83% of Bonds Issued in the 2020 Low-Interest Era

Concerns of 'Surplus Bankruptcy' in the Rapidly Cooling Bond Market

[Asia Economy Reporter Sung Ki-ho] It has been revealed that major domestic automotive parts companies face bond maturities totaling 533 billion KRW in the first half of next year. Due to this, there are concerns that the bond market could freeze sharply, causing difficulties in fundraising, following the so-called 'Legoland Incident,' where the Legoland construction project operator in Chuncheon, Gangwon Province, failed to repay promissory notes exceeding 200 billion KRW borrowed from investors. Furthermore, most of the bonds maturing are loans taken out during the low-interest period of the COVID-19 pandemic, which means they could be severely impacted by the recent soaring benchmark interest rates.

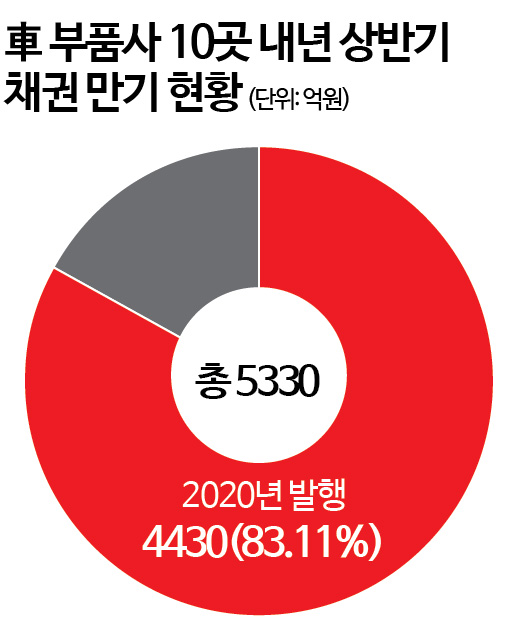

According to the Financial Supervisory Service's electronic disclosure system on the 30th, out of 13 major listed domestic automotive parts companies, 10 are facing bond maturities totaling 533 billion KRW by the first half of next year. Of this amount, 443 billion KRW (83.11%) was issued in 2020, during the height of the COVID-19 pandemic.

The companies with the largest bond maturities in the first half of next year are Hyundai Wia with 270 billion KRW and Mando with 140 billion KRW. Among these, the amounts issued in 2020 are 200 billion KRW and 140 billion KRW, respectively.

Additionally, Duol (30 billion KRW), Seoyon E-Hwa (10 billion KRW), Myungshin Industry (10 billion KRW), Pyeonghwa Industry (10 billion KRW), THN (5 billion KRW), and Daeyu A-Tec (23 billion KRW) have primary collateralized bond obligations (P-CBO) maturing in the first half of next year. Of these, 103 billion KRW was issued in 2020.

The problem lies in the fact that a large portion of the bonds maturing next year were issued in 2020, a period characterized by low interest rates due to the impact of COVID-19. The Bank of Korea lowered the benchmark interest rate from 1.25% in February 2020 to 0.75% in March and further down to 0.50% in May to stimulate the economy. The low-interest rate environment was maintained for some time until the benchmark rate was raised to 0.75% in August last year.

As a result, corporate bond issuance rates at that time ranged from the mid-1% to mid-3% levels. However, with the recent rapid increase in benchmark interest rates and the 'Legoland Incident' causing a credit crunch in the bond market, there are bleak forecasts that the interest rates on maturing bonds will rise sharply. Recently, unsecured 3-year maturity corporate bonds (AA-) have surpassed 5% for the first time in 12 years. Although government measures have somewhat calmed the situation recently, the unsecured 3-year maturity corporate bond (AA-) rate was still high at 5.592% as of the previous day.

Experts point out that considering automotive parts companies are struggling to even cover their annual interest payments with their yearly earnings, urgent and extraordinary measures are needed to overcome the crisis.

According to a recent analysis by the Korea Automotive Technology Institute of the management performance of 1,296 domestic automotive parts companies last year, 36.6% of these companies had an interest coverage ratio (operating profit/interest expense) below 1.

An interest coverage ratio below 1 means that the interest expenses exceed the earnings from operations. This implies a high risk of insolvency, as companies cannot even cover interest payments, let alone repay principal. During the COVID-19 pandemic in 2020, this ratio rose to 43.1%. Although it decreased compared to the previous year, the Korea Automotive Technology Institute notes that considering the emergency situation caused by COVID-19, this is the highest level in the past decade.

Lee Hang-gu, a research fellow at the Research Strategy Headquarters of the Korea Automotive Technology Institute, warned, "Since the benchmark interest rate has risen more steeply than at the time of the management performance survey, and with the recent rapid increase in corporate bond rates due to the 'Legoland Incident,' the situation is even more serious. If domestic parts companies collapse because they cannot afford interest payments, the domestic supply chain crisis could be more severe than the global supply chain shock."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)