Shinhan Widens Gap with KB to Secure 1st Place

Woori Financial Returns to 4th Place

[Asia Economy Reporter Minwoo Lee] The earnings of the four major financial holding companies?KB, Shinhan, Hana, and Woori?are expected to continue performing well in the third quarter of this year. This is interpreted as benefiting from the high-interest rate trend during a period when loan demand remained robust. However, the fortunes of each company diverged somewhat, with Shinhan Financial expected to overtake KB Financial to take the lead.

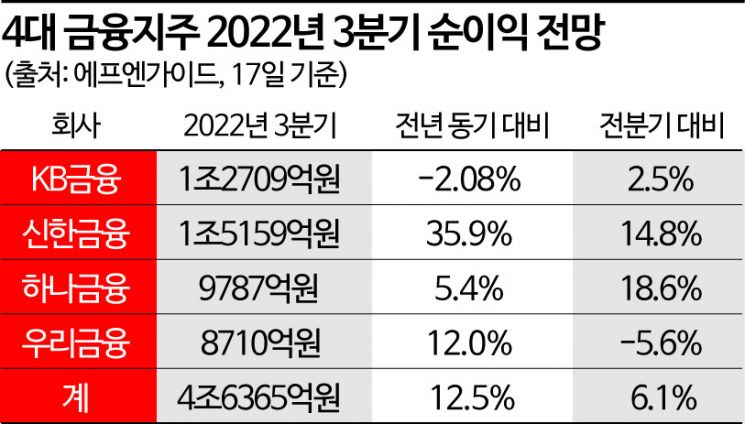

According to FnGuide, a financial information analysis firm, the combined net profit (attributable to controlling shareholders) forecast for the four major financial holding companies in the third quarter of this year is 4.6365 trillion KRW. This represents a 6.1% increase from the previous quarter and a 12.5% increase compared to the same period last year. Soeun An, a researcher at KB Securities, explained, “Despite the sharp rise in interest rates, loan demand remains solid, allowing the net interest income of major banks to potentially improve.”

However, the results varied by financial company. Shinhan Financial recorded a sharp 35.9% increase from the same period last year, reaching 1.5159 trillion KRW and securing first place. In the previous quarter, Shinhan Financial also ranked first by a narrow margin of about 16.9 billion KRW but was second in the cumulative first half of the year, trailing KB Financial. This time, Shinhan widened the gap with KB Financial to nearly 250 billion KRW, securing first place both for the third quarter and the cumulative year-to-date.

It is analyzed that the profit from the sale of the Shinhan Investment Corp. building in Yeongdeungpo-gu, Seoul (pre-tax 460 billion KRW) was reflected in the third-quarter earnings, along with the significant effect of securing the Seoul city treasury account worth 48 trillion KRW. While major banks are losing low-cost deposits such as demand deposits due to rising deposit interest rates, securing the city treasury account helped raise funds and contributed to the increase in net interest margin (NIM).

On the other hand, KB Financial is expected to be the only one among the four major financial holding companies to record negative growth. The consensus net profit forecast is 1.2709 trillion KRW, estimated to decrease by 2.1% year-on-year and 2.5% quarter-on-quarter. This is attributed to the fact that the improvement in NIM lagged behind Shinhan Bank in a situation where financial holding companies heavily rely on bank interest income. Hana Securities predicted that the NIM improvement at KB Kookmin Bank would rise by only 1 to 2 basis points (bp; 1 bp = 0.01%) compared to the previous quarter, which is expected to be the lowest among major commercial banks, including Shinhan Bank (5 to 6 bp).

Since the proportion of low-cost deposits is relatively high, the impact of funds flowing out to fixed deposits and savings deposits amid the deposit interest rate hike rally is also expected to be the greatest. Jo Ahae, a researcher at Meritz Securities, explained, “As of the second quarter of this year, the proportion of low-cost deposits was 53.1%, higher than Shinhan Bank (46.7%) and Hana Bank (39.6%). The reason for the sluggish NIM compared to other banks is also due to this outflow of low-cost deposits.”

Meanwhile, Woori Financial, which briefly surpassed Hana Financial in the previous quarter, is expected to fall back to fourth place in the third quarter. The estimated net profit is 871 billion KRW, up about 12.0% year-on-year but expected to decrease by 5.6% from the previous quarter. This is about 100 billion KRW behind Hana Financial’s net profit estimate of 978.7 billion KRW. Until the last quarter, Woori Financial was ahead of Hana Financial by nearly 100 billion KRW due to the absence of securities and insurance affiliates, which contrasts with the current situation.

Woori Financial posted relatively solid results in the previous quarter when the capital market situation was poor and it had no securities or insurance affiliates, but Hana Financial’s performance improved in the third quarter as overseas securities worth about 70 billion KRW and the stock price of the Bank for Investment and Development of Vietnam (BIDV) partially recovered. Ultimately, the competition for third place among financial holding companies this year is expected to be decided by the end of the year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.