Reducing Oil Business Share and Increasing Battery and Solar Power Share

Shifting Focus to Energy Sectors like Battery Materials and Solar Power

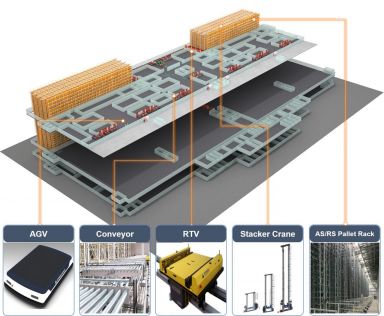

Plan for Establishing a Smart Logistics Solution at LG Chem's Gumi Cathode Material Plant. Photo by LG Chem

Plan for Establishing a Smart Logistics Solution at LG Chem's Gumi Cathode Material Plant. Photo by LG Chem

The petrochemical industry, heavily affected by the 'triple burden' of high exchange rates, high inflation, and declining global demand, is seeking solutions through expanded investments in new business sectors. The prolonged energy crisis and the soaring exchange rate trend, among other structural changes in the external environment, appear to be accelerating their pace of transformation.

According to the industry on the 25th, major domestic chemical companies such as LG Chem, Lotte Chemical, and Hanwha Solutions are expected to see operating profits decrease by about 50-80% in the third quarter of this year compared to the previous year. This is due to a significant increase in cost burdens caused by the sharp rise in international oil prices following the Russia-Ukraine war, as well as demand contraction amid China's COVID-19 lockdown measures and concerns over a global economic recession.

Petrochemical companies are actively investing in new businesses such as mergers and acquisitions (M&A) to reduce the proportion of volatile petrochemical products. The core focus is on eco-friendliness. In line with the international trend of carbon neutrality, their strategy is to transform their business structure by reducing carbon emissions and entering eco-friendly businesses. Battery and solar power sectors have particularly caught the attention of these companies.

LG Chem has positioned eco-friendly materials, battery materials, and new drug development as its three major new growth engines. To expand research and development and production capacity, it plans to invest 4 trillion won annually starting this year and aims to increase sales to over 30 trillion won. It is especially proactive in expanding its business in essential battery materials. LG Chem stated, "We are actively considering mergers and acquisitions in the battery materials business," adding, "These will focus on new businesses rather than cathode materials."

Lotte Chemical has reorganized its structure around hydrogen materials, battery materials, and plastic recycling businesses. Its goal is to achieve sales of 50 trillion won by 2030. It has announced aggressive investments in the battery materials business, driven by the expansion of electric vehicle adoption. At the center of this is Iljin Materials, recently acquired and ranked fourth globally in the battery copper foil sector. In partnership with the U.S. battery materials startup Solect, it plans to establish a lithium metal anode production facility in the U.S. worth about 200 million dollars by 2025.

Hanwha Solutions is targeting both solar power and battery businesses. To strengthen cost competitiveness of solar products, it secured production facilities through equity investment in U.S.-based REC Silicon together with the group, and decided to expand the caustic soda production facility covering 42,900㎡ (about 13,000 pyeong) at its Yeosu plant. Caustic soda is essential for impurity removal in the cathode material production process.

The solar business is also gaining momentum in performance, supported by the rapid growth of the North American solar market. Accordingly, Hanwha Solutions became the largest shareholder earlier this year by acquiring additional shares in REC Silicon, a U.S. polysilicon manufacturer, and plans to expand its solar module production plant in the U.S. to over 10 GW annually. Hanwha Solutions' renewable energy division (solar) ended a six-quarter losing streak and turned profitable in the second quarter. As a result, it was the only major chemical company to record a 25.6% increase in operating profit to 277.7 billion won in the second quarter of this year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.