SM "Parting Ways with Lee Soo-man" vs.

Align "Board Must Have Independence"

[Asia Economy Reporter Junho Hwang] "We expect your cooperation in providing smooth data until the 18th."

On the 14th, SM Entertainment Co., Ltd. (hereinafter SM) announced through a board resolution that it would terminate the producing license contract with Like Planning early. This was the response from activist private equity firm Align Partners Asset Management Co., Ltd. (Align) on the 15th.

With SM's firm decision to terminate the contract with Like Planning, the contract under which SM had been paying hundreds of billions of won annually as fees to Like Planning has ended. Like Planning is the personal company of Lee Soo-man, SM's Chief Producer (PD).

SM Shareholders 'Cheer'

Source: SM

Source: SM

SM signed a producing service contract with Like Planning in 1997, before its listing. From 2000 to 2014, it paid 15% of album sales, and since 2015, it has paid up to 6% of SM's separate sales as royalties.

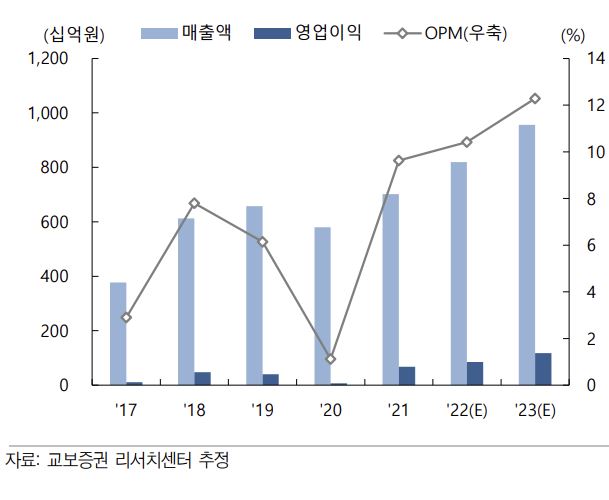

Royalties are reflected in the cost of sales and directly affect profitability. Sung-guk Park, a researcher at Kyobo Securities, analyzed, "Assuming the royalty payment standard changes from 6% of separate sales to 2% starting next year, next year's consolidated operating profit will increase from 96.2 billion KRW to 117.5 billion KRW, and controlling shareholder net profit will increase from 92.8 billion KRW to 109.2 billion KRW. In this case, the current price-to-earnings ratio based on next year's controlling shareholder net profit is 16 times."

He added, "The termination of the producing contract will contribute not only to performance improvement but also to the normalization of the multiple discount compared to peer companies, which had been discounted due to opaque governance and continued poor performance of consolidated subsidiaries."

On the 14th, the stock price rose sharply, closing at 69,200 KRW, up 0.49% from the previous day.

It's Not Over Yet

However, while respecting SM's decision, Align demanded early liquidation of the contract with Like Planning and requested that the "board meeting minutes and accounting books inspection request" be fulfilled within the deadline.

Align stated, "Since this contract has been maintained for a long time, deciding on early termination would not have been easy," "Nevertheless, we positively evaluate the current SM board's willingness to respond to the long-standing demands of many shareholders by concluding an early termination agreement through a board resolution and promptly proceeding with the final disclosure."

However, they pointed out that "transactions with DREAMMAKER Entertainment Ltd., SM Brand Marketing Co., Ltd., and issues such as personal shareholdings of major shareholders or related parties in these companies, as well as problems with unprofitable non-core subsidiaries, are also major concerns for many shareholders."

They emphasized, "We expect the SM board to cooperate smoothly in providing the requested materials by the deadline of October 18, which we requested through the inspection request."

Goal is Governance Improvement

The ultimate goal is governance improvement. Align said, "We plan to thoroughly review the board meeting minutes and accounting books to be provided in the future and continuously demand the SM board to take substantive measures for company development and shareholder value enhancement not only regarding the contract issue with Like Planning but also other issues."

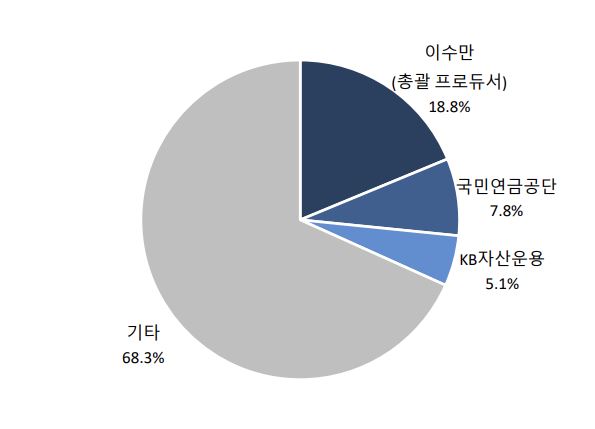

Among the current SM board members are figures such as Co-CEO Young-joon Tak, who has built SM for over 20 years, and inside director Jun-young Park. However, Co-CEO Sung-soo Lee (Lee Soo-man PD's nephew-in-law) and outside director Chang-hoon Ji (former CEO of Korean Air and a high school classmate of Lee Soo-man PD at Kyungbock High School) are considered to be directly or indirectly connected to Lee Soo-man PD. It is also necessary to examine transaction relationships and ownership structures with other affiliates and related companies besides Like Planning. If there is a second Like Planning, this could be an area where contract relationships need to be reorganized.

Industry insiders believe that since the terms of SM board members end in March next year, Align may move to demand a board replacement as the next step.

Align stated, "Despite meaningful board resolutions, the company's shareholding structure and board composition remain the same as before. Therefore, we plan to continue reviewing and promoting additional necessary measures to fundamentally establish a transparent governance structure, such as recommending independent and competent directors at the shareholders' meeting so that the company can continue to progress in a positive direction."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.