US Fashion Market Grows 3%, While Used and Resell Market Expands 33%

Naver Focuses on C2C Used Trading, Aggressively Investing Over 3 Trillion Won

MZ Enjoy Resell Like a Game... Rapid Growth of Used Trading Market

[Asia Economy Reporter Yuri Choi] Naver has invested more than 3 trillion won in secondhand trading and resale platforms this year alone. This far exceeds Naver's total investment amount from last year. As the secondhand trading market experiences explosive growth, money is also flowing into competing platforms of Naver. Since the MZ generation (Millennials + Generation Z) is leading the secondhand trading market, there is an analysis that the growth potential is significant going forward.

Aggressive Investment in Cream and Poshmark...More Than Last Year's Total Investment

According to the IT industry on the 7th, Naver's investment scale in secondhand trading platforms this year has reached 3.4 trillion won. Domestically, it expanded its investment scale through its subsidiary 'Cream,' and overseas through the acquisition of 'Poshmark.' Considering that Naver's annual investment amount last year was about 2 trillion won, this is an aggressive investment.

Naver plans to invest 50 billion won in Cream in the fourth quarter of this year. The explanation is that by investing in Cream, which intermediates individuals to resell limited edition products such as sneakers, clothes, and watches, it strengthens its commerce capabilities. This is the first time Naver has directly invested in Cream without going through its subsidiary Snow.

Until now, Naver has invested in Cream through Snow. In February, it participated in Snow's paid-in capital increase and invested 150 billion won, and Snow has invested 60 billion won in Cream three times this year. Through this, Cream secured operating funds for its service and invested in Southeast Asian secondhand trading platforms such as Japan's 'Soda,' Malaysia's 'Shakehands,' and Singapore's 'Rivelo.'

In North America, last month, Naver bet 2.3 trillion won on acquiring the fashion secondhand trading platform Poshmark. This is not only Naver's first trillion-won scale investment since its founding but also the largest acquisition and merger conducted by a domestic internet company.

Through all-around investments, domestically, Naver has expanded secondhand trading product categories to fashion, luxury goods, daily necessities, and automobiles. Externally, it has built a portfolio connecting Asia, Europe, and North America. In 2020, Naver invested in the French luxury secondhand trading platform 'Vestiaire Collective' through the 'Corelia Capital K-Fund 1.'

Stormy Growth of the US Fashion Secondhand Market...Led by the MZ Generation

Naver is not the only one eyeing the secondhand trading market. Especially, investment funds are pouring into resale platforms that add premiums to rare and valuable products.

Musinsa's resale platform 'Soldout' secured 40 billion won in investment last April. Dunamu, which invested 10 billion won in Soldout last year, participated again this time. 'Trenbe,' which handles luxury resale, recently attracted 35 billion won in investment from IMM Investment and Korea Investment & Securities. Last year, the secondhand trading platform 'Bungaejangter' received 30 billion won in investment from Shinhan Financial Group. The funds are used to revitalize the resale market and develop related content.

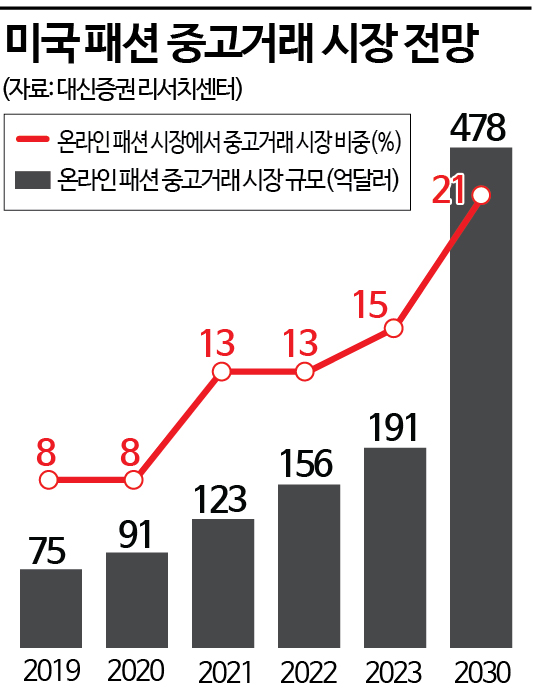

The reason money is flowing into secondhand trading and resale platforms is that the market has grown rapidly. According to Daishin Securities Research Center, while the US fashion market grew at an average annual rate of 3.4% over the past four years, the fashion secondhand trading market grew by 32.9% annually. Accordingly, the fashion secondhand trading market is expected to reach $15.6 billion (about 22.25 trillion won) this year.

Future growth potential is also expected. By 2030, the US fashion secondhand trading market is projected to be $47.8 billion (about 68.2 trillion won). Accordingly, the share of secondhand trading in the online fashion market is analyzed to rise from 13% this year to 21% in 2030.

80-90% of Cream and Poshmark Users Are MZ...Targeting Teens and Twenties with Community-Type Commerce

Targeting the secondhand trading market is also a strategy to embrace the MZ generation. Naver's existing users, who have grown centered on search services, are in their 30s to 50s, so targeting the teens and twenties is a major task. This is why Naver CEO Choi Soo-yeon, the 'young blood,' has been driving MZ generation inflow since her inauguration earlier this year.

In the case of Cream, 90% of users are from the MZ generation. Poshmark also has an MZ generation ratio of 80%. As a community-type commerce service similar to Instagram, users discover products while staying in the community, and purchases are made in this way. This is different from Naver's existing model, where purchases are made by searching with a purpose.

CEO Choi stated, "We judged that recommerce is a new trend for the MZ generation," and "Through Poshmark, which has a large user base, we have established an important foundation to understand the North American MZ generation more broadly."

The MZ generation is sensitive to trends but values experience itself over ownership, so they have no hesitation in selling what they have to buy products they do not own. They are also accustomed to communicating with individuals who share the same interests within specific categories such as limited editions and luxury goods through social networking services (SNS). This is why Naver has adopted 'community-type commerce' as a new format for its commerce business.

An industry insider explained, "The MZ generation enjoys the experience of 'discovering' desired items on SNS, acquiring them, and then reselling them as if it were a game," adding, "If luxury and designer brands in their wardrobes flood the secondhand trading market, a high-value e-commerce market will be formed."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.