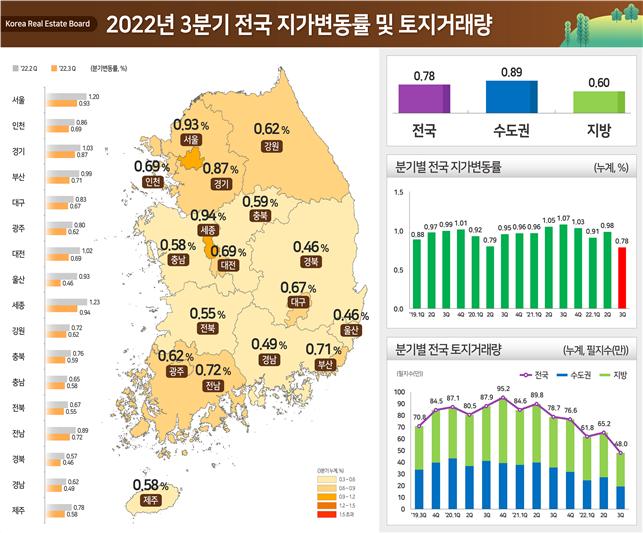

2022 3rd Quarter Nationwide Land Price Change Rate and Land Transaction Volume

As the housing sales market plunges into an unprecedented transaction freeze, the land market is also drying up. In particular, concerns over the potential default of real estate project financing (PF) loans in the second half of the year are spreading, causing development projects themselves to lose momentum, which is expected to further deepen the transaction freeze in the land market.

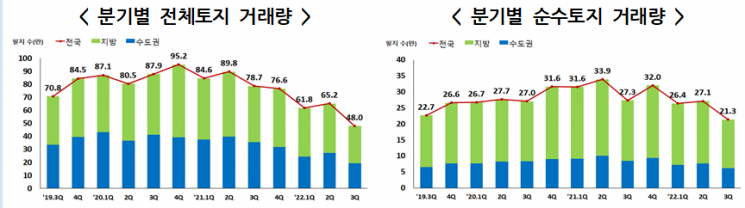

According to the "2022 Q3 Nationwide Land Price Change Rate and Land Transaction Volume" data released by the Ministry of Land, Infrastructure and Transport and the Korea Real Estate Board on the 25th, the total land transactions (including land attached to buildings) in the third quarter recorded 479,785 parcels. This is a sharp decline of 307,000 parcels, or 39.0%, compared to the same period last year (about 787,000 parcels). Compared to the previous quarter (652,211 parcels), it decreased by 26.4%. Land transaction volumes have been on a downward trend since recording 952,000 parcels in Q4 2020.

In particular, the pure land transaction volume excluding land attached to buildings in Q3 was about 213,000 parcels, down 21.3% from the previous quarter and 21.9% from the same period last year.

Pure land refers to bare land not attached to buildings and is also considered an indicator of the real estate development market. The decrease in pure land transactions is interpreted as a slowdown in the series of processes involved in purchasing and developing land.

Since last year, the rise in interest rates, peak housing price theories, and the real estate market downturn have cast dark clouds over the development industry first. In particular, recent concerns over PF loan defaults are expected to worsen this situation.

Along with the decrease in transaction volume, the rate of increase in land prices is also gradually slowing down.

In the third quarter, nationwide land prices rose by 0.78%, down 0.20 percentage points (p) from the previous quarter (0.98%) and 0.29 p from the same period last year (1.07%). The quarterly nationwide land price change rate recorded 1.07% in Q3 last year, dropped to 0.91% earlier this year, and has been showing a downward trend since.

Looking at the regions, both the metropolitan area (1.10% → 0.89%) and provinces (0.78% → 0.60%) saw a slight reduction in the rate of increase compared to Q2. Seoul (1.20% → 0.93%), Gyeonggi (1.03% → 0.87%), and Sejong (1.23% → 0.94%) showed levels higher than the national average (0.78%).

The Ministry of Land, Infrastructure and Transport stated, "We plan to closely monitor trends in land prices and transaction volumes and actively respond to any abnormal phenomena."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.