Record Quarterly Sales Amid Global Recession

Profitability Decline Due to Petrochemical Market Downturn

Meanwhile, Advanced Materials and Batteries Remain Strong

Cha Dong-seok CFO "Continued Expansion of Battery Materials Business... Will Increase Profit Scale"

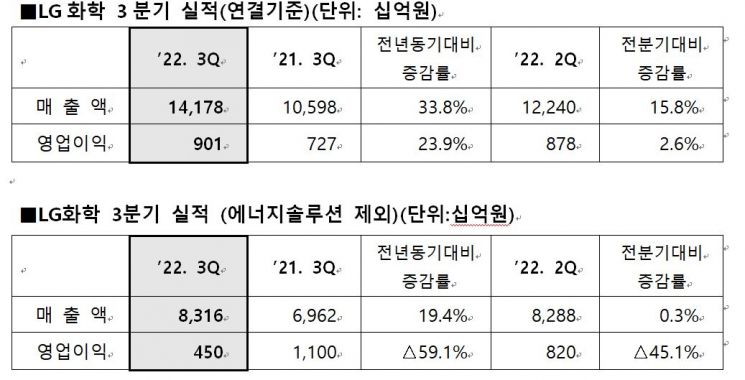

[Asia Economy Reporter Jeong Dong-hoon] LG Chem announced on the 31st that it achieved consolidated sales of KRW 14.1777 trillion and operating profit of KRW 901.2 billion for the third quarter of this year.

Compared to the same period last year, sales increased by 33.8% and operating profit by 23.9%. Compared to the previous quarter (Q2), sales rose by 15.8% and operating profit by 2.6%.

Cha Dong-seok, Vice President and Chief Financial Officer (CFO) of LG Chem, commented on the Q3 results, "Although profitability was affected by the worsening petrochemical market due to the global economic downturn, we achieved solid consolidated results by increasing sales growth and profitability in new growth engine businesses such as advanced materials and energy solutions. Looking ahead, with the petrochemical market expected to gradually improve from the fourth quarter as the bottom, we will continue to expand the battery materials business, which is the foundation of advanced materials like cathode materials, to further increase profit scale."

Petrochemical Profitability Declined but Battery Material Prices Increased

Looking at the detailed Q3 performance and Q4 outlook by business division, the petrochemical division recorded sales of KRW 5.4931 trillion and operating profit of KRW 92.6 billion. Profitability declined due to a deterioration in spreads of major products caused by rising oil prices and decreased demand amid global inflation.

Although difficult market conditions are expected in Q4 due to continued global demand weakness and increased supply, a gradual market recovery is anticipated from the second half of this year as the bottom.

The advanced materials division posted sales of KRW 2.5822 trillion and operating profit of KRW 415.8 billion. Sales growth continued due to expanded shipments and price increases of battery materials, and despite a downturn in the IT/semiconductor front markets, the increased share of the cathode materials business expanded profitability.

In Q4, a decline in cathode material sales is expected due to falling metal prices, but growth is projected to continue with stable shipment volume increases in the future.

Solid Performance Expected in Q4 with Expansion of Battery Production Capacity in North America

The life sciences division recorded sales of KRW 225.2 billion and operating profit of KRW 5.8 billion. Despite sales growth of key products such as growth hormones and Yusept, profitability declined due to delayed recovery of the aesthetic business in China and increased R&D expenses. In Q4, sales growth is expected with expanded shipments of vaccines and growth hormones, while R&D costs are projected to rise due to ongoing clinical trials for global new drug projects.

The energy solutions division posted sales of KRW 7.6482 trillion and operating profit of KRW 521.9 billion. It achieved the highest quarterly sales driven by increased electric vehicle battery shipments due to improved demand from European and North American customers, and profitability improved due to price increases following metal price rises.

In Q4, LG Chem plans to accelerate business expansion centered on the North American market, where rapid growth is expected, through the expansion of production capacity in North America and the establishment of smart factories.

Farm Hannong recorded sales of KRW 156.6 billion and an operating loss of KRW 3.4 billion. Sales and profitability improved compared to the same period last year due to increased domestic and overseas sales of crop protection products such as Terado.

In Q4, annual sales growth and profitability improvement are expected to continue through expanded overseas sales of crop protection products and special fertilizers.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Hostess to Organ Seller to High Society... The Grotesque Scam of a "Human Counterfeit" Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)