Martial Arts 'Recent Trends and Implications in Semiconductor Equipment Trade' Report Released

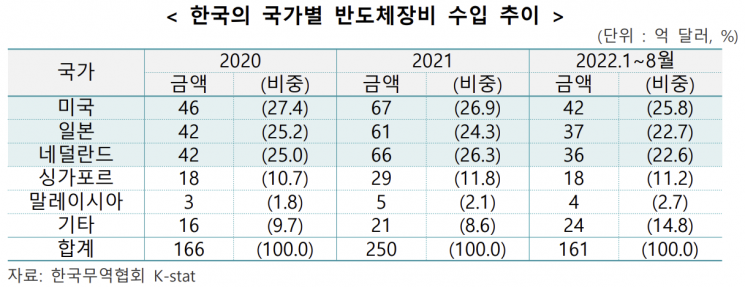

[Asia Economy Reporter Kim Pyeonghwa] Last year, South Korea's dependence on semiconductor equipment from the United States, Japan, and the Netherlands reached 77.5%. This overseas dependence was more pronounced than that of Taiwan and China. Given that high dependence could lead to future diplomatic and geopolitical risks, experts advised that South Korea should seek stable supply and demand of semiconductor equipment by participating in Chip4 (Chip4: South Korea, United States, Japan, Taiwan). Increasing the localization rate through research and development (R&D) of semiconductor materials, parts, and equipment is also a challenge.

On the 3rd, the Korea International Trade Association's International Trade and Commerce Research Institute released a report titled "Recent Trends and Implications in Semiconductor Equipment Trade" containing these findings.

South Korea Ranks 3rd in Semiconductor Equipment Imports... Imported $25 Billion Last Year Alone

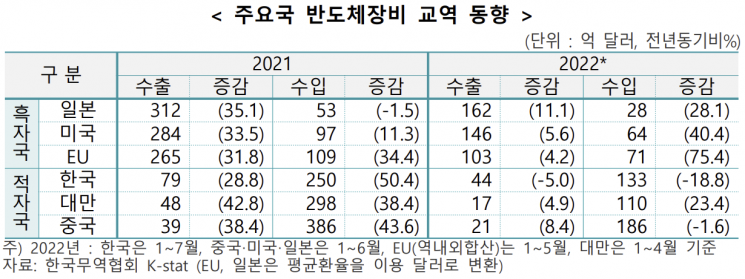

According to the report, due to a surge in global semiconductor facility investment, the global semiconductor equipment trade volume last year increased by 2.4% compared to the previous year, reaching a record high of $101.2 billion. Among these, the top three semiconductor equipment exporting countries were Japan ($31.2 billion), the United States ($28.4 billion), and the Netherlands ($20.1 billion). All are countries that host major semiconductor equipment companies.

The global semiconductor equipment market is dominated by five major companies: Applied Materials (USA), Lam Research (USA), KLA (USA), Tokyo Electron (Japan), and ASML (Netherlands), which together account for 79.5% of the total market share. Due to high technological barriers, the market is characterized by an oligopoly structure.

South Korea relies heavily on these companies for semiconductor equipment supply. As of last year, the top three semiconductor equipment importers were China ($38.6 billion), Taiwan ($29.8 billion), and South Korea ($25 billion). Notably, South Korea's dependence on imported equipment was higher than that of Taiwan and China. As of last year, South Korea's import dependence on equipment from the United States, Japan, and the Netherlands reached 77.5%, which is higher than Taiwan's 70.6% and China's 56.2%.

"Need to Improve High Overseas Dependence"

The report pointed out that South Korea's semiconductor equipment imports reached an all-time high last year and are likely to increase further in the future. Unlike China, which has seen a decline in import growth due to recent U.S. export restrictions on advanced semiconductor equipment, domestic imports are expected to steadily increase.

It also highlighted that the heavy dependence on overseas semiconductor equipment makes the structure vulnerable to diplomatic and geopolitical risks. The fact that the domestic semiconductor equipment self-sufficiency rate is only 20% adds to these concerns.

The report noted that due to the characteristics of the semiconductor equipment market, it is difficult to immediately localize semiconductor equipment or diversify import sources. To ensure stable supply and demand of semiconductor equipment, it is necessary to participate in the semiconductor alliance Chip4 and increase benefits.

Kang Sangji, a researcher at the Korea International Trade Association, said, "With the U.S. export restrictions on semiconductor equipment to China causing difficulties for China's semiconductor rise, we have an opportunity to gain a kind of indirect benefit." He added, "During this period, we should activate R&D in semiconductor materials, parts, and equipment to widen the gap with China and strengthen the domestic semiconductor industry base."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.