Hyundai Motor and Kia Set Additional Provision of 2.9 Trillion Won for Theta2 Engine

Costs of Theta2 Engine Resurface, Forecasting Negative Impact on Stock Prices

[Asia Economy Reporter Junho Hwang] 2.9 trillion KRW.

This is the amount of the provision related to the Theta2 engine that Hyundai Motor Company and Kia Motors announced through a conference call held on the 18th. It is the first provision recorded in two years since 2020. The provision amounts to 47% and 68% of the operating profit forecasts for the third quarter of this year for the two companies, respectively, triggering alarm bells for the defense of their stock prices.

The Return of the Ghost of the Theta2 Engine

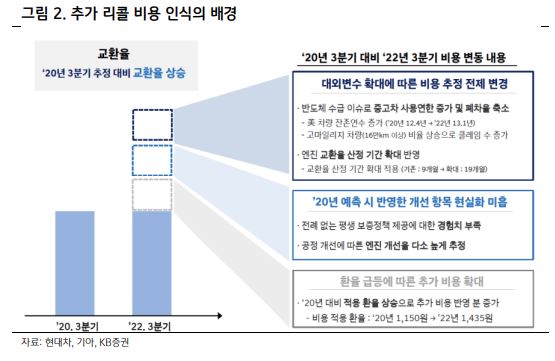

The reappearance of the ghost of the Theta2 engine after two years is the result of a combination of internal and external environmental changes. The recall target vehicles remain the same as before: 2.41 million units for Hyundai and 1.81 million units for Kia. Both companies decided to recognize additional provisions of 1.36 trillion KRW and 1.54 trillion KRW, respectively.

First, the semiconductor supply issue caused by the COVID-19 pandemic had an impact. Due to the shortage of semiconductors, the delivery period became so long that people said they were "tired of waiting to receive new cars." As a result, the usage period of used cars lengthened, and the scrappage rate also decreased. The frequency of (Theta2 engine) replacements increased more than initially expected.

In fact, the residual life of cars in the U.S. increased from 12.4 years at the time of the first provision forecast in 2020 to 13.1 years this year. This led to an increase in the proportion of high-mileage vehicles with over 160,000 km, which in turn increased complaints about repairs.

The strong dollar also contributed to the expansion of quality costs. At the time of the first provision forecast in 2020, the applied exchange rate was 1,150 KRW, but it soared to 1,435 KRW this year.

Internally, it was stated that "the realization of improvement items reflected in the first provision forecast in 2020 was insufficient." Hyundai explained, "Although an unprecedented lifetime warranty policy was provided, there was a lack of experience with it, and the engine improvement rate due to process improvements was somewhat overestimated."

Researcher Junseong Kim of Meritz Securities analyzed, "The increase in residual ratio and defect occurrence rate, unlike previous calculations, is due to the lifetime warranty policy and the shortage of car inventory and price surge after COVID-19," adding, "The usage period of recall target vehicles has increased compared to the original plan, and the expansion of aged vehicles due to the increased usage period has raised the absolute number of defective vehicles requiring recall."

Third Quarter's Record High Performance Slips Away

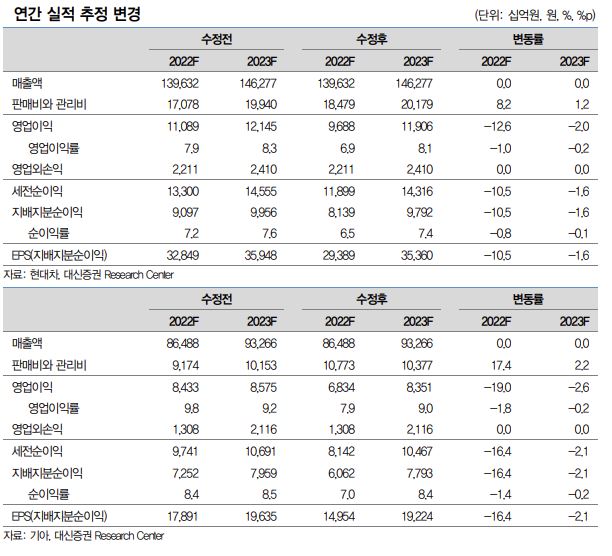

Before reflecting the provision recognition, the performance forecasts for Hyundai and Kia were expected to reach record highs. Hyundai was expected to achieve an operating profit of 3 trillion KRW for the first time on a quarterly basis, and Kia was also expected to reach a record high of 2.2341 trillion KRW.

However, due to the recognition of quality cost provisions, Hyundai's operating profit is estimated to remain in the 1.6 trillion KRW range, and Kia's is expected to fall below 1 trillion KRW. There is also a possibility of negative growth compared to last year's third quarter operating profits (Hyundai 1.6067 trillion KRW, Kia 1.327 trillion KRW).

Researcher Sungjin Kang of KB Securities observed, "Hyundai and Kia are estimated to assume that 28.2% of the total recalled vehicles will be recalled," explaining, "The recall cost per vehicle is 1.78 million KRW (total accumulated related provisions of 7.5 trillion KRW, target vehicles 4.21 million units), but the actual recall cost per vehicle is estimated to be around 6.29 million KRW."

Brokerages have started to lower their target stock prices. Researcher Kwiyeon Kim of Daishin Securities set the target prices for Hyundai and Kia at 220,000 KRW and 110,000 KRW, respectively, lowering their expectations by about -9.1% and -8.3%.

The common view in the securities industry is that this provision recognition cannot be seen as the last. Researcher Kang said, "In the long term, the possibility of additional related provisions cannot be completely ruled out," adding, "There is room to interpret that the recall is proceeding faster than usual, and in the long term, the actual recall rate may exceed the assumed rate, and additional recall costs may be recognized."

This provision recognition is the fourth, following 460 billion KRW in 2018, 920 billion KRW in 2019, and 3.4 trillion KRW in 2020.

Why Recognize the Provision?

The controversy related to the Theta2 engine emerged in 2015. Accidents occurred where vehicles equipped with the Theta2 engine stopped while driving, raising concerns about engine defects.

Accordingly, Hyundai and Kia began recalls simultaneously in the U.S. and Korea in 2017. Approximately 1.3 million units in the U.S. and about 170,000 units in Korea were targeted. The affected vehicles include Hyundai Sonata, Tucson, Santa Fe, and Kia K5, Sorento, Sportage, among others.

The Theta engine is Hyundai's independently developed engine, first developed in 2002 and exported to the U.S., Japan, and other countries. The successor Theta2 engine was introduced in 2009.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.