On the 17th, visitors attending 'InterBattery 2022' held at COEX in Samseong-dong, Gangnam-gu, Seoul, are examining a POSCO battery pack model for electric vehicles made with composite materials at the POSCO Chemical exhibition hall. Photo by Hyunmin Kim kimhyun81@

On the 17th, visitors attending 'InterBattery 2022' held at COEX in Samseong-dong, Gangnam-gu, Seoul, are examining a POSCO battery pack model for electric vehicles made with composite materials at the POSCO Chemical exhibition hall. Photo by Hyunmin Kim kimhyun81@

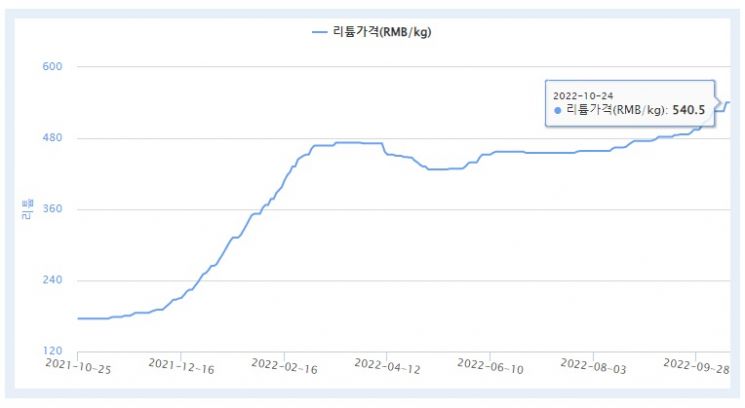

[Asia Economy Sejong=Reporter Dongwoo Lee] The price of lithium, a key material for electric vehicle batteries, surged nearly 3% in just one day. Analysts attribute this to the rapid increase in electric vehicle demand and the intensifying global competition to secure lithium, driven by the full-scale implementation of the U.S. Inflation Reduction Act (IRA) starting next year.

According to the Korea Resource Information Service on the 25th, the price of lithium (based on 99% lithium carbonate) reached a record high of 540.5 yuan per kilogram as of the previous day. The price of lithium, which was 175.5 yuan per kilogram in October last year, has risen 3.1 times in one year. In particular, lithium prices, which had been stable at 525.5 yuan over the past week, surged 2.85% in just one day, marking the second-largest increase since January 6 this year (2.99%↑).

The soaring lithium prices contrast with the stabilization trend of other raw material prices. Prices of key battery materials such as nickel and cobalt have clearly declined since the Russia-Ukraine war. In the case of cobalt, after reaching a peak price of $81,690 per ton in May, it has repeatedly fallen to $51,505 per ton as of the previous day, a drop of about 37%.

The main reason lithium prices alone are soaring is the significant impact of the U.S. IRA on key electric vehicle materials. Under the IRA, which will be implemented from next year, automakers must equip batteries that use more than 40% of minerals sourced from the U.S. or countries with which the U.S. has free trade agreements (FTA) to receive tax credit subsidies ($7,500 per vehicle). This ratio will increase by 10 percentage points annually, expanding to 70% by 2027.

Additionally, the strengthening of the U.S. dollar has pushed the Chinese yuan exchange rate past 7 yuan per dollar, causing import prices of lithium from Australia and Chile to rise. Power outages caused by heatwaves in China have also led to shutdowns at lithium carbonate refining plants, further driving up production costs.

As securing lithium has become a major challenge for the battery industry, companies are seeking new avenues by signing agreements with overseas mineral companies. POSCO Group signed a memorandum of understanding (MOU) last year with Australian resource development company Hancock for the development of lithium, nickel, and other mines to secure stable resources. SK On also invested 10% equity in Australian company Lake Resources and signed a long-term supply contract for a total of 230,000 tons of high-purity lithium.

However, concerns have been raised that if the rapid rise in lithium prices continues, companies’ cost burdens could increase exponentially at the time of contract renewals. According to market research firm SNE Research, global lithium demand is expected to surge from 529,000 tons this year to 1,043,000 tons in 2025 and 2,739,000 tons in 2030.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)