'Xi Jinping Risk' Causes Shanghai Housing Prices to Plunge 40% in One Day

Chinese Government Unveils Foreign Investment Promotion Package

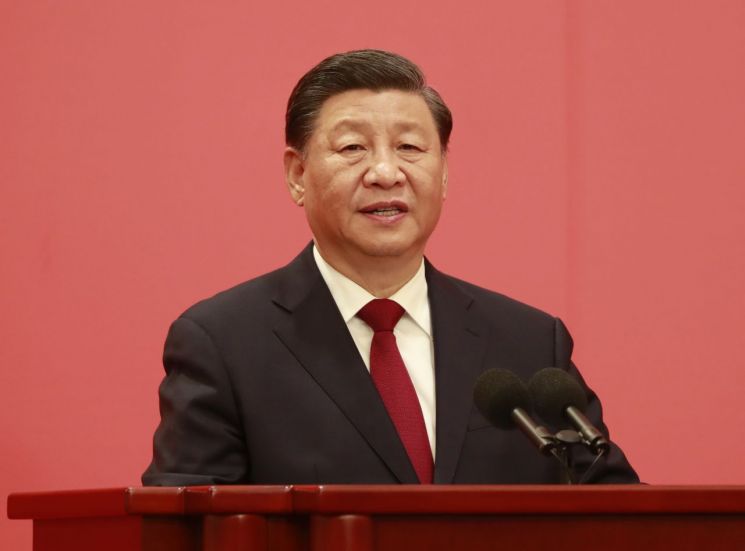

Chinese President Xi Jinping is giving a greeting at the press conference for the newly appointed Standing Committee members held at the Great Hall of the People in Beijing after concluding the 1st Plenary Session of the 20th Central Committee of the Communist Party, which elected the General Secretary and members of the Politburo Standing Committee on the 23rd. Photo by Yonhap News

Chinese President Xi Jinping is giving a greeting at the press conference for the newly appointed Standing Committee members held at the Great Hall of the People in Beijing after concluding the 1st Plenary Session of the 20th Central Committee of the Communist Party, which elected the General Secretary and members of the Politburo Standing Committee on the 23rd. Photo by Yonhap News

[Asia Economy Reporter Yoon Seul-gi] Following Xi Jinping's third term as China's president, the phenomenon of 'China Run' (a portmanteau of China avoidance and bank run) has become prominent in global capital markets, prompting the Chinese government to unveil a package of measures to promote foreign investment immediately after the 20th National Congress of the Communist Party of China (Party Congress).

According to the website of the National Development and Reform Commission (NDRC) of China on the 27th, six departments including the NDRC announced 15 policy measures on the 25th aimed at promoting foreign investment, focusing mainly on manufacturing. This is seen as a response to the widespread spread of 'Xi Jinping risk' following the confirmation of Xi Jinping's third term.

Earlier, concerns were raised that China's reform and opening-up policy might regress as the Party Congress laid the groundwork for Xi Jinping's lifelong rule, and all seven members of the Politburo Standing Committee, the leadership of Xi Jinping's third term, were composed of the 'Xijiajun' (習家軍, Xi Jinping's close associates group).

As a result, the Hong Kong stock market plunged 6.36% on the 24th, and Chinese-speaking region stock markets fell sharply in unison, while China-related stocks also declined across the U.S. stock market. According to the Wall Street Journal (WSJ) and Bloomberg News, due to the 'Xi Jinping risk,' the market capitalization of the five major Chinese companies listed on the New York Stock Exchange evaporated by $52.17 billion (approximately 75.2 trillion KRW) in one day, and the wealth of Chinese billionaires decreased by $12.7 billion (approximately 18.25 trillion KRW). The value of the yuan also hit its lowest level in 15 years.

Additionally, an exodus of wealthy Chinese is being observed. This is because Chinese authorities are expected to impose high taxes on the wealthy under the banner of 'common prosperity' (aiming to reduce income gaps and inequality so that everyone prospers). On the 26th, Taiwan's Zi You Shi Bao reported, "A luxury residence in Shanghai, Huashan Xiadu Yuan, sold for 60 million yuan (approximately 1.17 billion KRW) last month, but since the 24th, listings have appeared at 35.99 million yuan (approximately 700 million KRW)," adding, "Prices dropped by more than 40% overnight."

In response to these movements, Chinese authorities introduced measures to stabilize investment to prevent the outflow of foreign capital. The implementation of the 'Negative List for Foreign Investment' (which generally allows foreign investment but prohibits or restricts it in specific areas) includes provisions ensuring that foreign-invested enterprises can enjoy support policies on an equal footing with Chinese companies according to laws and regulations.

At the local government level, preferential policies to promote foreign investment will be introduced. Measures include encouraging foreign-invested enterprises to reinvest in China's manufacturing sector and ensuring smooth logistics such as production and material transportation for foreign-invested enterprises.

Plans to facilitate the entry of global businesspeople were also discussed. Provided that COVID-19 prevention is well managed, the policy includes making it easier for senior managers, technical personnel, and their families of multinational companies and foreign-invested enterprises to enter and exit China. Furthermore, support will be provided for the import and export activities of foreign-invested manufacturing enterprises, facilitating trade and customs clearance, and supporting the innovation and development of foreign-invested enterprises.

Regarding these measures, Bai Ming, Deputy Director of the International Market Research Institute at the China Center for International Economic Exchanges, told the state-run Global Times on the 26th, "As the first opening policy package after the conclusion of the Party Congress, it signals China's willingness to open up."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.