Yuamco (SPC) Structure... Enables Free Decision-Making and Rapid Execution

Private Equity Funds: Securities Firms That Provide Capital Cannot Intervene in Fund Execution

Establishing SPC Results in a Stock Company under Commercial Law

Capital Execution after Investment... Enables Swift Liquidity Supply

[Asia Economy Reporter Hwang Yoon-joo] The securities industry is establishing special purpose companies (SPCs) like UAMCO (United Asset Management Company·AMC) to acquire real estate project financing (PF) asset-backed commercial papers (ABCPs) in the industry. Due to differing interests between large and small to medium-sized firms regarding PF ABCP acquisition criteria, interest rates, and loss-sharing ratios in case of forced sales, sharp disagreements are expected over the details.

According to the Korea Financial Investment Association and the securities industry on the 28th, instead of the Bond Market Stabilization Fund (Bond Stabilization Fund), an SPC will be established to stabilize the bond market. About 30 securities firms, including comprehensive financial investment business operators (CFIBOs), will contribute funds to the SPC, which will then acquire bonds (PF ABCPs). (Related article)

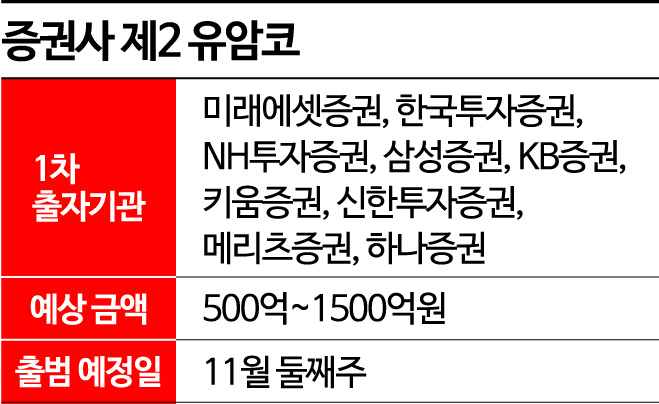

Initially, nine CFIBOs (Mirae Asset Securities, Korea Investment & Securities, Samsung Securities, NH Investment & Securities, KB Securities, Kiwoom Securities, Meritz Securities, Shinhan Investment Corp., and Hana Securities) will lead the launch, followed by additional contributions from small and medium-sized firms in a second phase. Key securities industry practitioners will gather to finalize the details, with plans to launch in the second week of November.

The contribution amount has not yet been decided but is expected to be roughly between 50 billion and 150 billion KRW per firm. There are differing opinions on whether CFIBOs and small to medium-sized firms will contribute the same amount. Some securities firms will also need to respond to capital calls from the government-established Bond Stabilization Fund during November.

The reason for adopting the UAMCO structure is that it allows for flexible decision-making and rapid fund execution. Private equity funds strictly separate the roles of the fund manager (GP) who manages the funds and the institutional investors (LP) who provide the capital. If structured as a fund, the contributing securities firms cannot participate in operations such as ABCP purchases. Also, as a stock company under commercial law, it can be established without Financial Supervisory Service registration procedures, enabling quick fund execution from contribution to ABCP acquisition.

Meanwhile, UAMCO is a private bad bank established in 2009 to resolve non-performing loans during the financial crisis. Six banks (Kookmin Bank, Shinhan Bank, Woori Bank, Hana Bank, Industrial Bank of Korea, and NH Nonghyup Bank) contributed funds to acquire general secured bonds and restructuring bonds (recovery companies). At that time, it also led the non-performing loan market by acquiring real estate PF loan bonds.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.