Impact of Falling International Oil Prices and Refining Margins

Operating Profit Down 69.7% QoQ

Sales Reach 22.7 Trillion Won, Up 14.3%

Lubricants Business Operating Profit 336 Billion Won

Increased by 80.8 Billion Won QoQ

Battery Business Also Shows Profitability Improvement

[Asia Economy Reporters Hyungil Oh, Seoyoon Choi] SK Innovation's third-quarter operating profit fell to one-third of the previous quarter due to declines in international oil prices and refining margins. However, the lubricants business achieved its highest quarterly operating profit, and the battery business also improved profitability.

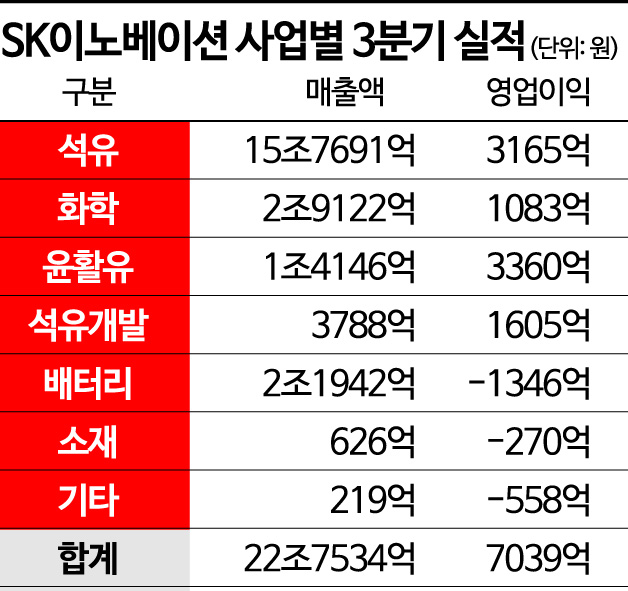

SK Innovation announced on the 3rd that its third-quarter operating profit was 703.8 billion KRW, down 69.7% from the previous quarter. During the same period, sales increased by 14.3% to 22.7533 trillion KRW compared to the previous quarter, but net profit dropped 86.9% to 175.1 billion KRW. SK Innovation explained, "Operating profit sharply decreased compared to the previous quarter due to the decline in oil prices and refining margins amid concerns over a global economic recession," adding, "Sales increased compared to the previous quarter thanks to higher operating rates in the petroleum business and improved production capacity at new battery plants."

Net Debt Up by 5.43 Trillion KRW... Additional Increase Expected Due to Battery CAPA Expansion

In particular, operating losses of 400.4 billion KRW occurred due to increased foreign exchange losses from the expanded exchange rate rise and increased interest expenses from higher borrowings, resulting in a pre-tax profit of 303.5 billion KRW. Net debt rose by 5.43 trillion KRW from the end of last year to 13.8429 trillion KRW, influenced by facility investments for battery business expansion.

Kim Yangseop, SK Innovation's Chief Financial Officer, said during the conference call after the earnings announcement, "Compared to the end of last year, oil prices and exchange rates rose, increasing working capital overall, and the battery business experienced raw material price increases along with ramp-up effects from new plants in the U.S. and elsewhere," adding, "We expect working capital to increase further due to battery business production capacity (CAPA) expansion, which may lead to a slight increase in borrowings."

The petroleum business's operating profit was 316.5 billion KRW, down 1.9126 trillion KRW from the previous quarter due to falling oil prices and refining margins caused by tightening policies in various countries and China's announcement of large export quotas. The chemical business posted an operating profit of 108.3 billion KRW, up 32.3 billion KRW from the previous quarter. The lubricants business achieved an operating profit of 336 billion KRW, up 80.8 billion KRW from the previous quarter, marking its highest quarterly performance. The petroleum development business recorded an operating profit of 160.5 billion KRW, down 5.7 billion KRW from the previous quarter due to decreased sales volume despite reduced cost of goods sold.

"Battery Business Financing Progressing Smoothly... Preparing for Long-term FI Investment Attraction"

The battery business achieved sales of 2.1942 trillion KRW, up 906.2 billion KRW from the previous quarter, driven by increased sales volume and passing on raw material price increases through sales price adjustments. Profitability significantly improved through negotiations on price adjustments for raw material cost increases, resulting in an operating loss of 134.6 billion KRW.

Jin Sunmi, Head of Battery Planning at SK On, explained, "The yield rates at the U.S. Plant 1 and Hungary Plant 2, which have been in full operation since last year, are stabilizing, and we are negotiating price adjustments with OEMs regarding cost increases including metals," adding, "As a result of these efforts, profitability greatly improved in the third quarter compared to the previous quarter, achieving EBITDA (earnings before interest, taxes, depreciation, and amortization) profitability."

SK Innovation stated that financing for the battery business is progressing smoothly despite uncertain financial market conditions. Current construction projects by SK On include the U.S. Plant 2, Hungary Plant 3, Yancheng Plant, and investments through BOSK in the U.S.

Kim Yangseop, SK Innovation's CFO, said, "The U.S. Plant 2 is scheduled for mass production in the first quarter of next year, and additional capital expenditure (CAPEX) demand is limited," adding, "Hungary Plant 3 completed a $900 million capital increase in July and a $2 billion new loan in October, securing most of the resources needed for the plant." He continued, "The Yancheng Plant is preparing resource acquisition through debt financing, and the large-scale BOSK investment is also preparing to secure more than half of the total through debt financing."

The remaining equity is shared 50% each by SK Innovation and Ford. SK Innovation's share is less than 25% of the total investment and will be paid in installments over several years. Kim said, "SK On is preparing to attract long-term financial investor (FI) investments," adding, "Although delayed compared to the original plan, negotiations are ongoing, and the timing and scale have not been finalized, so it is difficult to disclose details at this time."

U.S. Inflation Reduction Act Benefits Battery Companies... SK On Already Secured a Favorable Position

The U.S. Inflation Reduction Act (IRA) is expected to benefit battery companies. Ryu Jinsook, Head of Battery Management Strategy at SK On, said, "SK On operates local plants in the U.S., enabling immediate response, and is pursuing CAPA expansion in the U.S., which is advantageous," adding, "Even before the IRA announcement, we were securing material-battery supply chains, so we have already secured a favorable position in terms of preparation."

Ryu added, "Regarding Hyundai Motor's benefits, it is not appropriate to comment due to customer issues, but since they are a major customer, we are monitoring the situation," noting, "To receive benefits, assembly lines must be located in the U.S., which is a disadvantage, but I understand efforts are underway to resolve this through inter-country cooperation negotiations. We are actively discussing early response plans with Hyundai Motor."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.