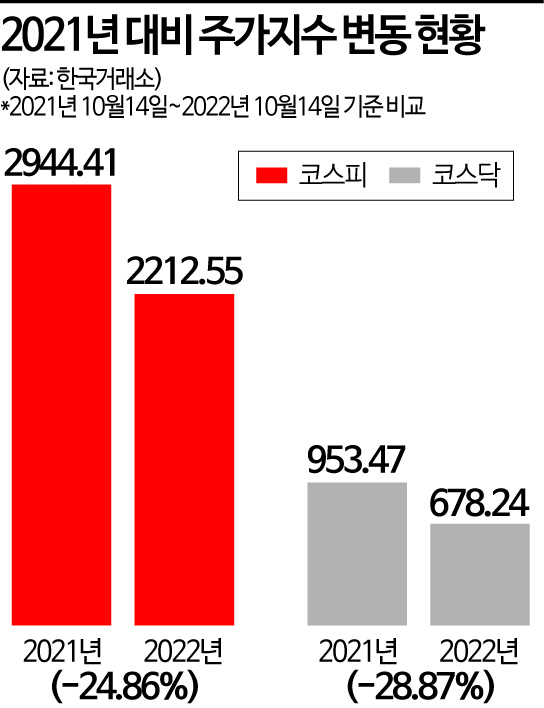

KOSPI Down 24% · KOSDAQ Down 28%

23 Stocks with Prices Halved Twice

Bithumb Affiliate InvioGen

Largest Drop of 78.11% in One Year

[Asia Economy Reporter Myunghwan Lee] Due to the cold wave that swept through the domestic stock market, the market that was aiming for the ‘Samcheonpi’ level barely managed to hold the ‘Icheonpi’ level after one year. Fifteen percent of all listed companies saw their stock prices halved.

On the 17th, Asia Economy analyzed the stock index and individual stock price trends between October 14 last year and October 14 this year. During this period, the KOSPI and KOSDAQ indices fell by 24.86% and 28.87%, respectively. The KOSPI, which was seeking a rebound from the mid-2900s to the 3000 level last October, retreated to 2200.

Many stocks also saw their prices halved. There were 381 stocks in the domestic market?including KOSPI, KOSDAQ, and KONEX?that dropped more than 50% compared to a year ago, accounting for 15% of the total 2,540 listed companies. Additionally, 23 stocks experienced a quartering of their prices (-75%).

Since the market conditions were unfavorable, most stocks declined compared to a year ago. Looking at the stocks that fell by market, 810 KOSPI stocks, or 87.28%, declined. In the KOSDAQ market, 1,262 stocks, accounting for 84.75% of listed companies, also fell.

Among the stocks that showed a downward trend, Inbiogen recorded the largest decline in the KOSPI, dropping 78.11% to 766 won over the year. Inbiogen is affiliated with Bithumb, a cryptocurrency exchange recently embroiled in controversy over its actual ownership, and was recently subject to a prosecutorial raid related to allegations of embezzlement by its management.

Airline stocks, considered representative reopening (resumption of economic activities) beneficiaries, also fell sharply. Air Busan dropped 71.46%, while T’way Holdings (-65.64%), T’way Air (-57.48%), and Asiana Airlines (-51.65%) all fell more than 50%.

Kakao affiliates and Naver, which have recently shown weak stock performance, also recorded declines exceeding 50% over the past year. KakaoBank fell 68.69%, while Kakao (-56.07%) and Naver (NAVER) (-56.68%) also dropped by more than half.

In the KOSDAQ market, the decline was significant mainly among bio stocks such as Jinain Pharm (-82.55%), Antrogen (-81.64%), and Enzychem Lifesciences (-80.66%). Kakao Games, a Kakao affiliate listed on the KOSDAQ, also fell 41.60%.

Although most stocks have declined like this, securities firms predict that a rebound next year will be difficult to expect. Hanwha Investment & Securities Research Center forecasted the 2023 stock market, stating, "Amid sluggish global economic trends, a box range fluctuation is expected," and "There will be a rotation between mid-cap and large-cap stocks within a lower-to-higher movement."

There is also a forecast that next year’s stock market will show differentiated trends by industry. Jaeman Lee, a researcher at Hana Securities, predicted, "In 2023, due to the elevated interest rate levels, it will be difficult to expect valuation increases; instead, stock price differentiation by industry will intensify based on profit growth rates."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.