[Asia Economy Reporter Changhwan Lee] An analysis has emerged that the success or failure of big tech companies like Naver and Kakao in the insurance business depends on whether they can provide services that create network effects.

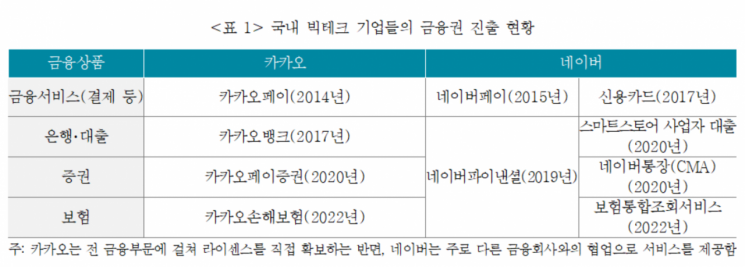

According to the report "Network Effects and Leverage Issues through Platforms" by Lee Jung-woo, a research fellow at the Korea Insurance Research Institute, on the 16th, interest in the success of big tech companies such as Naver and Kakao has increased as their entry into the insurance industry has been permitted.

The researcher pointed to network effects as the background for the growth of these big tech companies. This means that the more customers participate in the network provided by the company, the greater the utility for all participating customers.

KakaoTalk and Facebook utilized network effects among users, Uber and Lyft leveraged network effects between passengers and drivers, and Amazon utilized network effects between consumers and sellers.

Once a network reaches a certain scale (critical mass), it tends to grow regardless of the company's will. Companies that have already secured sufficient market share can maintain their market share due to network effects even if they raise consumer prices afterward.

The researcher forecasted that whether big tech companies can create services that generate network effects in the insurance industry will determine their success or failure.

However, due to the nature of the insurance industry, where there is not much interaction among users, it remains to be seen whether big tech companies can provide products or services that create network effects, the analysis said.

In particular, P2P (peer-to-peer) insurance is unlikely to have network effects because if additional network contract holders are likely to cause insurance claims, it can negatively affect the utility of existing contract holders.

Also, while financial product comparison services may generate network effects because the more diverse the products connected to the platform and the more users the platform has, the greater the utility for users and the more incentives insurance companies have to connect their products, there are limits to the increase in insurance companies or products, so the network effects may be limited.

There is an analysis that big tech companies may maximize network effects by adding products outside the insurance industry preferred by insurance consumers to the platform through means such as advertising.

The researcher also raised concerns that digital platforms entering other markets may benefit consumers in the short term but could block competitors and hinder market competition in the long term.

He stated, "There are concerns about cases where big tech, as owners of digital platforms, make their products sold in adjacent markets searchable on their platforms, bundle them with the platform, or have adjacent products installed together with the platform installation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)