Asia Economy and Samsung Securities Survey 304 High-Net-Worth Individuals with Over 3 Billion Won in Assets

Stocks and Bonds Tie for Top Spot at 30% Each in New Investment Plans

Monthly Interest-Paying and Tax-Efficient Low-Coupon Bonds Gain Popularity

Investors Prepare to Buy Undervalued Korean Stocks at Bargain Prices

[Asia Economy, reporter Lee Seonae] #Kim Jisan, a high-net-worth individual in his 40s living in Seoul, withdrew all his funds from his stock account earlier this year due to stock market volatility. Facing the highest tax rate under the comprehensive financial income taxation system, he was concerned about the tax burden on traditional financial products. While considering his options, he purchased monthly interest-paying bonds and also bought a large amount of low-coupon bonds that were issued several years ago. By buying high-interest monthly interest-paying bonds, he secured stable interest income, and by purchasing low-coupon bonds at a discount-whose prices had dropped significantly since issuance-he could realize capital gains if their prices rose or by holding them to maturity. A low-coupon bond refers to a bond with a relatively low face interest rate (also called a "coupon rate") paid at maturity. As market interest rates have risen, the trading prices of such bonds have fallen. If purchased and held to maturity, only the interest income is taxed at 15.4%, while capital gains are not taxed, offering a tax-saving advantage. Kim said, "Investing in regular financial products means that if I earn interest or dividend income, nearly half of my profits are taxed, which is a significant burden. However, by utilizing low-coupon bonds, I can increase my after-tax returns through tax savings, making them attractive." He added, "Next year, I plan to continue investing in these bonds and, given that Korean stocks have become much cheaper, I intend to allocate funds back into stocks for a balanced investment between bonds and equities."

Among high-net-worth individuals with assets of 3 billion won or more, 6 out of 10 selected "bonds," which offer both stability and high returns during periods of rising interest rates, and "undervalued Korean stocks" as their top investment choices for next year. This indicates a strategy to pursue both bonds and stocks simultaneously.

This year, high-net-worth individuals have continued to channel their investment funds into bonds, and this trend is expected to persist next year. Additionally, due to volatility in the stock market this year, there was a strong money move out of stocks into assets such as bonds, time deposits, and savings deposits. However, next year, there is a high likelihood of a reverse money move, with funds flowing back into the stock market. As the valuations of the KOSPI and KOSDAQ indices have dropped to levels reflecting even a recession, major investors are preparing to buy stocks at low prices, suggesting that investment funds will flow back into equities.

