[Asia Economy Sejong=Reporter Kim Hyewon] The National Tax Service announced on the 31st that it will expand the delivery notification service for national tax bills starting November 1 to facilitate taxpayers' convenience, including interim payment of comprehensive income tax.

The National Tax Service developed the 'National Tax Bill Delivery Notification Service' in collaboration with the Korea Post to ensure taxpayers' convenience and timely delivery of bills, and has been operating a pilot service since August targeting returned national tax bills.

This expansion aligns the service scope with the mass issuance periods of national tax bills such as interim payment of comprehensive income tax and comprehensive real estate tax.

In Korea, due to the increase in single-person households and dual-income households, there are many cases where the recipient, such as the taxpayer or cohabitant, is absent at the delivery location, causing difficulties for postal workers in delivering tax bills. Additionally, taxpayers who did not properly receive national tax bills often had to visit tax offices or delivery post offices or request redelivery by phone, which was inconvenient.

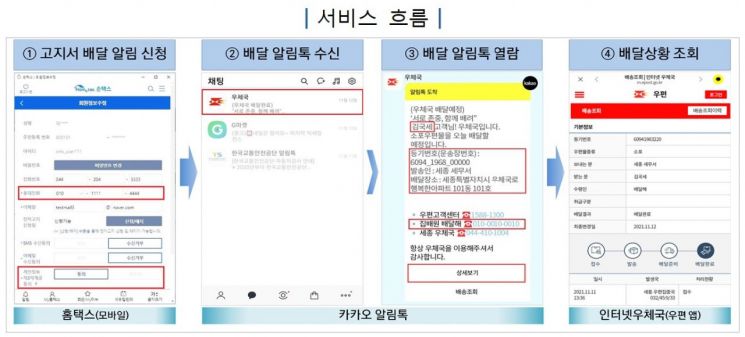

Going forward, taxpayers can apply for the service by registering their mobile phone number after signing up on Hometax (including mobile) and consenting to the provision of information by the Korea Post. From the day after application, they can receive delivery notifications for personal tax bills sent to them.

For bills sent thereafter, delivery status can be checked via mobile, and it will be possible to contact the postal worker by phone and select a preferred delivery location.

The National Tax Service plans to gradually implement delivery notification services for dunning notices and refund notices in later stages.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.