14% Sharp Decline Compared to a Week Ago

KakaoPay Usage Drops by 30%

Users of Competing Bank Apps Increase

[Asia Economy reporters Bu Aeri and Lee Minwoo] The aftermath of the Kakao 'blackout' incident is also affecting its financial affiliates. The number of users of major financial applications such as KakaoBank and KakaoPay has dropped by more than 10%, showing signs of instability. Although user numbers began to recover on weekdays when usage typically increases, they remain significantly lower compared to a week ago.

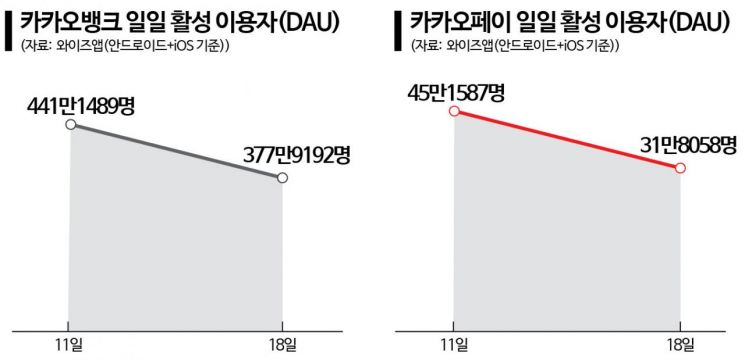

According to big data analytics firm WiseApp on the 21st, as of the 18th, KakaoBank's daily active users (DAU) were recorded at 3,779,192. This is a decrease of 632,297 users (14%) compared to 4,411,489 on the 11th, a week earlier. During the blackout incident on the 15th and 16th, the number of users fell to the 3.5 million range, with 3,534,807 on the 15th and 3,548,540 on the 16th.

KakaoPay experienced an even larger drop in users. Its DAU on the 18th was 318,058, a decrease of over 130,000 users compared to 451,587 on the 11th, representing a 30% decline. For KakaoPay, the decrease was more severe because remittance and payment services were suspended following the fire incident and only normalized around the evening of the 18th. Especially since the key function of sending money is closely linked with KakaoTalk, the impact was greater, according to analyses.

As errors occurred in financial services where stability is crucial, a sentiment of 'unease about entrusting money' has been continuously detected among users. On online communities, some users have even posted proof of withdrawing from KakaoBank. One user said, "I have used it for a long time, but I cannot understand how a single fire can cause a blackout," adding, "Although deposits are protected, I no longer want to use it." Another user said, "The response was so amateurish that I felt I needed to move my money," and added, "I plan to keep only the ongoing savings and transfer matured deposits to other banks."

On the other hand, competing internet-only banks and commercial bank apps appear to have benefited from this incident. According to mobile index, a big data analytics solution by IGAWorks, K-Bank's DAU on the 17th, immediately after the Kakao blackout, was 447,255, a 69.5% surge compared to the 16th. Even considering the weekend, this was about an 11.8% increase compared to the 11th, a week earlier. Other apps such as 'KB Star Banking (1.8%)', 'Woori WON Banking (2.4%)', and 'Shinhan SOL (3.6%)' also saw increased usage during the same period.

The incident also caused stock prices to plunge, prompting some users to launch a 'boycott' against KakaoBank, KakaoPay, and related services. Office worker Kim Yongdeok (pseudonym, 36) said, "The stock price has already halved, and now the service blackout makes me lose trust even more," adding, "I plan to leave the Kakao ecosystem and try similar financial apps."

However, a KakaoBank official stated, "The average DAU in October is 3.2 million," explaining, "The 11th, which was used as a reference, was the first business day after a three-day holiday, and the number was about 4.41 million, approximately 30% higher than usual due to around 6 million cashback deposit notifications."

Meanwhile, as of this date, most Kakao services have been restored to normal. Following this incident, Kakao CEO Namgoong Hoon announced his resignation. Currently, a dispute over responsibility between SK C&C and Kakao is ongoing. From identifying the cause to compensation and legal battles over accountability, it is expected that resolving the situation may take some time.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.