlier, the government announced the SMP cap system in May and reviewed its application timing. The core of the SMP cap system is to temporarily apply a normal settlement price level when the wholesale electricity price rises to an abnormally high level. The draft SMP cap system announced by the Ministry of Trade, Industry and Energy states that it will be triggered when the 'average SMP of the previous three months' is greater than or equal to the 'top 10% of the monthly average SMP values over the past 10 years.' Although implementation was uncertain due to opposition from private power producers at the time, the recent sharp rise in SMP led the government to judge that it can no longer delay the measure.

However, it is difficult to guarantee actual implementation. Private power producers are still strongly requesting the withdrawal of the SMP cap system. They argue that the SMP cap system is an inappropriate policy that cannot fundamentally solve KEPCO's deficit. If the SMP cap system is implemented, the SMP, which has recently been around 250 KRW per kWh, could be lowered by about 80 to 100 KRW per kWh on average, reducing the power producers' electricity sales profits. For example, if a power producer imports fuel at 160 KRW per kWh to generate electricity and sells it at 250 KRW, it makes a profit of 90 KRW, but applying the cap system could reduce actual profits by more than half. Although the government promised compensation for the difference if the SMP falls below the energy production cost, it is still a loss from the power producers' perspective.

The Ministry of Trade, Industry and Energy plans to seek maximum cooperation from power producers to introduce the SMP cap system. For KEPCO, which supplies electricity to consumers, the SMP cap system is essential. Recently, with the bond market tightening, KEPCO is facing increasing difficulties in securing new operating funds, and the structure of 'losing more the more it sells' has reached its limit. KEPCO has issued about 26.16 trillion KRW in corporate bonds for operating funds as of the end of last month. Approximately 2 trillion KRW per month is needed for electricity purchases and other expenses. Due to the so-called 'financial choke' phenomenon caused by deteriorating liquidity in the bond market, KEPCO is currently raising funds at high interest rates of around 6%.

Although the government is reportedly considering applying a price bidding system to the electricity wholesale market in the '10th Basic Plan for Electricity Supply and Demand (2022?2036)' next month, the actual implementation remains uncertain. Even if the price bidding system is implemented, it is a long-term electricity supply plan and cannot immediately prevent KEPCO's deficit structure from increasing this winter. KEPCO's expected deficit for this year is 30.125 trillion KRW, and the financial industry forecasts operating losses to continue through 2024.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)