Ritz Association "Acquisition-type Rental REITs Differ from Short-term and Speculative Corporations"

Demand for Amendment of Local Tax Special Cases Act Including Local Tax Reduction Provisions

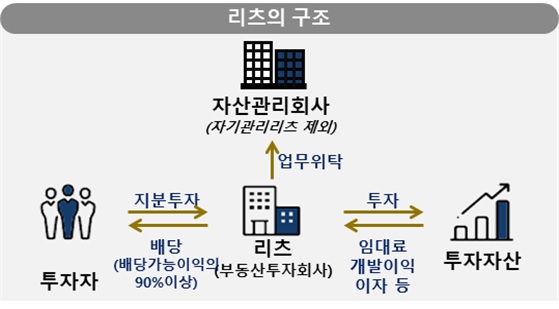

[Asia Economy Reporter Noh Kyung-jo] The domestic REITs (Real Estate Investment Trusts) industry has rolled up its sleeves to revitalize purchase-type rental housing REITs. As a prerequisite, they are urging the relaxation of acquisition tax regulations, emphasizing that purchase-type rental REITs will contribute to housing stability for ordinary citizens seeking rental housing amid the real estate transaction freeze.

An official from the Korea REITs Association stated on the 1st, "We have recently requested the Ministry of Land, Infrastructure and Transport and the Ministry of the Interior and Safety to ease acquisition tax regulations on purchase-type rental REITs and have been meeting with officials from each ministry to explain the necessity of relaxation." Although they had verbally suggested this during REIT-related meetings with the Ministry of Land, this is the first time they have followed an official procedure.

Rental REITs, jointly invested by the Housing and Urban Fund and private business proposers, are divided into construction-type and purchase-type. Among these, the purchase-type involves REITs buying already completed houses to supply them. Therefore, there is no actual effect on housing supply.

The government’s decision to impose a fourfold acquisition tax surcharge on purchase-type rental REIT operators, treating them the same as speculative corporations, is in this context. The Moon Jae-in administration, which emphasized eradicating illegal real estate speculation, removed the basic deduction for corporate housing acquisition in the June 2020 housing stability measures and imposed acquisition tax surcharges in the July 2020 livelihood stabilization direction. Article 13-2 of the Local Tax Act stipulates that the acquisition tax rate for corporations shall be "the standard rate plus four times the surcharge rate."

In response, the association argued that an exception clause for purchase-type rental REITs should be included in the Restriction of Special Local Taxation Act. This law lists provisions for various tax reductions under the Local Tax Act. An association official said, "Until the announcement of the measures, 10 purchase-type rental housing REITs operated a total of 2,919 rental units, but new projects have since been halted. Purchase-type rental REITs, which operate with approval from the Ministry of Land, unlike speculative corporations aiming for short-term gains, have supplied long-term rental housing for at least eight years."

They also highlighted that, intertwined with the real estate market, housing purchase demand is decreasing while rental demand is increasing, making appropriate rental housing supply necessary. The official added, "Even during a period of falling house prices, many demanders still feel prices are high, and interest rates are also elevated. Additionally, due to the burden of jeonse and monthly rent, people seek rental housing. The revitalization of purchase-type rental REITs is a movement aimed at stabilizing the housing market and revitalizing the overall REITs market, separate from the recent decline in listed REIT stock prices caused by concerns over real estate project financing (PF) defaults."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.