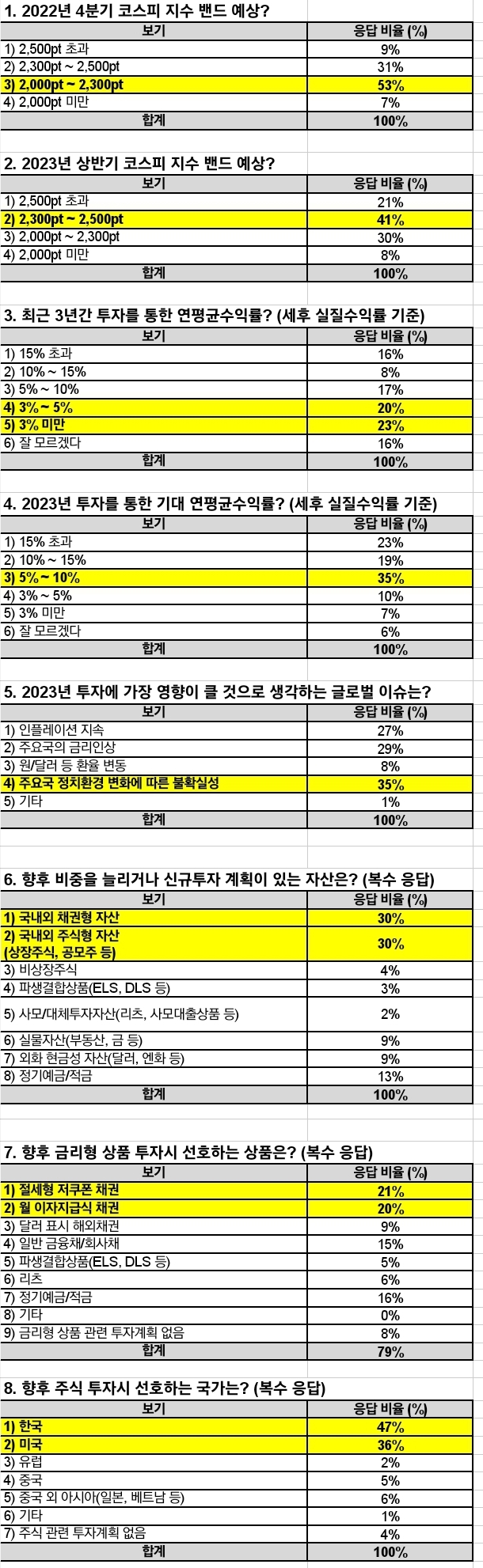

According to a recent two-week investment survey conducted by Asia Economy and Samsung Securities among 304 high-net-worth individuals with assets exceeding 3 billion won, both stocks and bonds accounted for 30% each as assets they plan to increase or newly invest in, tying for first place. In contrast, unlisted stocks, derivative-linked products (such as ELS and DLS), and private and alternative investment assets (such as REITs and private lending products) were largely disregarded. Real asset investment plans, such as real estate, gold, and silver, accounted for 9%, foreign currency cash assets like the dollar and yen made up 9%, and time deposits and savings deposits accounted for 13%.

The "barbell strategy" of high-net-worth individuals, which involves pursuing both stability and risk through bonds, is expected to continue next year. When asked about preferred interest rate products for future investment, tax-saving low-coupon bonds and monthly interest-paying bonds ranked first and second, accounting for 21% and 20% respectively. Additionally, dollar-denominated overseas bonds and general financial and corporate bonds accounted for 9% and 15% of responses, respectively, with bonds overall making up 65% of preferred investment products.

The reason major investors are focusing on bond products is to pursue both stability and high-risk, high-return strategies during periods of rising interest rates. By purchasing high-interest bonds, they secure stable interest income, and by buying low-coupon bonds-whose prices have dropped significantly since issuance-at a discount, they can realize capital gains if prices rise or by holding them to maturity.

Returns from bond investments are largely divided into regular interest income and capital gains. The 15.4% interest income tax is levied only on the interest, not on capital gains. Since capital gains are excluded from interest income tax, they are also exempt from comprehensive income tax. Among bonds traded over-the-counter that were issued at low coupon rates during previous low-interest periods, recent interest rate hikes have caused their prices to fall significantly below face value, increasing the potential for capital gains. Therefore, the proportion of taxable interest income (coupon rate) in total bond investment returns is relatively small, making it advantageous for reducing tax burdens. For this reason, bonds have been extremely popular this year. In fact, the amount of low-coupon bonds purchased by high-net-worth clients at Samsung Securities (with assets over 3 billion won) increased 6.4 times year-on-year (as of September), reaching 2.6 trillion won.

Baek Hyejin, Executive Director of SNI Strategy at Samsung Securities, said, "There is a growing trend among high-net-worth individuals to implement bond portfolio strategies that combine the purchase of high-coupon bonds, which provide a stable pre-tax annual interest rate of around 4%, with low-coupon bonds, which help reduce tax burdens and increase after-tax real returns."

Major investors are planning to pursue both opportunities next year, with one of them being the Korean stock market. They are preparing to buy undervalued Korean stocks at low prices. This matches the survey results, where 47% selected "Korea" as their preferred country for future stock investments, ahead of "the United States" at 36%. They expect the domestic stock market to hit a bottom in the fourth quarter and recover (rise) next year. For the expected KOSPI band in the fourth quarter, 53% predicted a range of 2,000-2,300, and 62% expected it to exceed 2,300 in the first half of next year. This indicates a strong view that the KOSPI will bottom out in the fourth quarter and then rise.

Kim Yonggu, Senior Research Fellow at Samsung Securities, said, "Currently, both domestic and international stock markets have already priced in the reality of an economic recession. Unless additional risks emerge in 2023, the downside will be limited, and the market could shift to one that is sensitive to positive news."

Among major investors who plan to invest in both stocks and bonds, 77% expect an after-tax investment return of "over 5%" in 2023. This expectation is attributed to the higher interest rate environment and a positive outlook on the stock market. The proportion of respondents who reported an average annual investment return of over 15% over the past three years was 16%, while those with over 5% reached 41%.

The main risk factors anticipated for next year were uncertainties arising from changes in the political environment of major countries, accounting for 35%. "Interest rate hikes" (29%), "inflation" (27%), and "exchange rate fluctuations" (8%) were also cited, but concerns about uncertainties outweighed worries about these more predictable risks.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.