Semiconductor Inventory Rate Surges 52.2%P in One Year... Chemical Products and Primary Metals Also Rise Double Digits

Export Growth Rate Expected to Turn Negative Within the Year... Concerns Over Sharp Economic Slowdown as Companies Cut Production

[Asia Economy Sejong=Reporter Kwon Haeyoung] The recent surge in manufacturing inventory rates to levels seen during the foreign exchange crisis is due to a significant increase in semiconductor inventories caused by demand contraction amid global economic recession concerns. The disappearance of the COVID-19-related 'pent-up effect' (the phenomenon of suppressed consumption exploding) and the weakening of global supply chain instability are cited as major factors. As the manufacturing sector, anchored by semiconductors which are the backbone of our economy, plunges sharply due to worsening domestic and international conditions, concerns are spreading that if companies drastically reduce production going forward, the already rapidly freezing economy will face an even harsher winter next year.

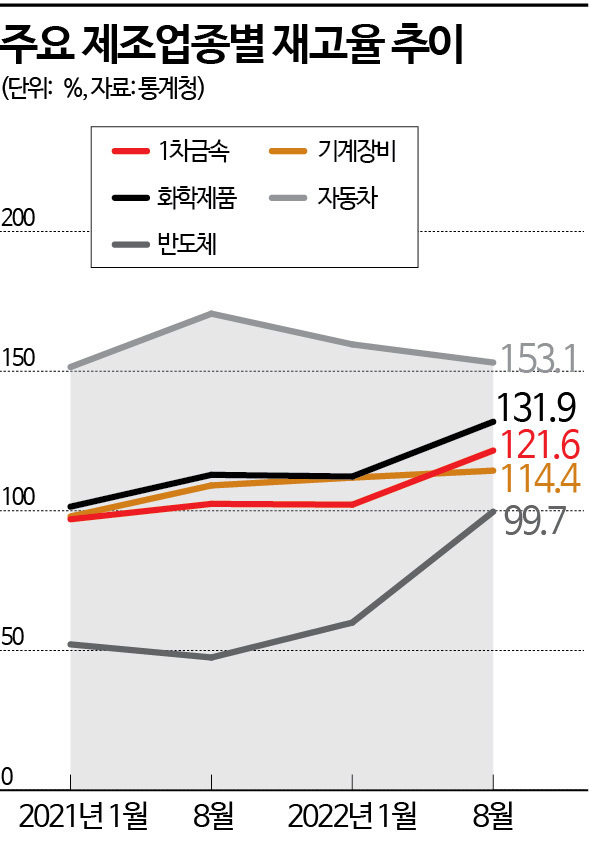

According to Statistics Korea on the 25th, the semiconductor inventory rate (inventory ratio to shipments) recorded 99.7% in August this year, rising 52.2 percentage points compared to 47.5% in August last year. The semiconductor inventory rate had dropped to 52.2% in January and 47.5% in August last year due to the recovery of demand suppressed by the COVID-19 outbreak and severe semiconductor shortages caused by global supply chain instability. It then rose to 60.0% in January this year but surged to nearly 100% as demand sharply contracted amid recession concerns. Earlier, the Ministry of Trade, Industry and Energy also expressed concerns about the semiconductor inventory rate when announcing export-import trends for September. The ministry explained, "Due to weak demand and inventory accumulation, memory prices fell, leading to a decrease in semiconductor exports."

Looking at major industries with high inventory rate weights alongside semiconductors, most saw steep increases compared to a year ago. The chemical products sector jumped 19.0 percentage points from 112.9% in August last year to 131.9% this August; primary metals rose from 102.5% to 121.6%, and machinery equipment increased from 109.1% to 114.4%, up 19.1 and 5.3 percentage points respectively. Only the automobile sector saw its inventory rate fall from 170.6% to 153.1%, down 17.5 percentage points. While companies significantly increased production and investment centered on semiconductors, which had entered a super cycle as the economy recovered from the COVID-19 slump, the economy rapidly cooled due to the Ukraine war, high inflation, and monetary tightening by major countries, forcing companies to manage rising inventories within just one year.

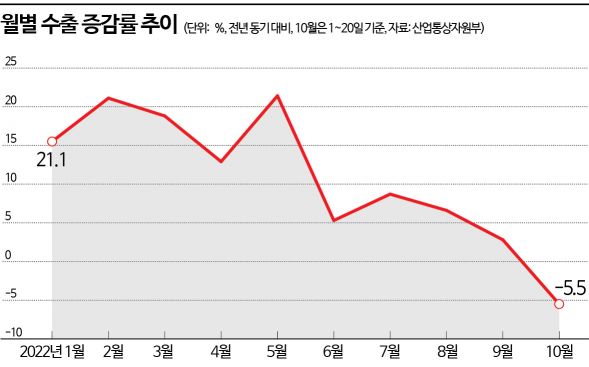

The problem is that amid the possibility of a global economic recession next year, export performance is rapidly slowing, and there is no sign of improvement in the manufacturing sector. According to Ministry of Trade, Industry and Energy statistics, the monthly export growth rate maintained double digits from March last year but dropped to single digits from June to September this year. Even this fell to -5.5% from the 1st to the 20th of this month, turning negative. The composite leading index of the economy from Statistics Korea, which predicts future economic trends, recorded 99.3 in August, down 0.2 points from the previous month. If the economy plunges sharply, the vicious cycle of 'global demand slowdown → inventory increase → corporate profitability deterioration → production and investment reduction → economic recession' is likely to accelerate further.

Major institutions such as the IMF have already forecast a faster-than-expected economic downturn. The IMF recently lowered South Korea's growth forecast for next year from 2.1% to 2.0%, a 0.1 percentage point drop. The global growth forecast was also lowered by 0.2 percentage points to 2.7%. Particularly, China's economy, on which South Korea heavily depends, was revised down from 4.6% to 4.4%, a 0.2 percentage point decrease. Both domestic demand and export outlooks are bleak.

With major countries rapidly raising interest rates in line with the U.S.'s sharp rate hikes, a global consumption contraction is inevitable. Although South Korea's retail sales increased by 4.3% month-on-month in August, indicating consumption remains firm for now, predictions suggest this growth will be difficult to sustain due to high inflation and monetary tightening reducing real purchasing power. When consumers close their wallets, inventory increases and production cuts follow, negatively impacting the economy.

Juwon, head of the Economic Research Office at Hyundai Research Institute, said, "As the global economy enters a recession phase, export growth rates may turn negative within this year," adding, "If overseas demand continues to weaken, companies may cut production to reduce inventories, further contracting the economy."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.