Omdia Global Smartphone Shipment Survey Results

Apple Narrowing Gap with No.1 Samsung

[Asia Economy Reporter Cha Min-young] As Chinese manufacturers face the dual challenges of weak demand and inventory burdens, global smartphone shipments in the third quarter declined by 7.6% compared to the previous year. Meanwhile, despite the worldwide economic downturn, Apple, which has a loyal premium customer base, is narrowing the gap with Samsung Electronics, the global number one.

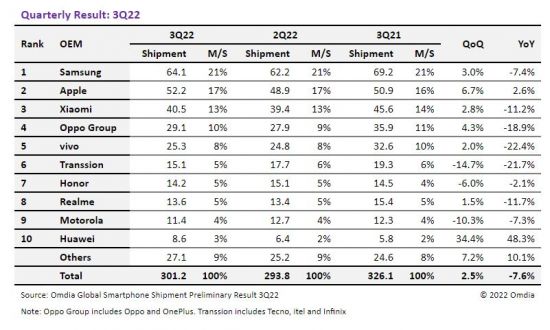

According to the latest smartphone shipment report for Q3 2022 by market research firm Omdia on the 28th, global smartphone shipments totaled 301.2 million units. This represents a 7.6% decrease compared to the same period last year but a 2.5% increase from the previous quarter.

The main reason for the global shipment decline is the poor performance of Chinese manufacturers. Major Chinese original equipment manufacturers (OEM) recorded significant negative growth year-on-year. Xiaomi, Oppo, Vivo, Transsion, and Realme all experienced double-digit percentage decreases in shipments.

Samsung maintained its top position with 64.1 million smartphone shipments in Q3. This was a 7.4% decrease year-on-year but a 3.0% increase quarter-on-quarter. During the same period, Apple, ranked second, shipped 52.2 million units, marking a 2.6% year-on-year increase and narrowing the gap with Samsung, with shipments rising 6.7% quarter-on-quarter.

Apple, which dominates the premium market, saw its market share rise nearly 2 percentage points from 15.6% in Q3 2021 to 17.3% this year. Apple’s iPhone shipments have increased year-on-year for eight consecutive quarters since Q4 2020.

Hong Ju-sik, director at Omdia, analyzed, "Apple’s consumers are generally loyal high-income customers who are less affected by the current economic downturn than mid-tier brands, resulting in better performance than competitors across a broader market in Q3. Despite rising gasoline prices, inflation, and reduced disposable income, Apple’s iPhone remains more resilient in the sluggish smartphone market."

He added, "Apple consumers have sufficient purchasing power to upgrade to the latest iPhone compared to customers of major Android-based companies such as Samsung, Honor, and OnePlus."

Senior researcher Jacker Li of Omdia pointed out, "The biggest factors prolonging this downturn are the slump in China’s domestic smartphone market, pandemic-related lockdowns in major Chinese cities, the Russia-Ukraine war, political conflicts in India, economic recession, and increasingly fierce competition with rapidly growing domestic Chinese brands like Honor and Huawei."

He further explained, "Additionally, Xiaomi and Oppo experienced component shortages last year, leading them to significantly increase purchases early this year to secure parts. However, due to weak smartphone demand this year, inventories surged. They are suffering from the dual burdens of weak demand and inventory problems."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.