SA, China Smartphone Market Slump Continues in Q3, Down 16% Year-on-Year

Chinese Brands Vivo, Oppo, Honor, Xiaomi Struggle with Sharp Shipment Decline

[Asia Economy Reporter Cha Min-young] Apple, buoyed by the love of iPhones among Chinese consumers, was the only manufacturer among the top five in the Chinese smartphone market in Q3 to show year-on-year growth.

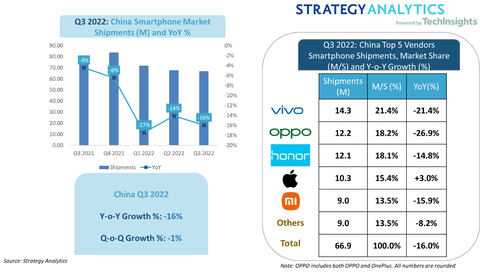

According to the announcement by Strategy Analytics (SA) on the 31st (local time), smartphone shipments in China reached 66.9 million units in Q3, down 16% compared to the same period last year. The decline continued for six consecutive quarters due to a combination of excess inventory and macroeconomic slowdown.

By company, Vivo shipped 14.3 million units, securing first place, but its volume decreased by 21% compared to the same period last year. Its market share also fell by 2 percentage points from 23% last year to 21%. It is evaluated to have performed relatively well through efforts to diversify its product portfolio and strengthen its premium and online segments.

Oppo ranked second with a market share of 18% and shipments of 12.2 million units, but recorded the largest decline among manufacturers with a 27% drop compared to the previous year. Honor ranked third with 12.1 million units, down 15%. Xiaomi, ranked fifth in market share, recorded shipments of 9 million units, down 16% year-on-year.

Compared to the struggling Chinese manufacturers, Apple recorded shipments of 10.3 million units, up 3% year-on-year, ranking fourth. Its market share also rose by 2 percentage points from 13% in the same period last year to 15%. Thanks to the discount effect of the iPhone 13 series and demand for the iPhone 14 series, Apple was the only one among the top five companies to record positive growth.

Wu Yien, SA’s senior analyst, said, "Due to ongoing disruptions caused by COVID-19 and economic headwinds, it will be difficult for the Chinese smartphone market to escape the recession phase in the next quarter. However, some premium segments are expected to remain resilient despite economic uncertainties, so differentiated product strategies targeting the high-end segment are necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.