Stock Short Selling Surges Amid Prolonged Bear Market... Short Selling Ratio Also Rises

Bond Lending Balance Hits Record High Due to Interest Rate Hikes and Market Tightening Effects

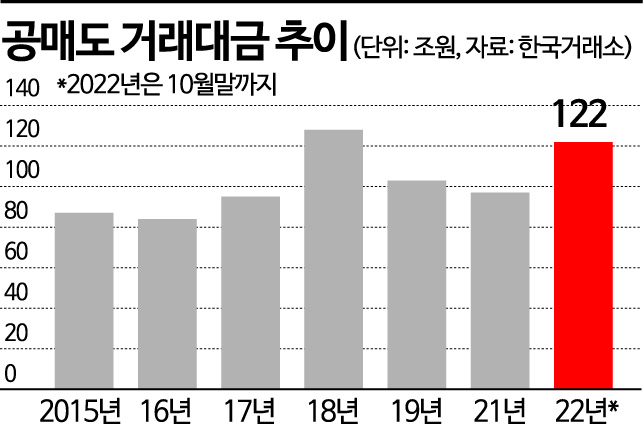

[Asia Economy Reporter Lee Seon-ae] Short selling is surging in both the stock and bond markets. In the stock market, the combined short selling transaction value of the KOSPI and KOSDAQ markets has surpassed 120 trillion won, raising the possibility of setting an all-time high record for the first time since short selling data began to be compiled. In the bond market, the loan balance has already exceeded 140 trillion won for the first time ever.

According to the Korea Exchange on the 2nd, the short selling transaction value in the KOSPI market this year was recorded at 94.1389 trillion won as of the end of October. The short selling transaction value in the KOSDAQ market was 27.8206 trillion won, bringing the combined transaction value to over 120 trillion won (121.9595 trillion won). This is about a 26% increase compared to last year's annual total (96.9178 trillion won). Last year, the short selling transaction value was 72.012 trillion won in KOSPI and 24.9058 trillion won in KOSDAQ.

The short selling transaction value has surged every year since statistics began to be compiled in 2009, starting from the 14 trillion won range, reaching 87 trillion won in 2015, and 95 trillion won in 2017. In 2018, it surpassed 100 trillion won for the first time, recording 128 trillion won. It maintained the 100 trillion won level in 2019 as well, reaching 103 trillion won. In 2020, short selling was banned due to COVID-19. If short selling continues to increase in the fourth quarter of this year and exceeds 128 trillion won, it will set a new record.

The rapid increase in short selling transaction value this year is interpreted as a result of the ongoing bear market. The short selling ratio is also on the rise. According to Eugene Investment & Securities, the short selling ratio relative to the total trading volume of KOSPI 200 stocks recently exceeded 10%. This is the first time in 2 years and 8 months since February 2020, when the COVID-19 outbreak occurred, that the short selling ratio has surpassed 10%.

However, considering the usual trend of short selling balances decreasing from November, experts believe that the short selling amount is likely to gradually decrease, so whether a new record will be set by the end of the year remains to be seen. Kim Jong-young, a researcher at IBK Investment & Securities, said, "The short selling balance amount tended to decrease at the end of the year from 2018 to 2021," adding, "It is presumed that short covering occurs due to short sellers returning dividend rights and the need to realize profits at year-end."

Short selling is also increasing in the bond market. According to the Korea Financial Investment Association, the bond loan transaction balance was recorded at 143.933 trillion won as of the end of October. The loan balance, which remained around 105 trillion won at the beginning of the year, exceeded 140 trillion won for the first time on September 29. It has increased by nearly 40 trillion won this year alone. At the end of last year, the loan balance remained at around 98 to 99 trillion won, staying below 100 trillion won.

Bond loan transactions are similar to short selling in the stock market, where investors buy relatively low-priced government bond futures while borrowing and selling overvalued spot bonds in advance to respond to bond price declines. An increase in bond loan transactions indicates that many investors expect prolonged high-intensity tightening in the U.S., aiming to defend against bond price declines (bond yield increases) and resulting valuation losses due to further interest rate hikes. Moreover, after Gangwon Province declared a default on the Legoland project financing (PF) asset-backed commercial paper (ABCP) but later announced repayment, investor sentiment has weakened across the bond market. There are many forecasts that the government's measures to stabilize the bond market will only be temporary, making it difficult for investor anxiety to be easily resolved.

On the previous day in the Seoul bond market, the 3-year maturity government bond yield closed at 4.068% per annum. The 3-year yield, which closed at 1.798% per annum at the end of last year, has recently remained in the 4% range. Long-term bond yields with longer maturities have also soared. The 10-year and 30-year yields recorded 4.135% and 4.029%, respectively, on the previous day. The CP yield reached 4.67%, setting a new annual high once again.

Kim Ji-na, a researcher at Eugene Investment & Securities, said, "It is positive that the government took action before PF-related issues spread beyond Legoland, but it will be difficult to completely extinguish the risk," adding, "Since the overall interest rates are rising due to monetary authorities' tightening to control inflation, the degree of stabilization is limited, and with ongoing tightening uncertainties, instability in the bond market is expected to continue."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.